China wants more top quality iron ore – and these ASX miners could benefit

Chinese weight-lifter Zhe Yang at the Rio 2016 Olympic Games. Pic: Getty

Iron ore prices will remain elevated throughout the December quarter and average about $US70 per tonne into 2019 – with higher grade ores attracting significant premiums, analysts say.

The steel market has been bolstered by Chinese government stimulus, but US tariffs will continue to impact export growth in China which would otherwise have grown strongly.

This means China could soften its commitments to environmental targets and structural issues – like shutting down inefficient enterprises – within its economy to protect a GDP growth rate of 6.5 per cent, Platts senior research analyst Max Court says.

“These forces continue to drive demand for higher-quality iron ores as the government moves to strike an optimal balance between protecting the GDP growth target and the level of steelmaking emissions,” Mr Court says.

“We expect that GDP growth will be preserved at the expense of air quality but that productive ores will mitigate some of the pollution as a larger production base will reduce emissions on a per-tonne of pig iron basis.”

And big premiums for high grade, low impurity iron ore are here to stay, says explorer Flinders Mines (ASX:FMS), which is searching for a way to upgrade the product at its Pilbara Iron Ore Project (PIOP) in Western Australia.

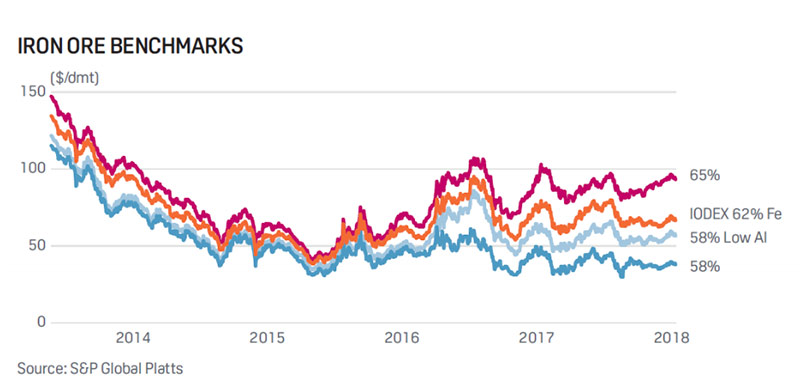

Lower grade iron ore was discounted by up to 40 per cent last year as Chinese steelmakers increasingly favoured higher quality feedstocks (above 62 per cent iron) to boost mill productivity and meet more stringent pollution control measures.

This is good news for Australian iron ore players with high grade, low impurity projects.

These growing premiums for high-grade iron ore products in response to China’s drive to improve the efficiency of its steel industry — and reduce air pollution — has brought Australia’s magnetite sector in from the cold.

Magnetite iron ore has a higher cost of production compared with direct-shipping hematite iron ores (DSO) — produced by iron ore majors like BHP and Rio Tinto — because of the downstream processing involved.

DSO — or direct shipping ore — refers to minerals that require only simple crushing before they are exported, which keeps costs low.

However, the upgraded magnetite iron ore product can grade between 65 per cent to 70 per cent iron, compared with 62 per cent for a premium DSO.

Magnetite producer Grange Resources (ASX:GRR) told investors that record premiums resulted in a 31 per cent increase in average received prices for the September quarter of US$132.41/t.

“The iron ore prices continue to be strong with the premium for high grade pellets reaching record levels,” Grange boss Honglin Zhao said.

Carpentaria Resources (ASX:CAP) is undertaking development studies at its Hawson project in NSW – which boasts a low cost, low impurity 70 per cent iron concentrate.

Emergent Resources, which plans to re-list as Fenix Resources (ASX:FEX), says it could produce up to a 65 per cent product.

The company, which has now launched a $4.5 million capital raising at 4c per share to pave the way for re-listing on the ASX, is acquiring the Iron Ridge project through the acquisition of Prometheus Mining.

And Adelaide based Iron Road (ASX:IRD) is looking for funding to develop its Central Eyre Iron Project (CEIP), located on the Eyre Peninsula in South Australia.

If developed, these high grade, low impurity iron ore projects are well positioned in what is increasingly seen as a structural change in the iron ore market.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.