Copper stocks are hurting as price slump continues amid demand doubt

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Commodity prices have plunged in recent days as fears of further contagion in emerging markets cast doubt on the demand outlook.

CBA commodities analyst Vivek Dhar cited the dual issues of Turkey’s financial crisis and US-China trade tensions as the main catalysts for the falls.

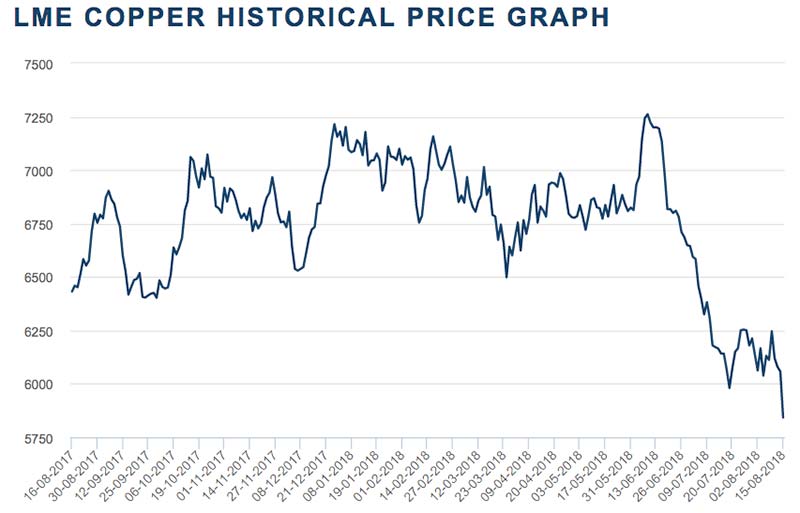

Base metals were hardest hit, as copper prices — often viewed as a barometer of global growth — fell heavily on Wednesday.

Copper prices dipped below $US6000 a tonne for the first time since May last year — and then fell through $US5900.

Many ASX-listed copper stocks have had a tough week.

Copper producer Aeris Resources is down 23 per cent over seven days. Metals X is down 11 per cent. Red River has lost about 9 per cent.

Oz Minerals, Independence and Sandfire are all down between 5 and 6 per cent for the week.

There were even heavier falls for zinc and nickel, while gold remained stuck in its recent malaise.

Although gold usually benefits from a risk-off tone on global markets, it’s also negatively correlated with the US dollar.

And safe-haven demand for gold has been more than outweighed by strength in the greenback, as the USD index briefly climbed to a 14-month high overnight.

Prices for the precious metal dipped further below $US1200 an ounce, falling to the lowest level since January 2017:

The recent gains in the greenback have put pressure on emerging market economies more broadly, many of which raise debt in US dollars.

Meanwhile, stocks in China fell sharply on Wednesday, and concerns about the Chinese economy also weighed on the commodities outlook.

“While China has looked to policy easing to support economic growth, activity data for July did little to give hope to the market,” Dhar said.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.