Cobalt and lithium exploration budgets are now up 500pc since 2015, says analyst

The anticipated surge in electric vehicle (or ‘EV’) demand has triggered an 82 per cent increase in global exploration budgets for cobalt and lithium in 2018.

Cobalt and lithium exploration budgets are now up 500 per cent from 2015 levels, according to a report from S&P Global Market Intelligence.

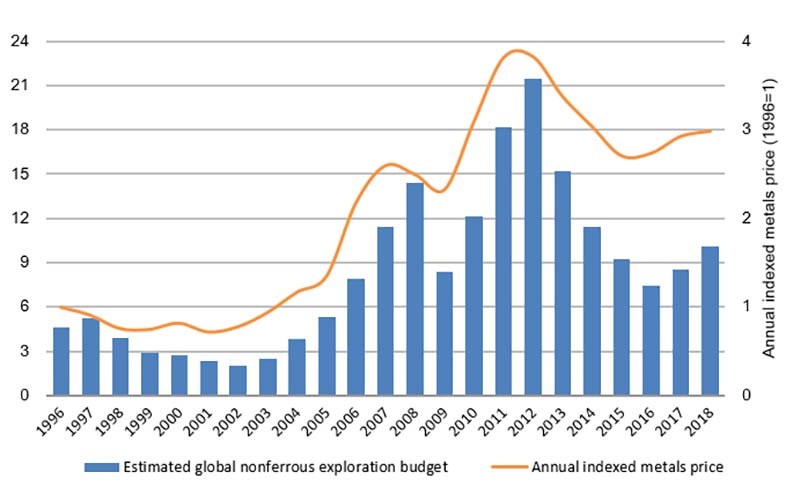

Overall, nonferrous – metals that don’t contain iron — exploration budgets increased by 19 per cent to $US10.01 billion for 2018.

And for the first time since 2012 there was been an uptick in the number of mining companies with exploration budgets, an 8 per cent increase to 1651 companies from the previous year.

Mark Ferguson, Associate Director of Metals & Mining Research at S&P Global Market Intelligence, says improved metals prices and margins since 2016 have encouraged producers to expand exploration.

Click here for news driving battery metals stocks >>>

“Over the same period, equity market support for the junior explorers has improved, leading to an uptick in the number and size of completed financings,” he said.

“This allowed [junior explorers] to increase exploration budgets by 35 per cent in 2018.”

The 2018 total is still about 900 companies less than the 2012 peak, however.

“Our data does show that, despite these improvements, the level of equity market support and industry-wide exploration efforts remain far below peak levels recorded from 2010 to 2012,” Mr Ferguson says.

Gold exploration budgets benefitted the most from the industry recovery, increasing to US$4.86 billion in 2018, up from US$4.05 billion in 2017.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Base metals exploration – such a copper, zinc or tin — has increased by more than US$600 million to US$3.04 billion, with copper remaining “by far the most attractive of the base metals”.

Budgets are up for all targets except uranium, Mr Ferguson says.

Canada is the top exploration destination, recording a 31 per cent increase to $US1.44 billion for the year, followed by Australia, which is up 23 per cent to $US1.33 billion.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.