Corella flags HPA feedstock potential for Tampu kaolin project with 24.7Mt maiden MRE

Pic: Tyler Stableford / Stone via Getty Images

WA kaolin player Corella Resources (ASX:CR9) has released the maiden inferred mineral resource estimate (MRE) for its Tampu Kaolin project.

The MRE came in at 24.7Mt, with an average yield of 53% for 13.1Mt at 36.5% aluminium oxide of <45μm — high quality bright white kaolin with low impurities, the company said.

Essentially, the purity highlights that potential of the resource to qualify as feedstock for high purity alumina (HPA) which is in increasingly high demand as it is used in smartphones, LEDs and, most significantly, lithium-ion batteries, a keystone in the renewable energy revolution.

Plus, the project’s kaolin resource has low levels of iron impurities – making it particularly desirable for HPA feedstock.

HPA was traditionally produced from aluminium metal, but new technologies mean it can now be produced more economically and with a lower environmental footprint from kaolin – which is fuelling demand and extremely high quality HPA premium prices of up to $60,000 per ton.

With demand outstripping supply and rapid market growth, Corella says there are “tremendous potential opportunities” for high purity kaolin feedstock offtake agreements in the near to medium-term.

Tampu still has room to grow

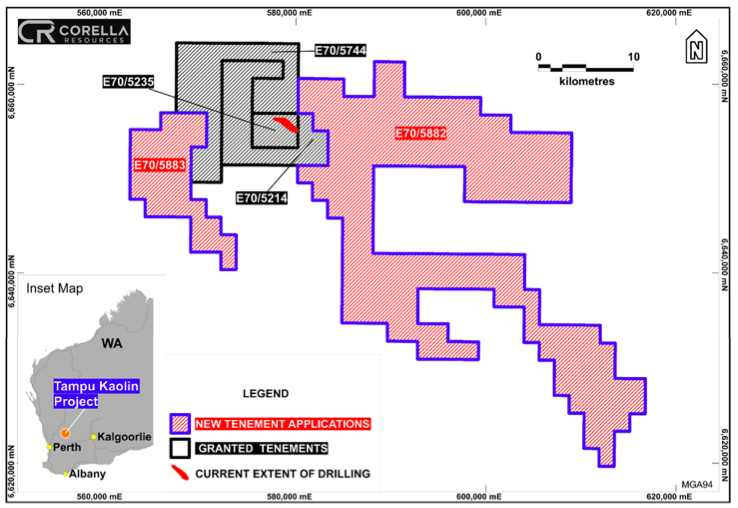

The company reckons the project has potential for future growth, with mineralisation open in all directions, an average depth of 4m and a footprint covering less than 0.15% of the total Tampu landholding.

Not to mention Corella has increased its landholdings 446% since listing in April this year.

“The completion of the maiden MRE on the spectacular high purity bright white kaolin deposit at Tampu is a very important milestone in the development of the company,” Corella managing director Tony Cormack said.

“Drilling results have demonstrated the quality, scale, and huge potential of the Tampu Kaolin Project through the thick, shallow, high purity bright white kaolin deposit now defined.”

“I am extremely proud of the Corella team that in just over six months from listing has delivered a maiden MRE for Tampu, a truly fantastic and transformational achievement.”

Samples sent to potential offtake partners

The company has already dispatched samples for HPA test work and to potential offtake partners to test using their own processes.

“Samples have been sent to the laboratory for HPA testing and to potential offtake partners who will test the Tampu samples using their own processes, with the aim of securing offtake,” Cormack said.

“We will now progress toward scoping and feasibility studies, with HPA test work results to underpin the economics, where we anticipate the high grade and low impurities at Tampu to translate to a low-cost operation with high profit margins.”

Scoping study planned for Q1 CY22

The next step is to commence technical studies to feed into a scoping study for the project in Q1 CY22, and further exploration is planned with the aim to increase the bright white kaolin resource base.

HPA test work results are also expected in Q1 CY22, along with the commencement of offtake negotiations.

With cash on hand of $4.5 million at the end of September 2021 and low drilling costs due to shallow deposits, the company says its well placed to deliver technical studies and resource growth with existing cash reserves.

Plus, Corella considers Tampu amenable to a simple, shallow open pit operation with the project close to excellent existing infrastructure in the wheatbelt region of WA.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.