Coda and Torrens may have hit IOCG paydirt. These explorers are right over the fence

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Junior joint venture partners Coda Minerals (ASX:COD) and Torrens Mining (ASX:TRN) have hit 200m of “intense IOCG alteration”, including ~50m of copper sulphides at the ‘Elizabeth Creek’ project in the Stuart Shelf region of South Australia.

This could be huge.

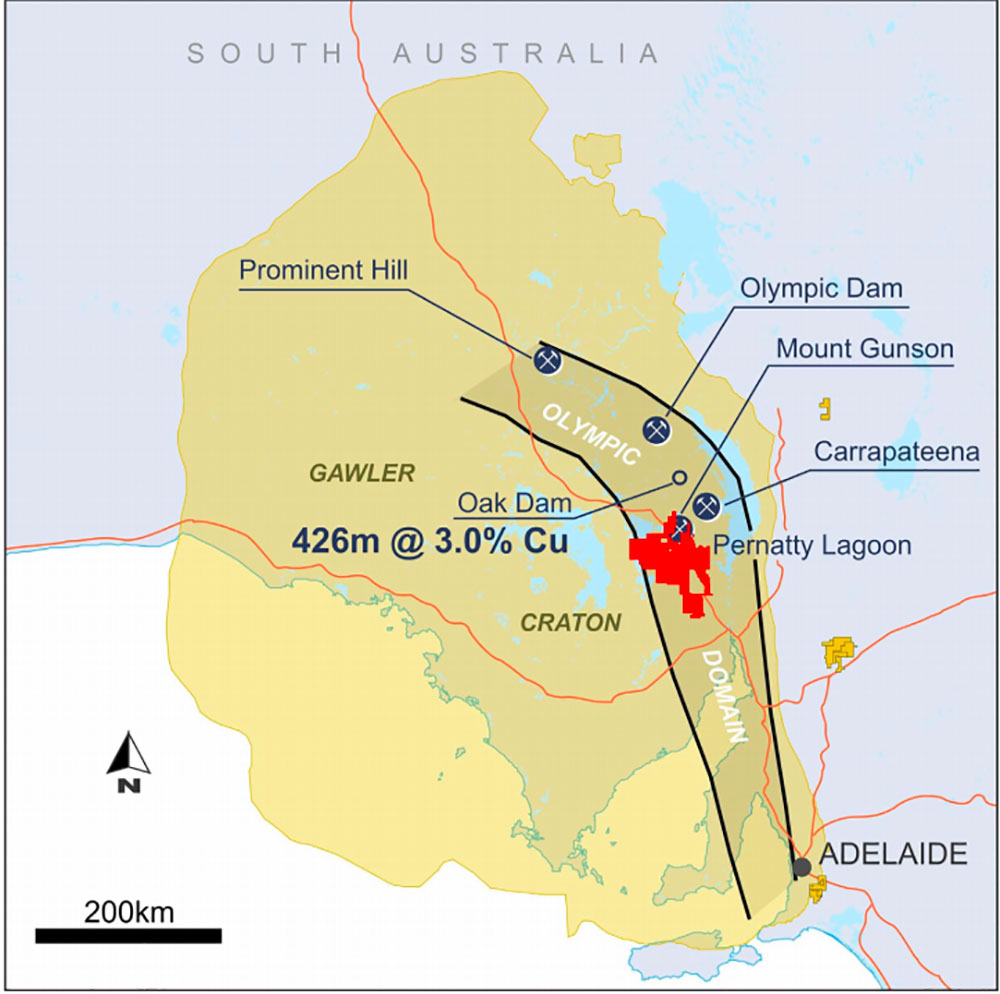

Iron oxide copper gold ore deposits (IOCG) — like BHP’s Olympic Dam mine or more recent Oak Dam discovery — can be tremendously large, and simple-to-process concentrations of copper, gold and other economic minerals.

The 2018 discovery hole at Oak Dam, 65km from Olympic Dam, included 180m grading 6% copper, 1km from surface.

That’s right: 1km. IOCGs can also start deep which makes hunting them a high risk and high cost, but very high reward endeavour.

It’s why so few holes have been drilled in this region since Olympic Dam was discovered.

“We have long known we are exploring in elephant country – a view backed up not only by the world class projects which surround us, but also by historical and geophysical evidence of an IOCG system in the northern part of our tenure,” Coda chairman Keith Jones says.

Is this the company-making discovery all juniors dream about? With assays pending it is still too early to tell, but Coda is now up ~280% since listing on the ASX in October last year, while Torrens is up ~50% on its January listing price of 20c per share.

Most of those gains have come over the last few days.

Who else is exploring the Stuart Shelf copper gold province? Here are six juniors looking for an IOCG payday of their own.

