Corazon to bank up to $9.5m as Future Battery Minerals expands Kangaroo Hills lithium project

FBM will farm-in to the lithium rights of Corazon’s Miriam project. Pic via Getty Images

- Corazon divests Miriam lithium rights for up to $9.5m

- FBM acquiring the rights to expand its Kangaroo Hills project

- Deal subject to FBM raising a minimum of $5m

- Corazon will use sale proceeds to fund ongoing exploration at Lynn Lake

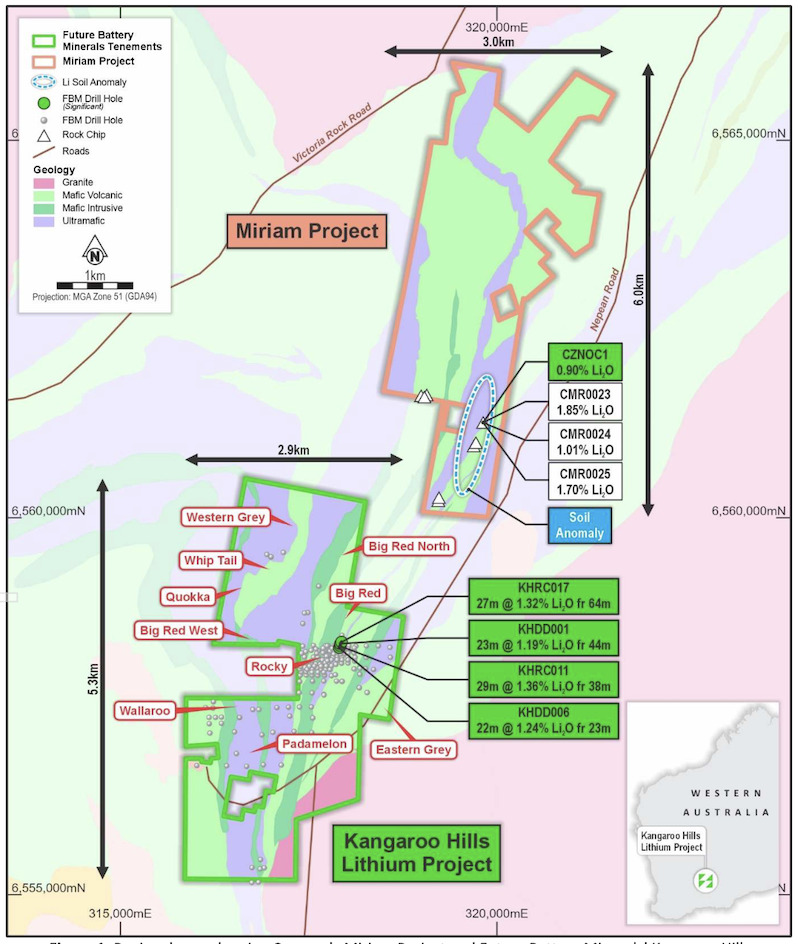

Special Report: Nickel-focused Corazon Mining will receive up to $9.5 million for the lithium rights of its Miriam project in the WA Goldfields, as Future Battery Minerals looks to expand its south-adjacent Kangaroo Hills lithium project.

Corazon Mining (ASX:CZN) says it will use proceeds from the sale – and redirect the funds it previously allocated to drilling at the Miriam lithium anomaly – to advance its flagship Lynn Lake nickel sulphide and Mt Gilmore copper-gold-cobalt projects.

CZN’s Lynn Lake in Manitoba, Canada, has a current 16.3Mt resource for 116,800t nickel, 54,300t copper and 5300t cobalt and metallurgical testwork is ongoing to determine further exploration activities.

At Mt Gilmore in NSW, CZN is compiling results from recent mineral vectoring geochemical studies targeting porphyry copper-gold style deposits.

For Future Battery Minerals (ASX:FBM), the purchase of the lithium rights of Miriam expands its footprint in the region, as the tenure is just above its own Kangaroo Hills lithium project where it has confirmed an extensive, near-surface lithium pegmatite swarm at the Big Red and Rocky prospects.

The Kangaroo Hills and Miriam project locations. Pic: Supplied (CZN)

Miriam lithium rights deal

Under the deal with CZN, FBM will acquire up to 85% of Miriam’s lithium rights via an initial payment of $2 million ($1 million in cash and $1 million in FBM shares) which can rise up to $7.5 million on achieving project milestones.

CZN will retain rights to base and precious metals minerals at Miriam and will be free-carried on the lithium exploration and development costs until the completion of a definitive feasibility study (DFS).

The acquisition will also be subject on FBM shareholder approval and the completion of a capital raise of at least $5 million and is anticipated to be completed in or around mid-May this year.

Expansion of lithium tenure

Exploration conducted at Miriam by CZN recently assayed rock samples returned up to 1.85% Li2O and revealed a 1.6km-long strike and a second trend of ~600m.

For FBM, the strategic acquisition of Miriam offers a highly prospective, drill-ready opportunity, as the discovery at Miriam is just 3.5km from its recent Big Red lithium discovery at Kangaroo Hills.

“Given our strong belief in the Kangaroo Hills lithium project, this acquisition represents an opportunistic and logical move to further consolidate our landholding in the region,” FBM managing director Nicholas Rathjen says.

“This strategic addition is on ground endowed with confirmed outcropping spodumene lithium-bearing pegmatites and we look forward to commencing work at Miriam immediately, conducting detailed target generation with first drilling to commence during Q3 CY24.”

This article was developed in collaboration with Corazon Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.