Chile is the land of the copper giants, but that will create a lucrative opportunity for nimble juniors

Mining

Mining

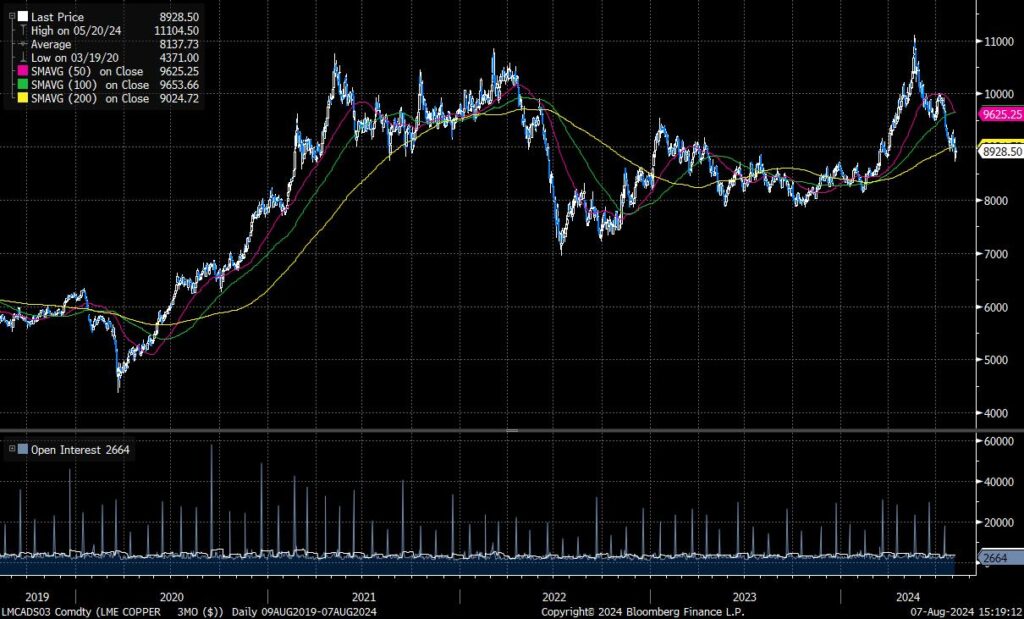

The copper price hit a high of US$11,104.50/t back in May, outpacing even the wildest dreams of long mining analysts. That’s above and beyond Deutsche Bank’s year-end target of US$10,000/t, reflecting improving global growth and a surge in speculative flows against a backdrop of structurally tight supply.

It’s now hovering a little under US$9000/t, still above the 12-month average of $8,858/t and five year average of $8,137/t. But the global investment bank thinks getting back above that US$10,000/t mark will be key to incentivising new mines.

Copper mine approvals are shockingly low, ranking in the single digits for the last seven years. Deutsche says that means the copper market, previously thought to be balanced in the short term, is expected to move into deficit from this year.

That deficit is forecast to hit 340,000t in 2026, partially driven by the artificial intelligence boom and the green energy transition, which will mean data centres, power grid upgrades, electric vehicles, charging stations, solar systems and wind turbines will all fuel demand.

Cable manufacturers are seeing business surge. Nexans SA’s Halden plant is sold out until 2028 and some customers seeing copper rich cable have reported backlogs up to 12 years due to soaring demand to connect renewables to the grid.

Goldman Sachs even dubbed copper “the new oil” for its cornerstone role in the energy transition.

What this boils down to is more supply needs to come online ASAP.

In the short term, Deutsche Bank says next year is looking better for approvals, noting that 2025 is shaping up to be a more meaningful year, “with several companies aiming to progress projects to board approval, driven by higher cash flows and an improving investment backdrop in several mining jurisdictions.”

But the medium and longer term supply outlook isn’t as rosy.

Deutsche Bank pointed to the actions of majors like BHP (ASX:BHP), which recently attempted to take over Anglo American and later signed up for a US$3.2bn deal to acquire a major development asset in Argentina, highlighting “the strategic importance of copper and the challenges in adding new supply at a time when ‘future facing’ demand driver (electrification broadly) are building momentum.”

Chile looks to be the place to be, with a range of majors making copper moves in the country in recent months.

BHP has lodged approval documents to to restart its Cerro Colorado copper mine by the end of the decade, having only been placed on care and maintenance in December 2023, and in July purchased half of TSX-listed Filo Corp with its Filo del Sol project and JV partner Lundin’s Josemaria deposit in a $3bn acquisition. Both sit in the Vicuna region on the Chile/Argentine border.

