Cohiba builds cash pile to expand hunt for Olympic Dam lookalikes

Pic: Getty

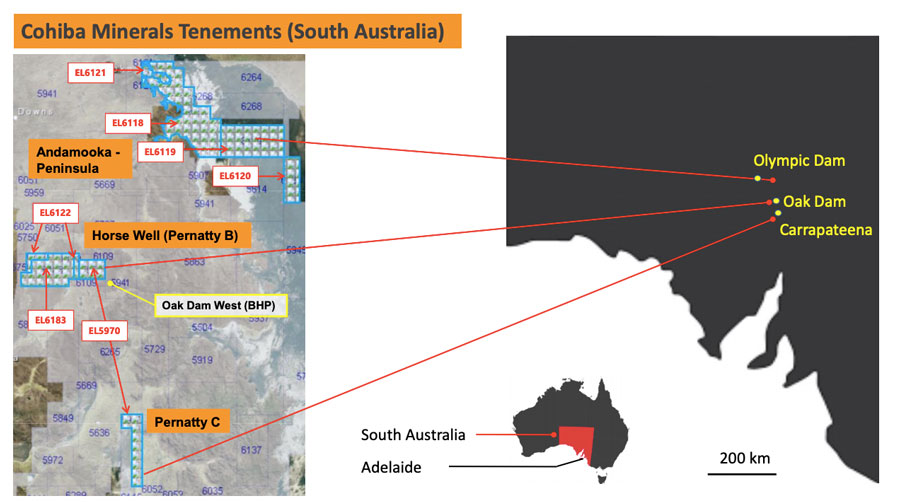

Special Report: Cohiba Minerals is working to top up its coffers with a $2m share purchase plan (SPP) to expand its exploration efforts in the same region as BHP’s massive Olympic Dam and Oak Dam deposits.

Cohiba Minerals (ASX:CHK) has launched a share purchase plan at 1.7c per share, the same price shares were trading at just prior to the announcement, to raise $2m.

The news gave Cohiba a slight nudge, with shares up nearly 6 per cent to 1.9c today.

Cohiba Minerals (ASX:CHK) share price chart:

The company has uncovered multiple targets in close proximity to world class deposits like BHP’s (ASX:BHP) giant Olympic Dam and OZ Minerals’ (ASX:OZL) $1bn Carrapateena copper-gold mine, which began production in December last year.

The funds raised under the SPP will be used to expand Cohiba’s exploration push at the Horse Well and Pernatty C projects in South Australia, as well as investigating new iron oxide-copper-gold (IOCG) targets at Lake Torrens, also in South Australia.

Cohiba is drilling four deep holes at the Horse Well prospect, where previous comprehensive geophysical analysis indicated the presence of a major “feeder” system believed to be associated with IOCG mineralisation that is comparable in size to the Olympic Dam feeder system.

IOCG systems can be tremendously large, high grade, and simple-to-process concentrations of copper, gold and other economic minerals.

Drilling is also backing that up, with one hole showing strong alignment to an IOCG environment and visual evidence of sulphides.

“We are excited by what we have encountered from the drilling program at Horse Well and eagerly await the analytical results,” CEO Andrew Graham said.

“We have applied considerable technical expertise to what we have seen to date to both extend the drilling program around HWDD03 and HWDD04 as well as investigate new targets in the Horse Well area.

“We have also reviewed the historical work at Lake Torrens and applied some new concepts to our thinking with a view to drill testing a primary target area for IOCG mineralisation.”

Once drilling at Horse Well is complete, Cohiba will start drilling at Pernatty C, which has already shown strong similarities to the Mt Gunson copper-cobalt-silver resource located 10km southwest.

Mt Gunson recorded historic production of 150,000 tonnes of copper and 2.1 million oz of silver at an average copper grade of 2.44 per cent.

Pernatty C has also shown strong similarities to the Zambian Copperbelt, which hosts massive mines like Chambishi (124 million tonnes at 2.6 per cent copper).

The cash raised from the SPP will also go towards finalising the mining lease for the Pyramid Lake gypsum project in Western Australia.

This article was developed in collaboration with Cohiba Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.