CLSA backs Xanadu’s tier one copper aspirations in Mongolia

Xanadu is honing in on high grade zones of mineralisation in latest drilling at its Kharmagtai copper-gold project in Mongolia. Credit: Getty Images

Special Report: CLSA analyst Trent Allen has endorsed Xanadu Mines’ renewed focus on exploration at its flagship Kharmagtai copper-gold project in Mongolia, agreeing with the company’s assessment that it can develop into a tier one asset with further drilling.

Kharmagtai already contains a globally significant resource of 1.9 million tonnes of copper and 4.3 million ounces of gold and Xanadu (ASX, TSX: XAM) had been heading down a path towards development.

One option being explored was starting with a small oxide gold open pit operation before moving on to mining the larger gold-rich copper porphyry.

But the appointment of Colin Moorhead, an ex-Newcrest Mining executive and geologist with intimate knowledge of some of the world’s biggest copper-gold porphyry systems, as chairman late last year led to a rethink in strategy.

In August, Xanadu raised $12 million through an institutional share placement, which CLSA was joint lead manager for, to fund an aggressive exploration program aimed at shoring up the project’s economics and proving its tier one status.

Initiating coverage on the company with a “buy” recommendation recently, Allen said: “The end game is to prove up a tier one mine, which to us means a reserve of +15 years with average annual production of +70kt of Cu (or +300kozpa Au).

“Kharmagtai could potentially produce that with ease, but to be comfortably profitable through the commodity cycle, it needs an All-In Sustaining Cost of less than US$2/lb Cu.

“The key to this will be grade. Kharmagtai is a vast intrusive complex that is still relatively untested, in particular at depth.

“Management has the experience to vector in on additional higher-grade areas (+0.8% copper equivalent) areas of the system, but drilling takes time – a sweet spot might emerge in the current program or in 2021.”

Right team in place

Allen worked under Moorhead at Newcrest’s Cadia Valley Operations in New South Wales and like his former boss, has observed similarities between Kharmagtai and Cadia Valley.

Knowing the critical role Moorhead played in the development of Cadia Valley – he drove the discovery of Cadia East, now Australia’s largest underground mine – and chief executive Andrew Stewart’s in-country background, Allen is comfortable that Xanadu has the team in place to be successful in Mongolia.

He is also of the view that the dramas surrounding the country’s largest mine, the giant Oyu Tolgoi copper-gold operation majority-owned by Rio Tinto, may ultimately prove beneficial for the likes of Xanadu.

“OT has attracted some operational and political controversy around permitting, project ownership and capex – but this is unsurprising given the mammoth scale of the asset,” he said.

“We expect that XAM can benefit from the OT example of how to, and how not to, develop a copper mine in Mongolia.”

Cheap by peer comparison

The Xanadu share price has drifted below the 4.5c price of the August capital raising, not an uncommon turn of events for a junior exploration stock.

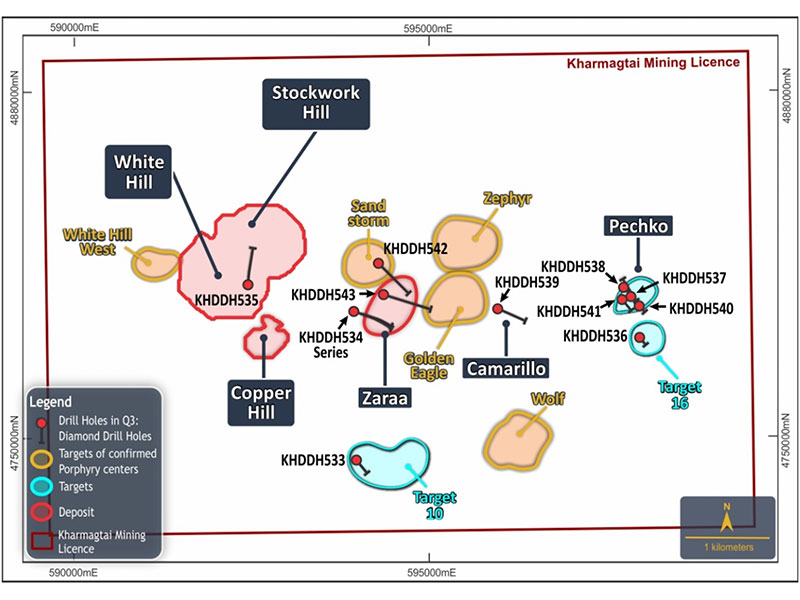

Allen expected that to turn around as the company started to deliver results from the 23km of diamond drilling it is currently completing at Kharmagtai (17km has been drilled to date), honed in on higher grade zones and moved towards a resource update for the project in the first half of next year.

He has a 12-month price target of 8c on the stock based on a sum of the parts valuation, assuming enterprise value to resource ratio improves to $46/t Cu or 0.5% of the in-ground value of the Kharmagtai resource, which is more in line with industry peers.

Nominal value has been applied to Xanadu’s other Mongolian assets, which include the Red Mountain copper-gold joint venture, where Japan’s JOGMEC is spending $7.2 million to earn a 51% interest, and the early stage Yellow Mountain copper project.

Like other investment banks and brokers, CLSA is bullish on copper and is forecasting an average 2021 price of US$3.20/lb, “driven by a clear, long-term theme of scarcity of high quality supply”.

“In this light, Xanadu could be attractive to other companies seeking copper exposure,” Allen said.

This story was developed in collaboration with Xanadu Mines, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.