Copper’s flying under the radar, but long-term thinkers are betting on the red metal

Copper is the nervous system of the energy transition, and miners are lifting investment even if retail hasn't caught on. Pic: Getty Images

- Copper has flown under the radar in 2025, despite prices sitting at historically high levels

- The long-term outlook has miners investing in future production growth wherever they can find it

- CuFe’s Mark Hancock says a bullish price outlook will support smaller, higher grade assets like its Tennant Creek project

Copper has flown under the radar for investors this year as gold stocks have gained admirers and battery metals have faded into the background.

But the red metal, which is both tied into broader themes around economic growth and the electrification narrative that has reshaped the mining world, has flown under the radar for much of 2025.

That is despite its continued run at historically high levels.

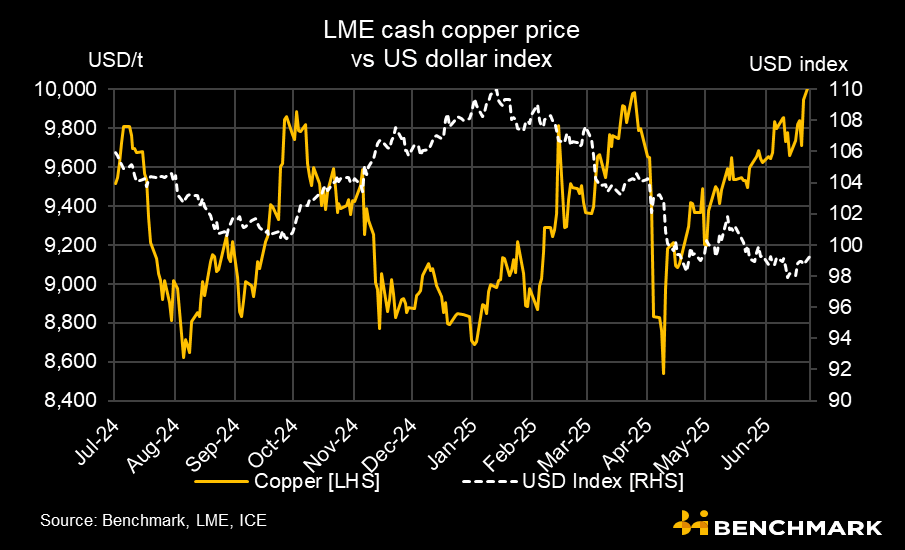

LME prices cracked US$10,000/t (on a cash basis) earlier this week, with three month futures on the key base metals exchange sitting at US$9712.50/t on Wednesday.

That’s 10% higher than the end of 2024. But the real action is in the US, where Comex futures are close to US$5/lb (equivalent to around US$11,000/t), levels hovering around all time highs.

There are two phenomena at play here: An arbitrage in the US market and backwardation in London, indicating demand for physical metal is acute and there are immediate shortages if you want copper today.

A lot of this is tied into concerns the US Government will issue tariffs on copper imports, something the Department of Commerce is actively investigating – highly distorting given the US has just two primary copper smelters and produced just 1.1Mt of mined copper in 2024.

Apparent use domestically was around 1.8Mt according to the US Geological Survey.

“Tariff-induced anxieties have pushed the US to import large volumes of copper both due to front-loading supply but also due to the related LME/CME arbitrage it has created,” Benchmark Mineral Intelligence analysts said in their latest copper brieifing.

“However, the latest broadening of the spreads seems to be less fundamentally driven, judging both by the speed with which it appeared and due to its extreme size.”

Miners get on board

Even so, the enormous investment miners are making in new copper supply, even in relatively small producer Australia, shows how strong the long-term outlook for the metal is.

BHP (ASX:BHP) suggests demand will rise 70% to more than 50Mtpa by 2050, driven by urbanisation, electric vehicles and renewables.

BloombergNEF thinks US$2.1tn will need to be spend on raw materials supply by then to meet net zero targets, with BHP anticipating the industry will need to inject US$250bn on copper supply alone.

It’s put its money where its mouth is in South Australia, a potential 500,000tpa+ copper district by the mid-2030s, with a $1.5bn investment announced to transition its copper concentrate movements from the Olympic Dam, Carrapateena and Prominent Hill mines from road to rail in a partnership with Aurizon Holdings (ASX:AZJ).

At the same time, Harmony Gold is spending $1.6bn to acquire MAC Copper (ASX:MAC), AIC Mines (ASX:A1M) raised $55m from investors to expand its Eloise copper plant in Queensland from ~12,500tpa to 20,000tpa as it develops the Jericho mine.

And Aussie companies overseas are drawing strong interest from corporates, with Kinterra Capital launching a 5.7c per share off-market takeover offer for New World Resources (ASX:NWC) in an effort to interlope on its 5.5c per share sale to Central Asia Metals.

Watching from afar, it’s giving exploration companies the confidence that the smart money is focused on the long-term outlook for the commodity.

“A lot of forecasts have got a reasonably firm run up in price over the next few years. The supply is a slower responder than some commodities, in terms of what’s required to bring it to market,” Mark Hancock, the executive director of junior explorer CuFe (ASX:CUF) says.

“You’ve got significant grade drops across most of those bigger projects.

