Cheap iron ore just got a whole lot more expensive

Ironing out the details Picture: Getty Images

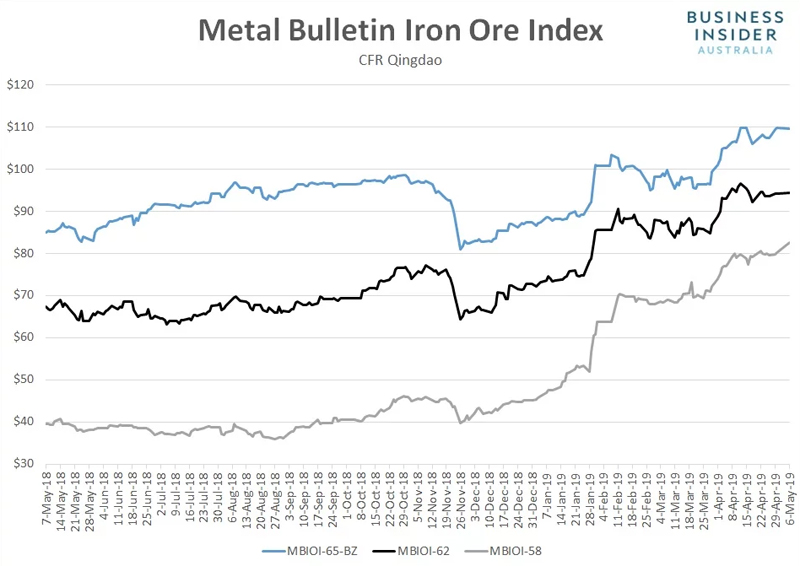

Prices for lower grade iron ore spiked on Monday, hitting the highest level in five years.

According to Metal Bulletin, the price for 58% fines jumped 2.9% to $82.48 a tonne, leaving it at levels not seen since May 2014.

Since late November last year, the price has surged by 108%.

In contrast to the spike in lower grades, the moves elsewhere were modest.

Benchmark 62% fines inched up 0.2% to $94.34 a tonne. 65% fines went in the other direction, slipping 0.2% to $109.60 a tonne.

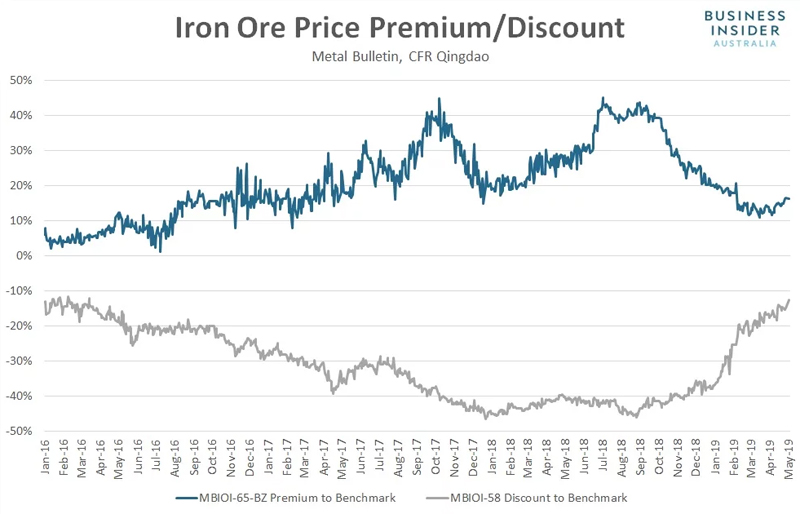

Given the divergence between lower and higher grade prices on Monday, the discount for 58% fines to the benchmark narrowed to the lowest level since March 2016.

Gains in lower grades may have been supported by weakness in Chinese steel futures during the session.

The most actively traded rebar and hot-rolled coil contracts on the Shanghai Futures Exchange slumped to 3,756 and 3,714 yuan a tonne respectively, down around 1.5% from where they closed on Tuesday last week.

Chinese markets had been closed until Monday for Labour Day holidays.

Data showing another hefty fall in Chinese iron ore port inventories may have also contributed to the strength in lower grades.

Steelhome consultancy reported a fall of 2.4 million tonnes to 133.6 million tonnes, leaving stockpiles at the lowest level since October 2017. Chinese iron ore inventories are dominated by lower grades.

Robust steel production in China, supply disruptions to seaborne markets, lower steel mill profit margins and less onerous industrial output restrictions on environmental grounds have all contributed to the pickup in demand for lower grades in recent months.

News that activity across China’s services sector in April , including its construction industry, improved at the second-fastest rate since May 2012 may also have helped boost sentiment. A reduction in the reserve ratio requirement for small and medium-sized Chinese lenders, freeing up additional funds for loans to the private sector, may have also provided some support.

Dalian iron ore futures rose to 638 yuan, up 0.6% from the prior close, while coking coal and coke futures climbed to 1,362.5 and 2,063 yuan, around 1% above where they finished on Tuesday.

As seen in the scoreboard below, all contracts bar iron ore continued to edge higher in overnight trade on Monday.

SHFE Hot Rolled Coil ¥3,722 , 0.11%

SHFE Rebar ¥3,767 , 0.24%

DCE Iron Ore ¥636.00 , 0.39%

DCE Coking Coal ¥1,365.00 , 0.44%

DCE Coke ¥2,086.50 , 1.73%

Trade in Chinese commodity futures resumed at 11am AEST.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.