Construction begins at South Africa’s next major gold producer

Theta Gold Mines has started the transition from development to construction at TGME. Pic: Getty Images

- Theta Gold Mines begins bulk earthworks on 6.1Moz South African gold project

- Construction contracts signed with funding secured for initial works phase

- Plant commissioning targeted for end-2026 and first gold pour in Q1 2027

Special Report: Theta Gold Mines has officially started bulk earthworks and civil works directed at resurrecting its shovel-ready 6.1Moz Transvaal Gold Mining Estates gold project in South Africa.

Located 370km northeast of Johannesburg on the eastern side of the Bushveld Complex, where 40-50% of historical global gold production was sourced, TGME includes more than 43 historical mines scattered around its 620km2 of ground.

The project currently has a resource of 45.84Mt grading 4.17g/t, or a whopping 6.1Moz of contained gold and is 74%-owned by Theta Gold Mines (ASX:TGM) with the remainder owned by Black Economic Empowerment entities including traditional Landowners Trusts and Employee Trusts.

Under a feasibility study dating back to 2022, TGME is expected to produce between 80,000 and 100,000oz of gold per annum over a near 13-year mine with production occurring as soon as early 2027.

This is expected to generate pre-tax net present value and internal rate of return – both measures of profitability – estimated at US$324m and 65% using an assumed gold price of US$1642/oz.

What makes this potentially very lucrative is that this assumed price is less than half (about 45% actually) of the current spot price of ~US$3639/oz, meaning the actual returns could be much higher. The Company is due to publish an updated FS in Q4 2025.

Theta plans to scale production to 160,000–200,000ozpa within five years, positioning TGME as a transformative asset.

Construction milestone

Speaking of works, the start of earthworks and civil engineering activities marks a pivotal milestone in the transition from development to construction.

It has signed off on contracts with leading construction partners PICM and Mainpro – who have a wealth of expertise and proven track records in large-scale infrastructure and resource developments – to deliver this essential phase of the project.

Meanwhile, project processing plant designers RM Process and Eco Elementum have been appointed to oversee this phase of the project.

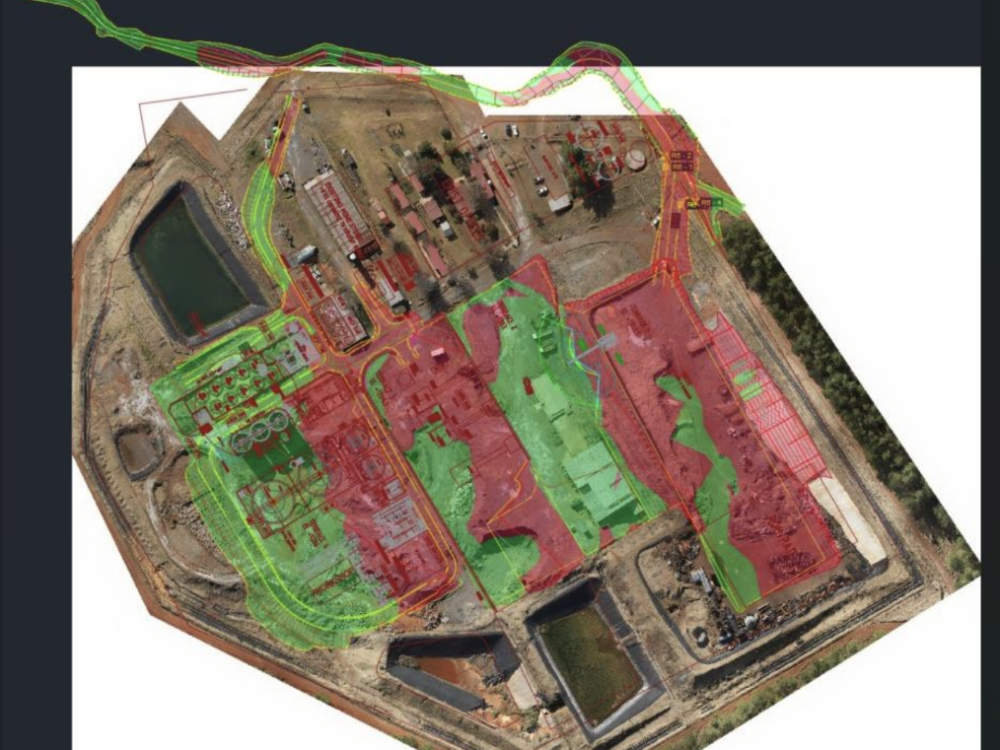

Works to be conducted now include:

- five bulk earthworks platforms;

- 721m of roads;

- 1355m of clean and dirty water channels;

- 10,000m3 of concrete dams;

- 135m CIL bund walls; and

- 5,540m3 plant civil works.

These operations are designed to optimise site conditions, laying the foundation for advanced water management systems and civil infrastructure, positioning TGME for the next phase of development.

The company also has a formal agreement with long-term institutional investors, Golden Asia Investment Group Limited and High Gift Investment to cover any upcoming payment obligations for earthworks, civil works and water management projects while it continues negotiations with lenders on the broader funding package.

“The start of the earthworks and other long lead activities demonstrates our commitment to becoming South Africa’s next gold producer,” Executive Chairman Bill Guy said.

“Once civil works and funding are complete, we will be commissioning the plant by end of 2026 and processing ore in Q1 2027.

“With skilled local teams and experienced contractors, we are hitting key milestones on schedule.

“Our training programs will deliver long lasting economic opportunities and prosperity for local communities and the region.

“TGM remains on target to release an updated and optimised Feasibility Study shortly.”

This article was developed in collaboration with Theta Gold Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.