Then there’s Freeport, which is considering the El Abra pre-feasibility study in partnership with Codelco. That would cost $7.5 billion to build and requires a seven to eight-year lead time due to permitting requirements.

Copper remains sensitive to supply shocks though, highlighted by news BHP and Rio’s Escondida, the world’s largest copper producer, could lose thousands of tonnes of production to a strike after negotiations on a new pay deal with the operators’ union failed.

Pan Asia Metals (ASX:PAM) chairman and MD Paul Lock says the scale of copper projects being considered by the majors require 10+ years to complete studies. That opens the door for juniors like PAM, which holds the Rosario copper project just 10kms from Codelco’s El Salvador copper mine in Chile.

“The more nimble smaller scale miners can focus on high margin, low capex and opex projects which the majors are not interested in,” he said.

Deutsche Bank says with supply structurally tight the market should place increased value on companies that can deliver near-medium term growth.

And with capital costs escalating by 30-40% in recent years, “this will likely mean a steady lift in approvals rather than a flood.”

Lock says this means the coming supply deficit will not be readily solved from near-term production. Companies which can deliver in these narrower time frames will “also get dragged along” in the copper boom “as these assets will be required to fill the subsequent shortfall”.

PAM signed a binding option agreement on Tuesday to acquire 100% of Rosario.

Lock told the market the project, which will see Pan Asia step outside its traditional base in South-east Asian and Chilean lithium exploration, has the ingredients to be developed and operate in the lower third of the global copper cost curve.

Rosario has the hallmarks of a Manto-style deposit, which are typically high in grade as far as porphyries go, with deposits often in the range of 1-3% Cu. The ~60,000tpa Mantos Blancos mine operated by Capstone Copper is a low capex Manto style open pit mined to the north of Rosario.

“Rosario offers a sound low-cost diversification strategy, copper, alongside lithium, is one of the most important global electrification transition metals,” he said in an ASX filing this week.

“The supply-demand dynamics for copper producers are compelling due to large projected deficits that are a result of declining production and grade, as well as a lack of new discoveries.

“For PAM, the Rosario Copper Project ticks all PAM’s boxes. It is located in an infrastructure rich setting, it has potential processing solutions located between Rosario and the nearest port; it demonstrates peer group leading copper grades from a significant suite of rock chips samples, and it is located in a premier copper producing region known for its cost advantages.

“In essence, the project has what is needed to gain a position in the lower third of the cost curve.”

Hot Chili (ASX:HCH) is in the process of wrapping up a pre-feasibility study for its 2.8Mt Costa Fuego copper hub.

In March, the company entered an MOU with the existing Las Losas port facility in Chile to negotiate a binding port services agreement and in May $31.9m was raised by way of a $24.9m private placement and $7m share purchase plan to fund development and exploration activities over the next 18 months.

On the exploration front, HCH has kicked-off several programs at newly acquired concessions covering the Domeyko Cluster, which span an area of 141km2 and represents a 25% increase in the company’s total landholding at Costa Fuego.

Culpeo Minerals (ASX:CPO) has the Vista Montana, Lana Corina and Fortuna Projects in the country, recently announcing a significant copper discovery at Lana Corina of 454m at 0.93% CuEq from 90m.

Both Lana Corina and Fortuna are in Chile’s Coquimbo region, renowned for its numerous world-class copper and gold mines.

And earlier this month the company raised around $2.2m via a placement at $0.04 per share to fund exploration.

Southern Hemisphere Mining (ASX:SUH) is in-country too, with its Llahuin copper-gold tenure just a stones-throw (8km) from Pucobre’s US$490m El Espino copper-gold mine currently under construction.

The infrastructure being implemented for El Espino, SUH says, significantly de-risks Llahuin, which has a current resource of 169Mt at 0.4% copper.

The explorer is in the midst of a drill program to test multiple targets so it can increase the resource base to support a 25-year mine life.

Then there’s Capstone Copper (ASX:CSC). The primarily TSX-listed miner just updated the feasibility study for the Santo Domingo project in Chile, projecting average annual production of 68,000 tonnes of copper over 19 years at cash costs of US$0.22 per pound.

The capital cost has risen from $1.5 to $2.3 billion, translating to a capital intensity of about $21,900 per ton of copper-equivalent production.

At Stockhead we tell it like it is. While Pan Asia Metals, Culpeo Minerals and Hot Chili are Stockhead advertisers, they did not sponsor this article.