Copper demand to intensify mining activity in Peru for years to come

Close-up of an open-pit copper mine in Peru. Pic: Getty Images

Shrouded in a heap of mystery and a lot of fog, the ancient Incan city of Machu Picchu was hidden away from the modern Western imagination in the mountains of Peru until the 19th century.

Now one of the New Seven Wonders of the World, the 14th century city was likely abandoned during the Spanish conquest, but its granite walls remain testament to more than the genius and strength of its masons.

The archeologist William H Prescott – the first American to really have a crack at studying the structure – reported in his 1847 opus (History of the Conquest of Peru), that that the Incan masons used only stone, copper and a few bronze tools to make the entire thing.

He was right, but only by 6%.

More modern analysis shows the bronze tools had barely that much tin in them.

The rest was pure copper.

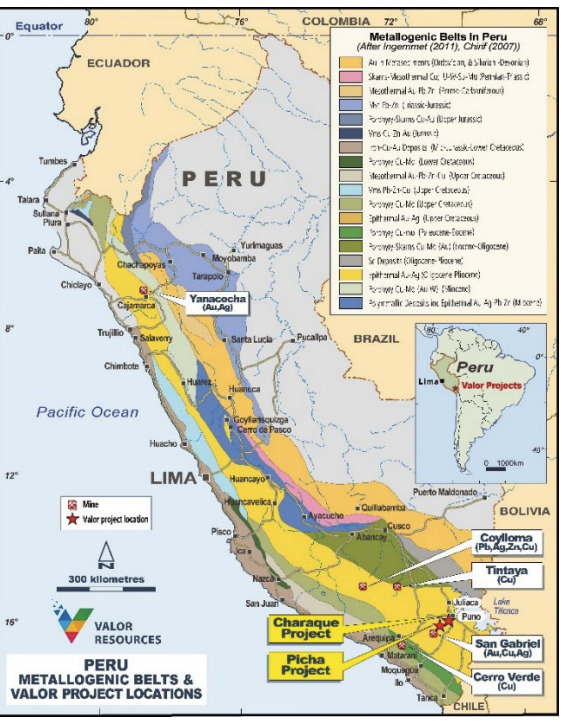

That’s because there is a stack of copper – the world’s largest reserves in fact – all along the mineral rich ‘Southern Mining Corridor’ of the Andean Mountain range.

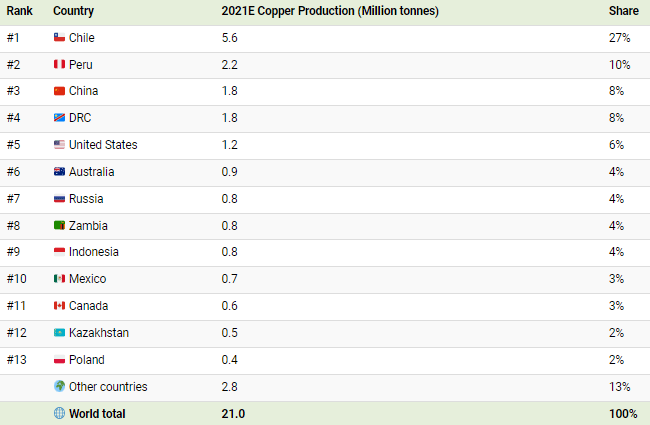

Bordered in the north by Ecuador and Columbia, and in the east by Brazil, the country is one of Latin America’s fastest growing economies and is responsible for around 10% of global copper production.

Trailing behind neighbouring Chile as the world’s number two copper producer, mining represents a dominant sector of the Peruvian economy, with copper more specifically accounting for about 30% of the country’s exports.

At the beginning of 2022, Peru’s ‘Southern Mining corridor’ – stretching some 400km through the southern regions of Arequipa, Apurímac, Cusco, Moquegua, and Puno – played host to widespread anti-government protests, disrupting copper output and triggering predictions of a further surge in prices for the red metal.

International mining majors dotted along this key mining transportation route all suffered varying degrees of impact, from reductions in operational capacity to full mine closures.

Exports at Peru’s two biggest copper mines, Freeport-McMoran’s Cerro Verde and the Chinese-owned Las Bambas mine, were the most impacted with production losses of 32% and 23%, respectively.

