Copper can have a big 2019 if Trump mends fences

The world needs more copper.

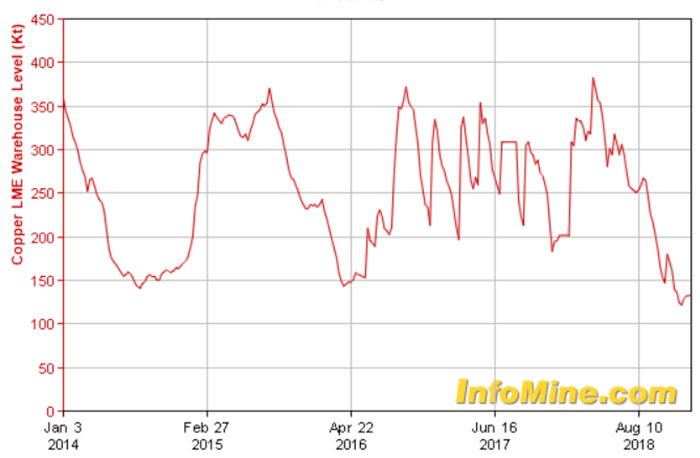

Current supply isn’t meeting demand, with copper inventories falling “to well below average levels”, according to metals and minerals researcher Wood Mackenzie.

Visible inventories are currently at levels last seen back in January 2015 (see chart below).

This means, from a fundamental perspective, copper prices should trend higher throughout the year.

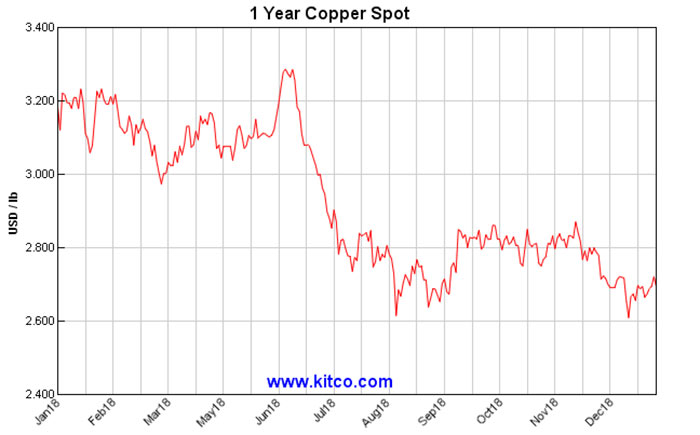

But “unpredictable trade antics” between China and the USA, uncertainty around Brexit, and growing concerns over the health of some of Europe’s economies could continue to throw a spanner in the works.

Right now, macroeconomic drama — not industry fundamentals — is the key driver of investor sentiment.

Investors are staying away – for now

This macroeconomic uncertainty is keeping copper investors on the side lines for now, despite the fundamentally robust outlook, according to Wood Mackenzie.

“The withdrawal of investor interest was a key driver of lower prices through the second half of 2018 and we believe that interest will remain muted this year given the risk-off attitude that appears to be overhanging global base metal markets at present,” Wood Mackenzie analysts say.

“The ‘risk-off’ approach to commodities markets adopted by many investors currently is likely to persist until there is further clarity on the trade issues and the macro outlook for a number of the key economies.”

Production isn’t growing fast enough

Following a near three per cent increase in mine production to 20.7 million tonnes in 2018, Wood Mackenzie expects just 0.3 per cent growth in 2019.

“Despite the start-up of greenfield projects such as Cobre Panama, Mirador and Carrapateena in 2019, their contribution will be more than offset by lower production from existing mines, and by Grasberg in particular,” the copper team says.

The massive Grasberg operation in Indonesia will produce less than half the amount of copper it produced in 2018, as it transitions from open pit mining to underground.

#Copper concentrate exports from Indonesia’s Grasberg mine are forecast to plunge in 2019 from 1.2mt to 200,000t because of a lag in output as operations move from open pit to underground #mining https://t.co/wr2f7D1FF7

— Mining Analysts (@MiningAnalysts) January 12, 2019

Early stage projects MUST progress

Earlier stage projects will continue to advance through 2019, incentivised by higher copper prices, according to Wood Mackenzie.

They need to, because the medium-term production pipeline looks increasingly thin.

“The steady advancement of new supply into our base case over the last couple of years has resulted in relatively few probable projects in the pipeline,” the Wood Mackenzie team says.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“Since the beginning of 2017, we can identify nearly 40 projects with a total production capability of over 2.2 million tonnes of copper per year that have been committed to and that have shifted from our probable category and into our base case.”

There are now 25 uncommitted probable projects remaining, totalling 1.5 million tonnes of copper per year — but only five of these projects could produce over 100,000 tonnes a year.

Compare this to 10 years ago — prior to the last boom in copper project development — when there were 60 probable projects in the pipeline totalling 5 million tonnes of copper per year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.