DGO GOLD (ASX:DGO) and INVESTIGATOR RESOURCES (ASX:IVR)

DGO Gold – known for making substantial investments in De Grey Mining (ASX:DEG) before it hit the motherlode at Hemi – has a project called ‘Pernatty’, 55km from OZ Minerals’ Carrapateena copper-gold mine.

DGO holds 16 licences covering 4,730ksqkm at Pernatty; five of these are under a binding deal with Investigator Resources, where DGO can earn an 80% interest over five years.

A recent maiden wide spaced drilling program hit copper, cobalt, and silver mineralisation up to 0.95% copper, 0.1% cobalt, and 26.7g/t silver.

“This drilling has confirmed the potential for Zambian style model of copper mineralisation in this area of the Stuart Shelf,” executive chairman Eduard Eshuys says.

“DGO’s strategic landholding of greater than 100km strike of the target zone puts us in a strong position to identify significant copper mineralisation in follow up drilling.”

TASMAN RESOURCES (ASX:TAS)

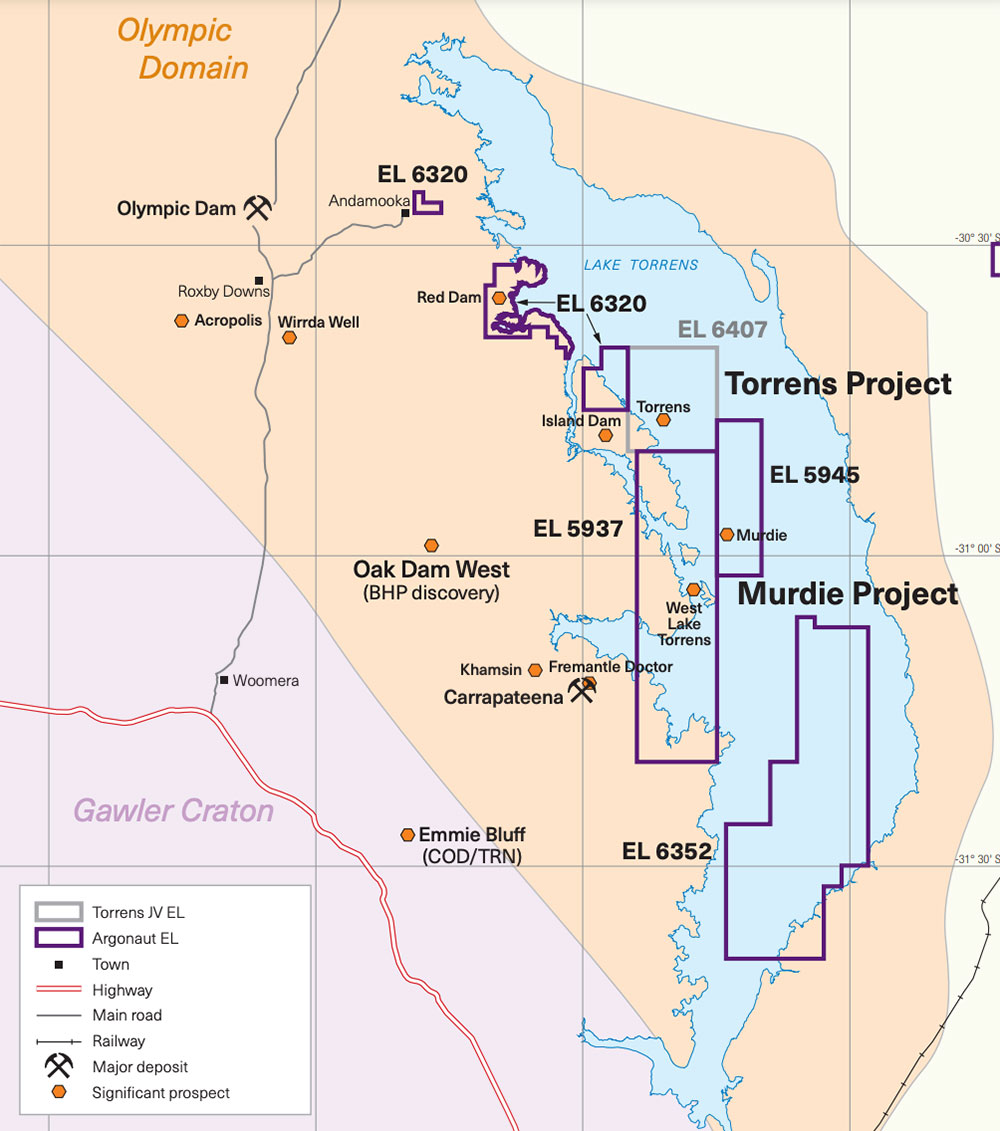

Tasman is free-carried under a deal which sees major miner Fortescue Metals Group (ASX:FMG) earn in to 51% of the ‘Lake Torrens’ project, 30km from Olympic Dam.

