Cohiba’s copper prospects looking good in IOCG dress circle

Pic: Wayne Eastep / The Image Bank / Getty Images

As some of the world’s biggest miners jostle for more red metal assets Cohiba Minerals has intersected additional visible copper mineralisation at its Horse Well Prospect, just 7km from BHP’s up and coming Oak Dam deposit in South Australia.

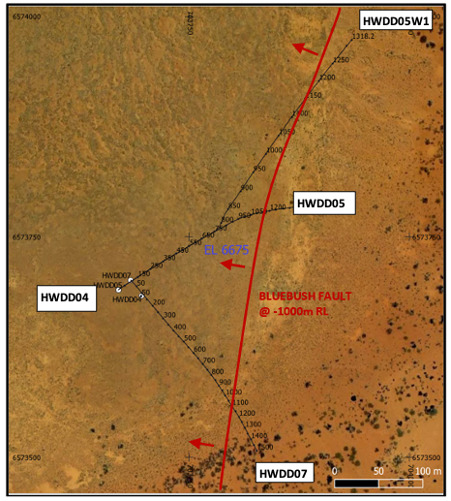

The latest drilling targeted the extension of the Bluebush Fault after copper mineralisation was found in 3 previous drill holes. These drill holes indicate that Cohiba Minerals (ASX:CHK) is sitting in a highly prospective zone with potential for an iron oxide-copper-gold (IOCG) discovery.

The latest drilling unearthed visible copper immediately next to the Bluebush Fault, boosting CHK’s confidence in the orientation of the fault to make way for more step-out drilling.

Premier address

Horse Well is part of Cohiba’s Olympic Domain project that covers 831sqkm in South Australia’s mineral rich Gawler Craton, the world’s top spot for IOCG deposits.

IOCG systems can be tremendously large, high grade, and simple-to-process concentrations of copper, gold and other economic minerals.

Cohiba has previously uncovered multiple targets close to globally significant deposits such as BHP’s (ASX:BHP) giant Olympic Dam and its large Oak Dam West discovery, as well as OZ Minerals’ (ASX:OZL) $1bn Carrapateena copper-gold mine and its large-scale Prominent Hill copper-silver-gold mine.

Comprehensive geophysical analysis by Cohiba has indicated the presence of a major “feeder” system believed to be associated with IOCG mineralisation that is comparable in size to the Olympic Dam feeder system.

Cohiba’s CEO, Andrew Graham says, “The Horse Well Prospect represents a key IOCG target zone within the Gawler Craton and we are committed to investigating it to the fullest extent possible.

“Drill hole HWDD07 was drilled with the express purpose of following up on the copper mineralization encountered along the Bluebush Fault in drillholes HWDD04, HWDD05, and HWDD05W1.

“HWDD07 was completed to a depth of 1,519.0m and successfully intersected the Bluebush Fault as interpreted, bringing the total strike length to more than 400m. This has generated significantly increased confidence in the area and will enable the Company to pursue an aggressive step-out program in the future.”

M&A in red metal heats up

Cohiba’s latest results from South Australia come hot on the heels of reports this week that BHP (ASX:BHP) is considering upping its A$8.4 billion offer for OZ Minerals (ASX:OZL) to get its hand on more metal needed for the clean energy transition.

Last month OZ Minerals rejected BHP’s first approach, claiming it undervalued the company’s prospects in metals including copper.

Meanwhile earlier this month Rio Tinto reached a final agreement to acquire all remaining shares of Turquoise Hill Resources, which owns a large copper mine in Mongolia, in its bid to add to its stores of the industrial metal.

The world’s largest producers are all optimistic about copper, forecasting dramatically increased demand as the global economy decarbonizes.

This article was developed in collaboration with Cohiba Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.