Collision course? A tale of falling mineral exploration budgets and impending supply shortfalls

Pavel Kolgotin crashes at the Men's Ski Cross Final of the FIS Freestyle Ski World Championships. Pic: Tom Pennington (Getty)

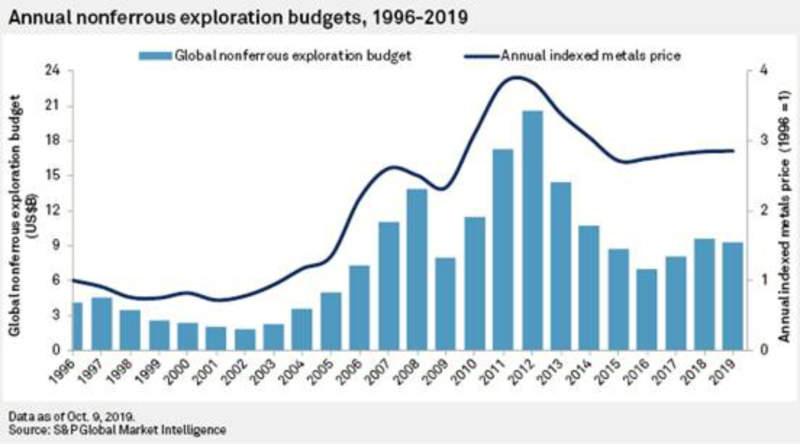

At first glance, it looks like a vicious picture with global non-ferrous exploration budgets still well down from their peaks in 2012 while supply gaps for critical metals such as nickel are likely to make their presence felt in the near-term.

Global market intelligence firm S&P Global has estimated that the exploration budget for 2019 is down 3 per cent year on year to US$9.8b with Australia being one of the few regions to buck the trend.

Australian non-iron mining exploration budgets in 2019 rose by US$199.4 million to US$1.53 billion thanks to budgets that were drawn up in the middle of 2018 when the industry was still on an upward trend.

Despite rising gold prices, gold explorers have slashed US$559m from their budgets to US$4.29b though both copper and nickel budgets have increased by US$245m and US$54m respectively to US$2.32b and US$351.6m.

“Difficult market conditions and high-profile M&A activity have unsurprisingly impacted budgets the most, as the amount of money being raised by companies dropped sharply from November 2018 through February of this year,” S&P Global Market Intelligence associate director of Metals & Mining Research Mark Ferguson said.

“Exploration expenditure in Australia has indeed bucked the global trend in 2019, in part due to significantly increase gold exploration, driven by a strong gold prices,” Association of Mining and Exploration Companies (AMEC) CEO Warren Pearce told Stockhead.

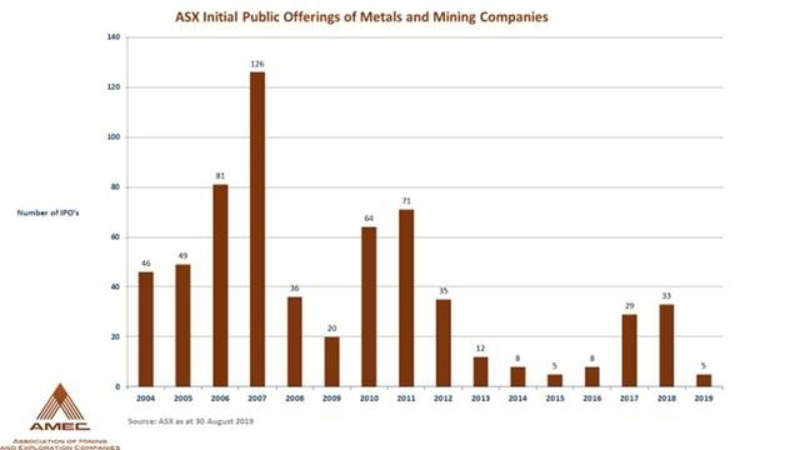

“However, Australian exploration companies have had to find new ways of attracting funding to support their exploration programs, due to a challenging investment environment. In 2019, we have only seen five IPOs, compared with over 30 at the same time last year.”

Supply Shortfalls

The fall in exploration budgets comes amid rising concerns about potential shortfalls for many minerals.

Demand for non-Chinese sources of rare earths is rising, particularly for neodymium-praseodymium, which are a critical component of permanent magnets that are used in high-tech devices such as magnetic resonance imaging, medical imaging systems, small but powerful headphones, and electric car motors.

Cobalt supplies are also forecast to become tighter with Benchmark Minerals questioning how well supplied the market will be with the impending shutdown of multi commodity giant Glencore’s globally significant Mutanda mine in the Democratic Republic of Congo.

Meanwhile, the combination of Indonesia’s decision to ban the export of nickel ore from New Year’s Day 2020 — two years earlier than planned — as well as rising Chinese steel demand and the rapid adoption of electric vessels has resulted in falling stockpiles and rising nickel prices.

Copper, a key indicator of economic performance, could also be impacted with one analyst estimating that supplies could be in deficit from 2024 though this could be tempered by ongoing trade tensions and its potential impact on growth.

Even gold could face supply issues with global resources consultancy Wood Mackenzie saying that peak gold supply is a real possibility given that exploration budgets have fallen since their highs in 2011-12 while the slight rebound in the recent years have been focused on brownfield projects and near-term developments.

Clearer Roads Ahead

However, there may be some light at the end of the tunnel.

Ferguson said that S&P is encouraged by some positive signs, such as the rising number of active companies, and copper recording a year-over-year increase in exploration budgets.

“As the market remains volatile, we anticipate exploration budgets remaining relatively flat in 2020, as any increase to gold budgets will likely be offset by lower allocations to other commodities.”

