China demand to drive graphite pricing as Triton starts to build Ancuabe mine

Pic: Tyler Stableford / Stone via Getty Images

Special report: News that government authorities have ordered the immediate shutdown of graphite production in the Qingdao region of China’s Shandong Province is set to fuel flake graphite pricing.

That’s good news for advanced players such as Triton Minerals (ASX:TON), which has been busy locking in supply deals for the graphite from its Ancuabe mine in Mozambique.

Broker Argonaut said it understood the shutdown was issued via a formal letter to a number of local producers ordering graphite production to cease from May 10 to October 1.

That’s expected to have a significant impact on global graphite supply.

“Qingdao accounts for the majority of Shandong’s graphite production, which in turn accounts for 15 to 20 per cent of China’s overall natural flake production,” Argonaut analyst Matthew Keane said in a recent research note.

“As China accounts for 60 to 70 per cent of global natural flake production, these shutdowns could impact 9 to 14 per cent of global supply and therefore have a positive impact on graphite prices.”

Buyers lining up

Triton has already locked in supply deals for half of the annual graphite concentrate that is expected to be produced from its Ancuabe mine.

The company has signed binding off-take sales deals with major Chinese graphite producers Qingdao Chenyang Graphite and Qingdao Tianshengda Graphite.

Both companies are based in the Qingdao region and have confirmed to Triton that they have been forced to shut down and are undergoing environmental audits.

“It is extremely positive for us,” managing director Peter Canterbury told Stockhead.

“The Shandong region has traditionally been the area where the larger flake graphite is produced, but that is diminishing.

“So it reinforces the value of large flake graphite deposits, like the Ancuabe project. It is also really a sign of the times that we’re probably going to see more of a capping of the production in China.

“A lot of this is caused by environmental and pollution concerns, so they will be looking to source pure graphite from non-chemical based mechanical flotation processes and so it really lends itself to both larger flake size and higher purity product that needs to supply into that market.

“Fortunately, we can provide that.”

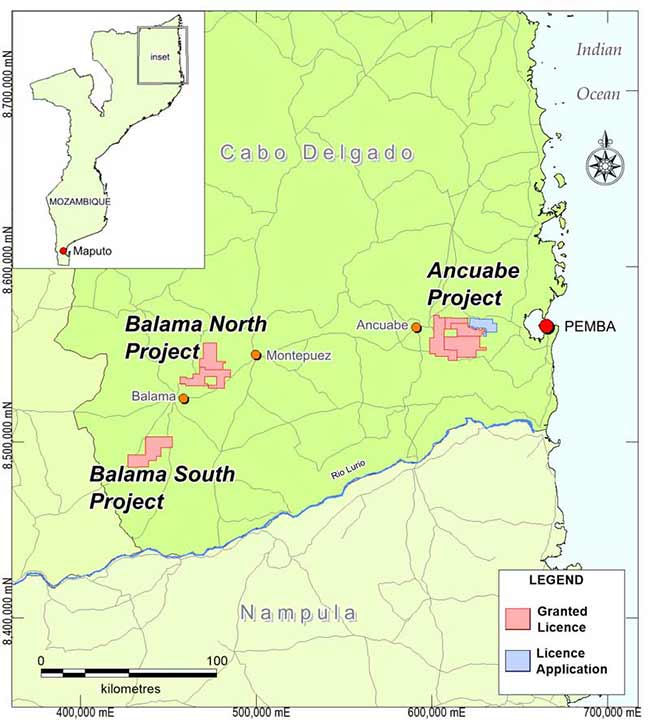

Triton’s project is located in the district of Ancuabe, in Mozambique’s Cabo Delgado province, which is known to host large and high-quality graphite deposits.

About a third of the graphite in Triton’s deposit is jumbo flake and about 59 per cent is large flake, which attracts higher prices over smaller flake graphite.

Argonaut says the Ancuabe project will produce one of the “highest grade, highest flake size products of any listed graphite company”.

Triton’s goal is to have Ancuabe in production by Q4 2019 following a short construction period.

Early works on site clearance and the water dam are on track to begin mobilisation in late May.

The company is progressing the engineering, procurement and construction contracts with Chinese heavyweights Sinosteel and China Metallurgical Group (MCC).

Sinosteel and MCC can also help Triton secure debt funding through their banking connections at a much lower interest rate than other financiers outside of China.

Other funding opportunities

Triton has recently had productive talks with parties in Dubai interested in a potential joint venture over its Nicanda Hill graphite and vanadium project.

“We continue to talk to a number of parties about the joint venture/farm-out of part of Nicanda Hill into a nearer term development, which would also assist in the funding options on Ancuabe,” Mr Canterbury said.

One of the reasons for Dubai’s interest in graphite is the recent fire that broke out in a 15-storey residential building.

Fire safety is rapidly becoming a global issue in commercial and residential construction.

Concerns over the combustibility of building materials used historically may require retrofitting of existing buildings.

The estimate is that there are as many as 30,000 buildings in Dubai that have non-fire retardant cladding.

Graphite is a cost-effective alternative with the added advantages of higher thermal efficiency and denser composition.

Expandable graphite attracts a significant market premium to batteries and refractories with many uses outside the building industry.

If similar laws are enacted in other countries the potential growth in demand is exponential.

This special report is brought to you by Triton Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.