Core Energy gears up to drill test Cummins uranium; snaps up Brooker project next door

Pic via Getty Images

- The Brooker project adds 517k2m to Core’s Eyre Peninsula holdings, now covering 2,837km2 and a further 1,750km2 in the central Gawler Craton

- Cummins drilling to consist of 50 air core holes over 3000 metres, once permitting complete

- Drilling to target historical uranium anomalies with scope for rapid follow-up of up to 177 additional holes

Special report: With the uranium market price lifting 14% in 2024 and demand only growing for clean energy and data centre power sources, Core Energy is readying to put drills to ground amidst a bullish uranium outlook.

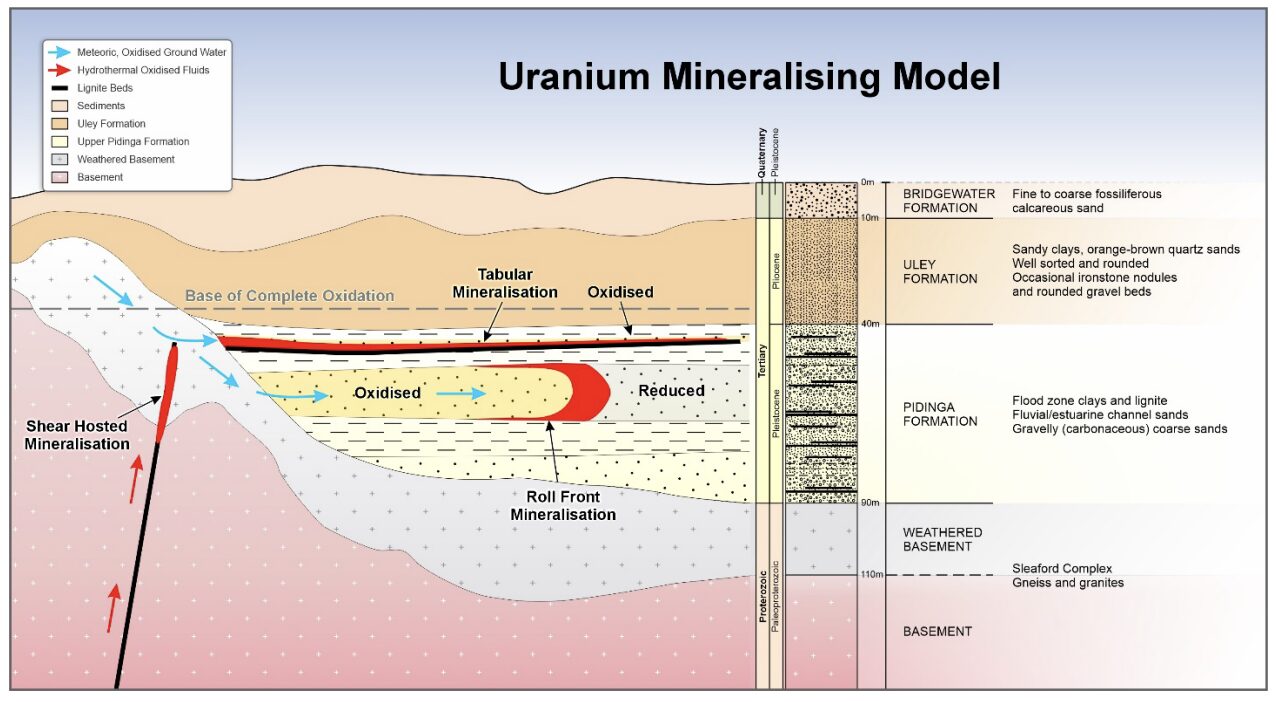

Core Energy Minerals (ASX:CR3) expects to mobilise drilling rigs to the Cummins uranium project in the second quarter of 2025, with permitting underway to enable a maiden campaign targeting “roll front” style mineralisation.

Historical drilling data – validated by French state-owned uranium exploration company Areva in 2009 – points to several broad, shallow zones of radioactive mineral concentrations over an area of more than 10km.

CR3 has since interpreted several areas to host roll front mineralisation prospective for uranium, representing high-priority areas for the maiden drilling campaign.

“We have submitted all of the necessary regulatory approvals to undertake the planned drilling campaign, with the aim of testing the compelling targets identified in the historical datasets,” Core Energy Minerals executive director Tony Greenaway said.

“We have planned approximately 50 Priority 1 holes for an estimated 3,000 metres of air-core drilling, however the permitting applications submitted covers a significant number of additional holes which will enable us to undertake rapid follow-up drilling.

“The planned air-core drilling, which is fast, cost effective and has a light environmental footprint, will test several highly compelling shallow targets identified in the historical data, comprising coincident analytical and geophysical gamma anomalies.”