The situation at Glencore’s Antapaccay mine was a bit dicier with protestors attacking the site on three separate occasions and setting fire to the worker’s camp, resulting in copper production losses of around 17%.

Peak copper demand and constrained supply growth

For now, the civil unrest has abated but experts believe the two-month long, almost-daily protests put about 30% of the country’s copper production at risk.

Geopolitics remain an ongoing an issue for global copper supplies at a time when demand is at its peak on the back of the world’s push towards decarbonisation and electrification.

Glencore told Stockhead copper supply growth will also be constrained by ageing assets, and a diminished project pipeline, with new projects likely to experience delays.

“In the near term, global demand sentiment will be dependent on the outlook for fiscal tightening measures and improving industrial activity and recovery in the construction sector in China,” the company said.

“But in the longer term, demand growth will be driven by population growth and rising living standards in emerging economies.

“Another key driver for the copper sector is the rise in support of climate change policies, given their role in accelerating the clean energy transition from renewable power generation and distribution to energy storage and electric vehicles.”

Peru’s thriving copper sector

Despite the protests, Peru expects to produce about 2.8Mt of copper this year, an almost 15% jump from last year with senior officials saying the mining sector is back to “working as normal”.

Over the last 20 years the mining industry, which accounts for 8.5% of the country’s GDP, has received inflows of substantial investment, resulting in an uptick in exploration and development activities.

Experts at Ernst and Young believe this is due to the country having maintained its investment-grade credit rating since Moody’s Investors Services raised it to that level in 2009.

In turn, the upgrade has had a positive impact on Peru’s economy and has slashed the risk premium demanded by multinationals and foreign investors.

“The country’s stable, credible, and consistent macroeconomic policies in various administrations are the key supporting factors for the investment-grade rating,” Ernst and Young transfer pricing and tax services partner, mining and metals leader, Marcial Garcia says.

For this reason, the country has been the source of much higher private investment and multinationals are beginning to take Peru more seriously.

ASX plays in Peru

ASX copper player Valor Resources (ASX:VAL) has been operating for about seven to eight years at its Picha copper project in the Moquegua and Puno regions of southern Peru.

Picha comprises 13 granted mining concessions for a total of 98km2 and is about 17km east of NYSE listed Buenaventura’s San Gabriel gold-copper-silver project, which reports an Indicated and Inferred resource of 7.6 million ounces gold equivalent.

The 7.6Moz Buenaventura SAA (NYSE:BVN) owned San Gabriel gold-copper project lies just 14km southeast of the Huancune target within the same northeast-southwest trending mineralised corridor.

A pipeline of large-scale, high impact porphyry and epithermal targets have been developed across the project site with drilling planned to commence as soon as approval is received from the Peruvian Ministry of Energy and Mines (MEM).

Third party validation and boots on the ground

In an interview with Stockhead, Valor executive chairman George Bauk says the biggest way the company has dealt with issues in Peru is by having a presence in-country with eyes and ears on the ground.

“For us it’s about a long-term view – you’re going to have your ups and downs at times when you have different government coming in, but it is important no matter where you work in the world that you keep an eye on what is happening.

“We can watch what happens in the media, but they often get their facts wrong and sensationalise – our way of handling that and our way of getting a more balanced view is by having a team in the country.”

Recently, Rio Tinto (ASX:RIO) entered into an agreement with Canadian giant First Quantum to form a joint venture that will work to unlock the development of the La Granja project in Peru – one of the largest undeveloped copper deposits in the work.

La Granja is a complex orebody located at high altitude in Cajamara, Northern Peru, that has the potential to be a large, long-life operation, with a published Indicated and Inferred Mineral Resource totalling 4.32 billion tonnes at 0.51 percent copper.

Under the deal, First Quantum will acquire a 55% stake in the project for $105 million and commit to further invest up to $546 million into the joint venture to sole fund capital and operational costs, taking the project through a feasibility study and toward development.

Bauk says moves like this give third party validation that it is safe to invest large chunks of capital in Peru.

“These are the sort of indicators that continue to give you confidence, but remember – we don’t get to say where the geology or where these great deposits are, we just have to go where they are and if you want to be in copper, then South America and Peru are the places to be.”

At Stockhead we tell it like it is. While Valor Resources is a Stockhead advertisier, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.