Woodmac also noted that with gold breaking through US$1500 per ounce, exploration activity might be turning the corner with major miners starting to take an interest in a few juniors with enticing exploration opportunities.

Mid-tier gold producers are likely to consider mergers with peers and acquire assets that majors have determined to be non-core, while smaller projects in low sovereign risk jurisdictions and short payback periods could be fast-tracked into production.

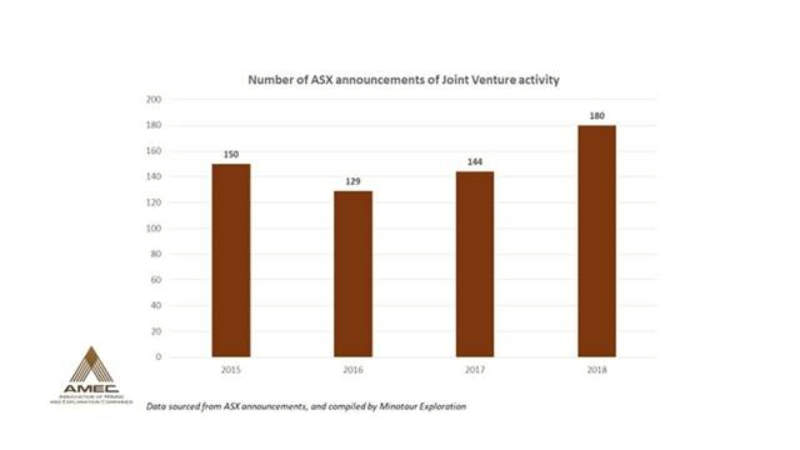

“While there has been increased M&A activity, this has not been a major factor in slowing exploration growth in Australia. Instead, joint ventures agreements have increased significantly, with many large miners choosing to partner with junior explorers hoping to unlock a new pipeline of mining projects,” Pearce said.

The AMEC CEO highlighted the following as some examples of major miners partnering with explorers:

- OZ Minerals and Cassini Resources – West Musgrave Project, Western Australia

- Independence & Prodigy Gold – Lake Project, Northern Territory

- Newcrest & Encounter Resources – West Tanami region, WA.

ASX small cap gainers

With the ongoing concerns about supplies and the overall fall in exploration budgets, what are some of the top gainers amongst the small cap miners over the past three months?

Stavely Minerals (ASX:SVY) has put on a meaty 495.45 per cent in this period thanks to a high grade at its namesake project in Victoria that appears to indicate that the company has made a major exploration breakthrough.

The hole, located 160m south of the discovery site targeting the Thursday’s Gossan prospect returned assays of 8m at 9.69 per cent copper, 0.4 grams per tonne gold and 16.8g/t silver from 177m down-hole along with a shallower but thicker intercept of 59m at 1.8 per cent copper, 0.43g/t gold and 15.4g/t silver from 98m.

Additionally, visual observations of drill core from another two step-out holes, each a further 80m to the southeast, indicate that both holes encountered zones of massive to semi-massive mineralisation.

Andromeda Metals (ASX:ADN) has been tearing up the tracks after Evolution Mining met its Stage 1 earn-in obligations for the Drummond gold project joint venture.

The gold producer subsequently committed to the second stage of the earn-in in mid-September.

Krakatoa (ASX:KTA) made big gains after starting due diligence on the Belgravia copper-gold project in New South Wales earlier this month and subsequently exercising its option to acquire the project about a week later.

Belgravia is located about 30km north of Newcrest Mining’s Cadia East project and has six initial targets that are considered to be prospective for porphyry copper-gold and associated skarn copper-gold.

| Code | Name | Price (3pm Wed) | 3M % Return | Market Cap |

|---|---|---|---|---|

| SVY | STAVELY MINERALS LTD | 1.31 | 495.45 | 240.65M |

| MAG | MAGMATIC RESOURCES LTD | 0.11 | 450 | 13.01M |

| AQX | ALICE QUEEN LTD | 0.05 | 300 | 37.77M |

| ADN | ANDROMEDA METALS LTD | 0.05 | 240 | 76.03M |

| SPX | SPECTRUM METALS LTD | 0.08 | 200 | 101.14M |

| SCN | SCORPION MINERALS LTD | 0.01 | 200 | 2.12M |

| CLZ | CLASSIC MINERALS LTD | 0.003 | 200 | 14.81M |

| SRN | SUREFIRE RESOURCES NL | 0.01 | 185.71 | 6.28M |

| DRE | DREADNOUGHT RESOURCES LTD | 0.01 | 175 | 16.13M |

| LMG | LATROBE MAGNESIUM LTD | 0.02 | 166.67 | 20.74M |

| MEI | METEORIC RESOURCES NL | 0.06 | 162.5 | 60.19M |

| AHK | ARK MINES LTD | 0.03 | 161.54 | 2.06M |

| SG1 | SAGON RESOURCES LTD | 0.06 | 148 | 19.49M |

| OAU | ORA GOLD LTD | 0.02 | 144.44 | 14.21M |

| MSE | METALSEARCH LTD | 0.01 | 140 | 5.77M |

| KGD | KULA GOLD LTD | 0.02 | 140 | 1.41M |

| DCN | DACIAN GOLD LTD | 1.52 | 139.37 | 343.94M |

| AZI | ALTA ZINC LTD | 0.01 | 133.33 | 12.81M |

| KTA | KRAKATOA RESOURCES LTD | 0.05 | 133.33 | 8.10M |

| CWX | CARAWINE RESOURCES LTD | 0.23 | 119.05 | 15.70M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.