Classic Minerals founder steps down as cost-cutting commences

Pic: Schroptschop / E+ via Getty Images

Classic Minerals is saying adios to its founding managing director and cutting costs as it moves to bring its flagship gold project into development.

Classic had only $100,000 left in the kitty at the end of September — and planned to spend most of the remaining funds this quarter.

A potential R&D rebate up to $542,329 was expected this month and Classic has access to a $5 million facility.

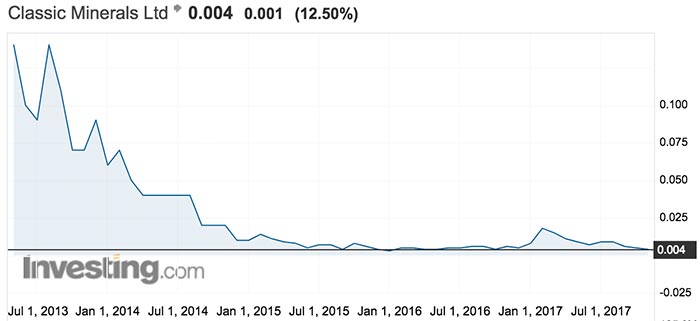

Classic (ASX:CLZ) announced on Friday that founder Justin Doutch had resigned as managing director after seven years at the helm.

Mr Doutch managed the company through its initial public offering and ASX listing in 2013 while securing the company’s flagship Forrestania project.

Experienced mining industry executive Dean Goodwin will take over as acting chief executive while corporate senior executive John Lester joins as a non-executive director.

Mr Goodwin was previously head of geology at Focus Minerals (ASX:FML) and headed up Barra Resources (ASX:BAR) and Mount Ridley Mines (ASX:MRD).

He also has experience as an exploration geologist with Western Mining Corporation and was involved in discovering the Intrepid, Redoubtable and Santa Anna gold deposits at Lake Lefroy.

Mr Lester was formerly head of corporate finance at Pembroke Securities in Sydney and managing director of Golden West Resources where he helped raise $60 million from Asian investors.

He is probably best known as chairman of Yilgarn Infrastructure which was a major tenderer for building the Port of Oakajee in Western Australia.

Cost reduction

The new management will focus on cost-cutting and bringing Forrestania into production.

Non-executive director’s fees have been cut to $30,000 while salaries for the managing director, exploration manager and commercial manager have been terminated.

Several long-standing consulting and services agreements will be cut and two “non-core” tenements costing more than $220,000 a year reviewed for sale.

An ongoing review is expected to deliver further corporate and operational cost reductions.

Classic has acquired 80 per cent of the gold rights on the Forrestania tenements from a third party, while ASX-listed Hannans maintains a 20 per cent stake.

Hannans owns all non-gold rights on the tenements including nickel, lithium and other metals.

Forrestania contains an existing mineral resource of 5.9 million tonnes at 1.25 grams of gold per tonne for 240,000 ounces of gold.

Shares in Classic were last trading at 0.4c with a market cap of around $4 million.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.