Brooker project acquisition

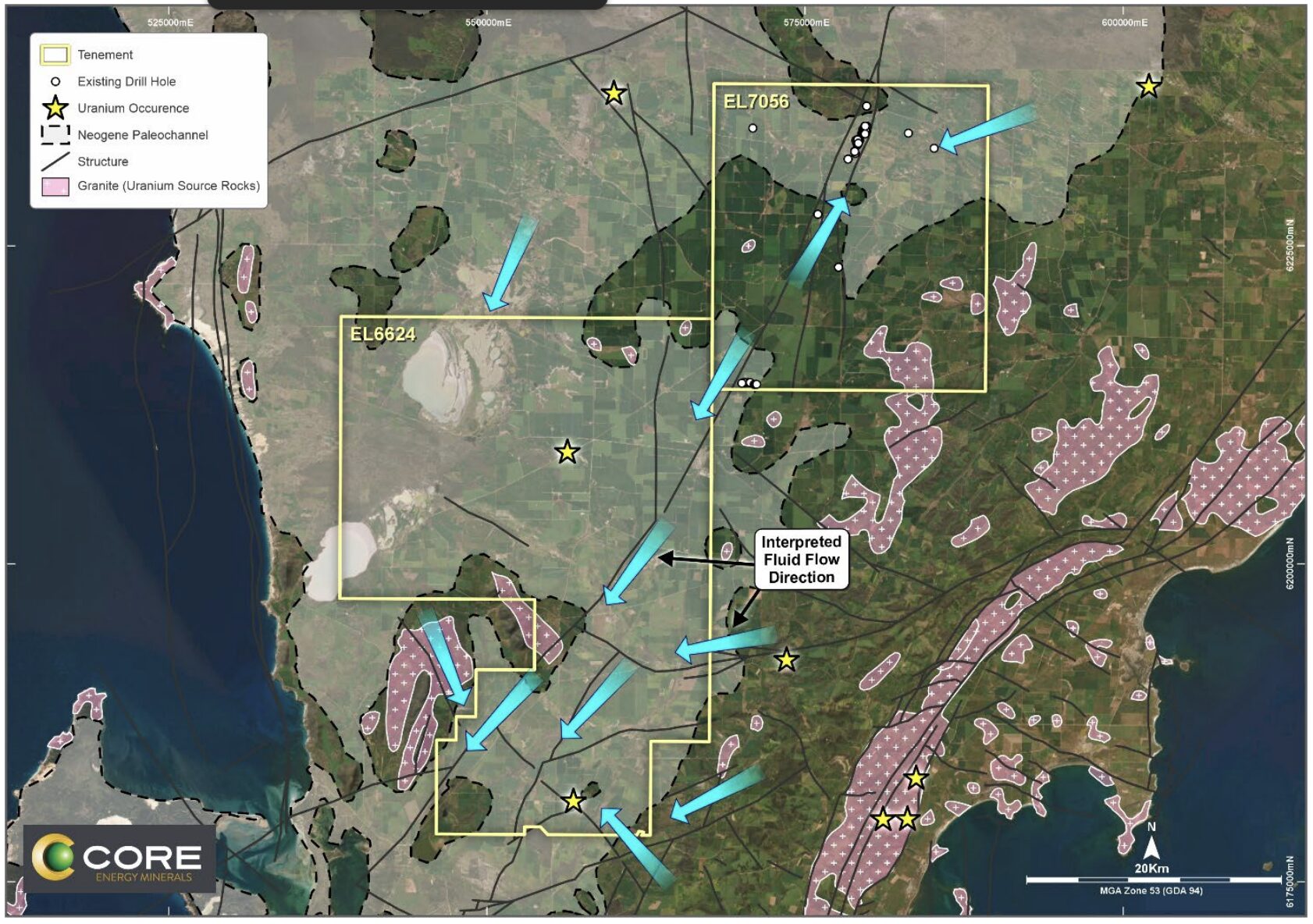

The newly acquired Brooker project sits directly to the northeast of Core Energy’s Cummins project, along the western margin of the Port Lincoln Uplands in an area with several uraniferous granite source rocks and uranium occurrences, including Mount Hill 12 kilometres to the east.

Mount Hill, or more specifically Radium Hill, was recommissioned by the South Australian Government in 1954 to produce uranium oxide, supplied to the UK-USA Combined Development Agency.

The mine operated for seven years and produced a total of 850 tonnes of uranium oxide.

CR3 says there is evidence of uranium being leached from the Port Lincoln Uplands into the Tertiary palaeochannel within the Brooker project, similar to the uranium mineralisation identified at the Karanna uranium prospect just 8km to the west.

The company has highlighted several large-scale regional structures trending through the tenement area that offer potential ‘trap sites’ for uranium to accumulate along several structures and basement offsets.

Bullish uranium term market

While the spot price for uranium has retreated from recent highs of US$100 per pound in January last year to a more modest spot price of US$64.4 per pound in recent months, the term market, which represents the larger of the two markets, was up 14% during the 12 months of 2024.

Uranium isn’t traded in the same way as other commodities, with the majority of contracts being long-term agreements over an average of 3-15 years, made directly between producers and utilities and generally at a higher price than the spot market.

The uranium market has been strongly trending up in recent months, driven by an increased interest in small and modular reactors, predominantly from the data centre and artificial intelligence sectors.

Google and Microsoft have both signed deals to procure nuclear power, the former looking to small nuclear reactors, potentially built on site at data centres, while the latter seeks to reopen the Three Mile Island nuclear energy plant.

Modelling by global management consulting firm McKinsey & Company predicts the energy transition could require an additional 400 to 800 gigawatts of new nuclear power to meet the need for dispatchable power (on-demand power, rather than wind or solar) by 2050.

This article was developed in collaboration with Core Energy Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.