“Every day, there’s a new article coming out talking about shortness of supply into the copper market. So that’s very much an opportunity that we see and hopefully can help to play a small part in filling.”

Speed to market

CuFe is an example of the kind of company that could benefit as supply fails to meet demand.

The necessary new mines to bring prices under check are typically large, deep porphyries, with long lead times to get into production, low grades, high capex bills and complex environmental and social approval processes.

Many of them are in South America, where production has been stalling amid declining grades and political unrest.

But smaller, higher grade deposits could be in a sweet spot. Projects like those CuFe holds in the Northern Territory could benefit from increased prices caused by copper shortages, without taking years (or even decades) to bring into production.

It holds a resource in the Tennant Creek district of 10.35Mt at 1.53% copper and 0.92g/t gold for 160,000t copper and 302,000oz gold, a sizeable resource in which CUF boasts the majority 55% stake.

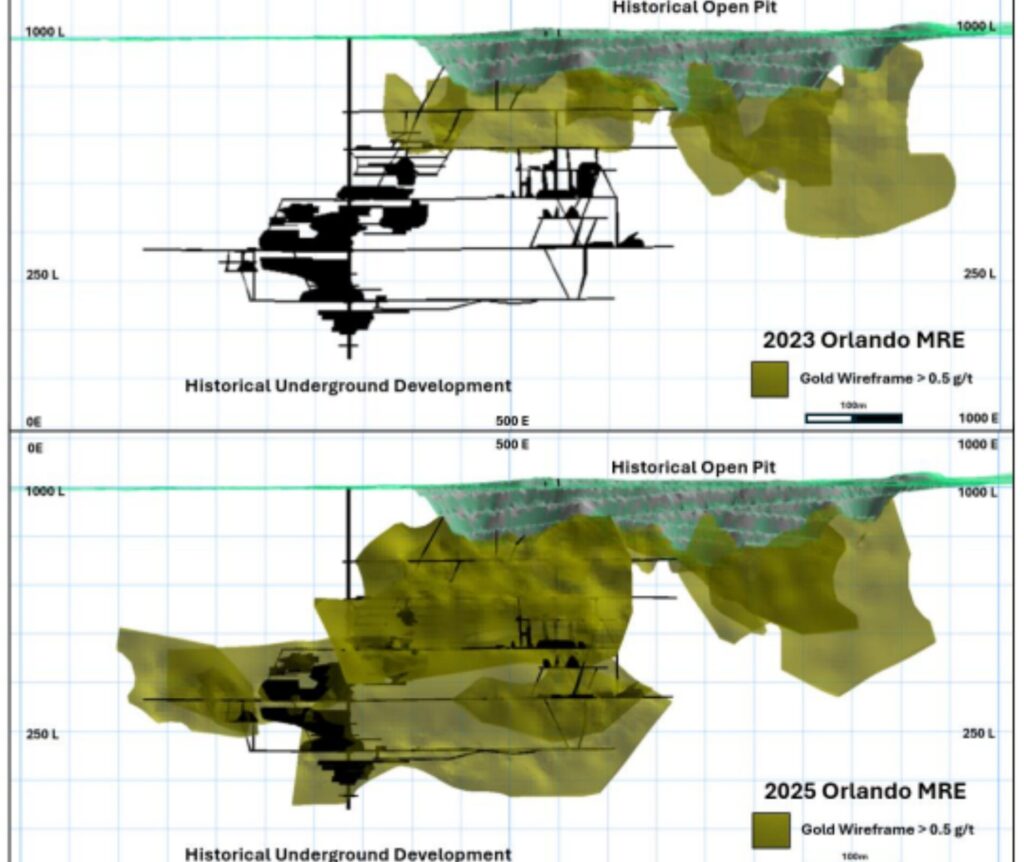

The centrepiece of that inventory, subject to a processing alliance with fellow NT explorers Emmerson Resources (ASX:ERM) and Tennant Minerals (ASX:TMS), is the Orlando deposit.

It contains 5.95Mt at 1.16% copper and 1.5g/t gold for 68,800t Cu and 287,000oz Au, or 579,100oz on a gold equivalent basis.

Most importantly, Orlando is not a greenfields opportunity requiring a large capital outlay to uncover the orebody. Rather it’s an open pit ripe to be cutback, having closed with copper prices under US$1/lb back in the 1990s under the auspices of Normandy Gold.

Previously, the mine had operated as an underground operation until 1975, producing 121,282oz of gold and 4852t of copper. That’s before considering another previously mined deposit within the Tennant Creek JV called Gecko.

“Even though it’s been mined previously, we do need to still get some further approvals,” Hancock said.

“But in terms of the complexity of construction and in our case in particular, being a cutback of an existing open pit, the lead times on that should be pretty short once we can get all those necessary approvals in place.”

The surge in the gold price to over $3300/oz this year will dramatically improve the outlook for the project as well, with a scoping study in the works on processing the various deposits controlled by CUF, ERM and TMS via a central hub.

“Originally, the revenue was heavily weighted towards copper, whereas in the economics we’re looking at now, we’re seeing a material revenue contribution from the gold given the strength in gold prices and the additional gold that we’ve identified,” Hancock said.

At Stockhead, we tell it like it is. While CuFe is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.