The first hole completed by FMG was a 1.675km long monster designed to test the ‘Vulcan North’ anomaly.

Assays released in April included “numerous intervals of copper mineralisation” including 62m at 0.55% copper (including 13m @ 1.04% copper and 0.6 g/t gold).

Tasman still awaits the assay results from VUD0019, the second of the two holes recently drilled by Fortescue and will release them as they come to hand.

Tasman has been chipping away at this project for over a decade, so a big mineral discovery would be something special.

ARGONAUT RESOURCES (ASX:ARE)

Argonaut’s ‘Murdie’ IOCG project is near BHP’s Oak Dam discovery.

A drilling program of 4-5 deep holes into large, prospective copper targets kicked off in March.

“The discovery of an IOCG deposit by Argonaut would be a transformative, company-making event,” the $30m market cap junior says.

The first hole at ‘Smith Dam 1’ intercepted an IOCG alteration system, the company says.

“The intensity of alteration indicates that WLTD001 is 300 to 1,000m from possible copper mineralisation,” it says.

Drilling of the second drill target, ‘Smith Dam 2’, is in progress.

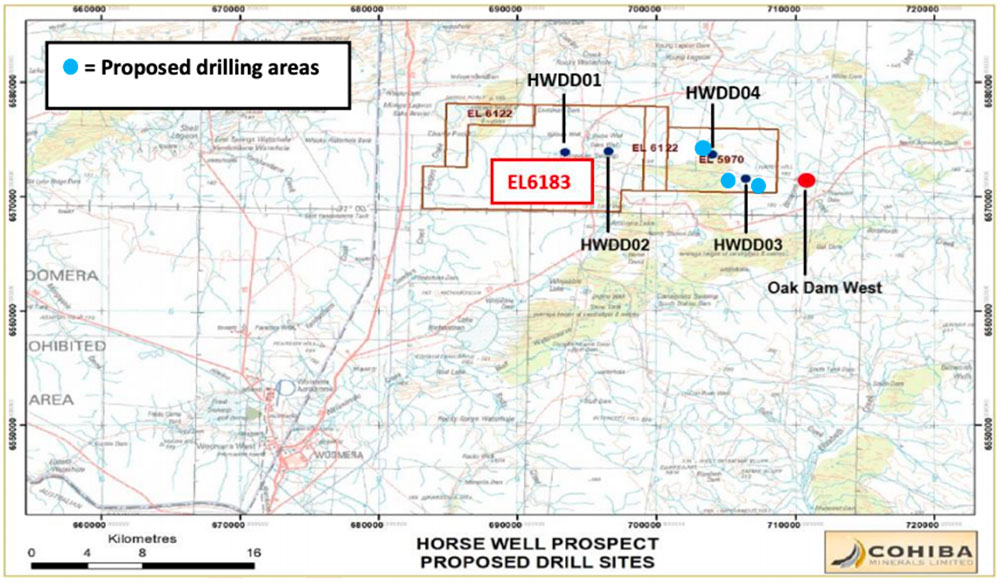

COHIBA MINERALS (ASX:CHK)

Cohiba’s tenement package contains substantial potential for IOCG deposits “and is to be explored aggressively”, the company said late April.

Up to 19,000m of drilling is planned, with the ‘Horse Well’ prospect (~12,000m) the primary target area.

While a recent drilling program at Horse Well missed paydirt, it confirmed the company was drilling in the right area for a big discovery.

“The company’s recent exploration activities at its Olympic Domain tenements, particularly at Horse Well, confirm the exciting potential for IOCG discoveries there,” Cohiba’s Andrew Graham says.

“The company is planning an extensive program of exploration activity, including up to 19,000m of drilling, to further test for this potential.

“Financially, we are in a very strong position to pursue this objective over 2021 as well as take advantage of opportunities to grow our portfolio in the Gawler Craton.”

AERIS RESOURCES (ASX:AIS)

The miner’s ‘Torrens’ JV with Argonaut (70% Aeris) lies within 50km of Oz Minerals’ Carrapateena deposit and BHP’s Oak Dam West discovery, and 75km from Olympic Dam.

A recent copper discovery at ‘Constellation’ (100% Aeris) and Helix’s (ASX:HLX) ‘Canbelago’ project (30% Aeris) — both in NSW — means Torrens probably isn’t a priority right now. No on-ground exploration activities were completed at the Torrens during the last quarter.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.