Coking coal guide: Why it’s hot and which small caps look well-positioned

Thermal coal may be on the nose among investors, but coking coal is still going strong — and it’s encouraging some interesting ASX activity.

Coking coal prices have been on the up since mid-2016, buoyed by strong demand in Asia for steel due largely to China’s focus on infrastructure and housing.

About 60 per cent of global supply comes from Australia, according to the Department of Industry, Innovation and Science.

The bulk is produced by Australia’s majors — Rio Tinto (ASX:RIO), Yancoal (ASX:YAL), Whitehaven Coal (ASX:WHC) — but there are at least seven smaller companies racing to fast-forward Australian mines or exploration blocks into production.

Bounty Mining (ASX:B2Y), is due to list in June with an $18 million IPO (and a project with a complicated tail of legal issues).

>> Scroll down for a table of ASX-listed coking coal stocks courtesy of leading ASX data provider MakCorp

Of the ASX’s 19 coking coal companies who aren’t a big coal producer, 11 are looking overseas for their competitive edge and few are doing any producing yet.

TerraCom (ASX:TER) and Aspire Mining (ASX:AKM) are in Mongolia, a country with some of the world’s richest coking coal reserves but which must largely sell to its neighbour China, limiting the country’s ability to raise prices.

The others are spread around the world and are entirely explorers, from Cokal’s (ASX:CKA) Indonesian licences to Tiger’s Realm Coal’s (ASX:TIG) Russian adventure.

Realm Resources is currently subject to a takeover offer. It has been in suspension for much of the last two years but did trade for a month in June and July last year.

Price is right

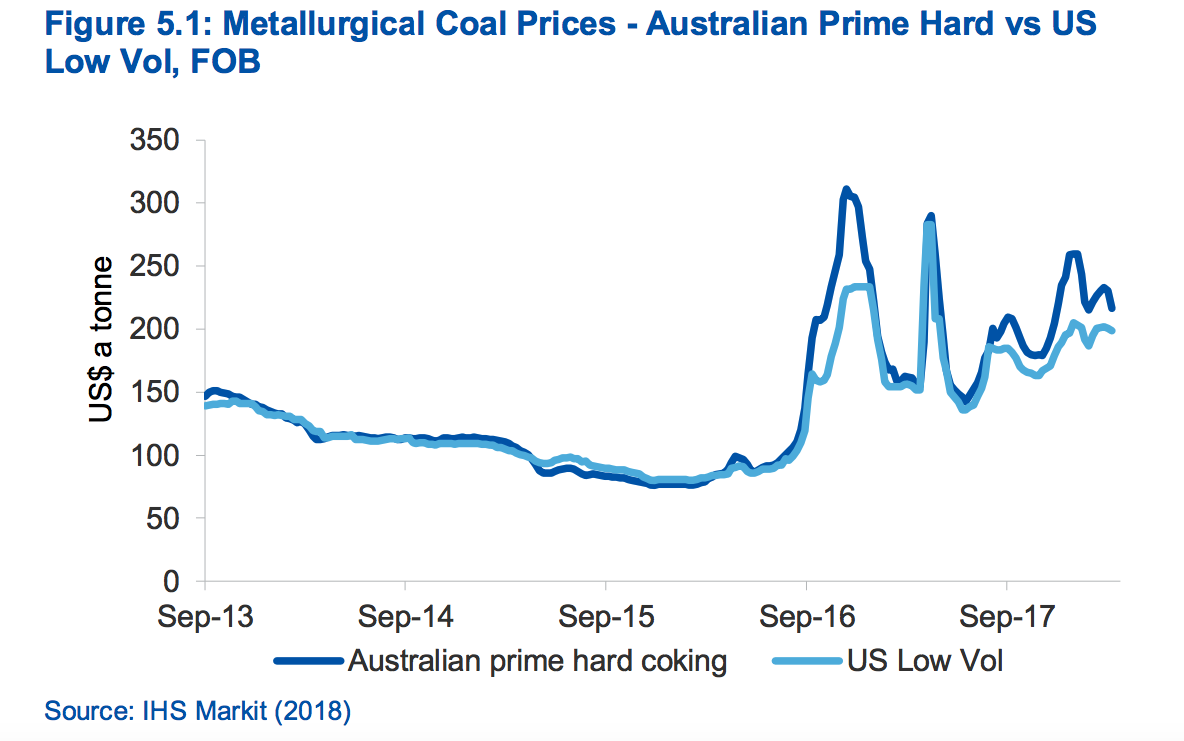

The reason for the rush of explorers is, partly, the fact that prices have surged since the middle of 2016.

The outlook for coking coal is much better than for its relative, thermal coal, due to the expected continuation of strong demand for steel.

Coking coal is vital in steel production.

Global crude steel production was 426.6 million tonnes in the first three months of 2018, up 4.1 per cent compared to the same period in 2017, according to the World Steel Association.

Spot prices for Australian coal were around $US220 a tonne earlier this year on strong Asian demand, bad weather in the United States, and supply problems in eastern Australia keeping the market tight.

While they’re expected to soften as more supply comes on stream — and indeed have dropped to around $US180-190 — they aren’t expected to drop past $US140 a tonne before bouncing again later this year, so speculated the March Resources and Energy Quarterly.

Pac Partners energy analyst Lawrence Grech wrote in late April that coal prices were still up around two year highs two years and “when combined with the rude health of North Asian steel mill margins – appear to be supportable in an environment of still firm global growth”.

“We believe this price outlook has significant upside potential as China’s coking coal mines face ongoing regulatory and resource challenges and there remain Australian infrastructure and mine production inefficiencies due to recent years under-investment,” he said.

“Indeed, significant re-investment in Australian mines as strip ratios increase as well as greenfield Canadian mine development costs support higher longer-term incentive prices than most market commentators are willing to concede at present.”

Here’s list of table of ASX-listed coking coal stocks, courtesy of leading ASX data provider MakCorp

| ASX Code | Company | 12-month price change | Price May 17 | Market Cap | Location of projects | Phase of projects |

|---|---|---|---|---|---|---|

| RRP | REALM RESOURCES | Suspended | 0.085 | -- | Queensland | Production |

| AHQ | ALLEGIANCE COAL | 1.27272727273 | 0.05 | 23.2M | Queensland, Canada | Exploration; Feasibility study |

| SMR | STANMORE COAL | 0.833333333333 | 0.66 | 167.4M | Queensland | Exploration |

| CKA | COKAL | 0.407407407407 | 0.038 | 28.5M | Indonesia | Exploration |

| PAK | PACIFIC AMERICAN | 0.245283018868 | 0.066 | 10.9M | Canada | Scoping Study - Advanced |

| JAL | JAMESON RESOURCES | 0.238095238095 | 0.13 | 33.4M | Canada | Exploration |

| PDZ | PRAIRIE MINING | 0.159574468085 | 0.545 | 93.0M | Poland | Bankable Feasibility Study - Advanced |

| AKM | ASPIRE MINING | 0.117647058824 | 0.019 | 50.6M | Mongolia | Feasibility Study - Advanced |

| TER | TERRACOM | 0.112903225806 | 0.345 | 118.8M | Queensland, Mongolia | Exploration; Production |

| LNY | LANEWAY RESOURCES | 0 | 0.003 | 10.0M | NSW | Feasibility Study - Advanced |

| MEY | MARENICA ENERGY | -0.12 | 0.11 | 6.3M | North America | Exploration |

| TIG | TIGERS REALM | -0.160714285714 | 0.047 | 86.0M | Russia | Feasibility Study - Advanced |

| NAE | NEW AGE EXPLORATION | -0.166666666667 | 0.01 | 4.1M | UK | Scoping Study - Advanced |

| MRV | MORETON RESOURCES | -0.181818181818 | 0.009 | 24.9M | Queensland | Exploration |

| WLC | WOLLONGONG COAL | -0.333333333333 | 0.006 | 56.2M | NSW | Production - Care & Maintenance - Advanced |

| BCB | BOWEN COKING COAL | -0.5 | 0.015 | 7.5M | Queensland | Exploration |

| MCM | MC MINING | -0.552631578947 | 0.51 | 71.8M | South Africa | Feasibility Study - Advanced |

| AJC | ACACIA COAL | -0.6 | 0.002 | 3.2M | Queensland | Sold |

New investors

It’s on the back of these kinds of prices that a company like Bounty Mining can take a complex project to the ASX.

Bounty took over a project in Queensland which came with a complicated tail of obligations to prior owners and partners.

Chief Gary Cochrane is highly optimistic about the potential of the Cook North project, which comes with major existing infrastructure, and the coking coal market.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

They got the lot for $40 million, a tiny sum compared to the hundreds of thousands already spent on the project because no one else could be bothered dealing with the paperwork.

Higher prices also allow Bounty to initially make casual, ad hoc sales before locking itself into long term contracts.

Mr Cochrane, who is even more bullish about the prospects of the poor cousin thermal coal, says they want to ensure they have the supply rather than just the potential for supply, before making contracts.

Stockhead is proud to use MakCorp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to MakCorp’s website.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.