Chart of the Day: Pure gold could be found in the falling Northern Star (ASX:NST)

Chart of Day - Northern Star (NST). Picture Getty.

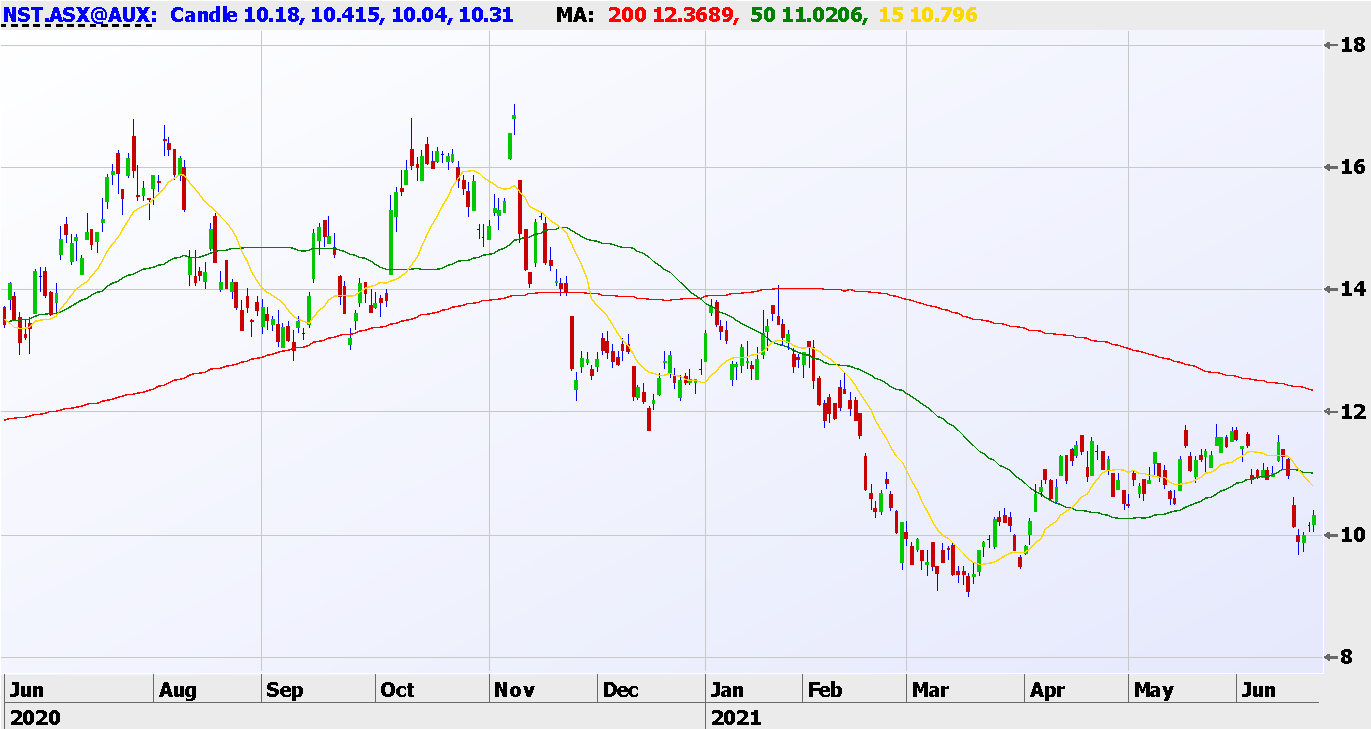

We again celebrate the volatility in Aussie gold plays by having a look at Northern Star Resources (ASX:NST) this week.

Whilst from a price action perspective we are quick to acknowledge that NST is in downtrend on a one-year horizon, these are attractive levels for a short-term trading entry to the long side, and enter we have.

The first gap fill target is at $10.92, which broadly coincides with the 50-day moving average in green and the 15-day in yellow.

As far as stops go, we will be hitting the exits should the lows of Friday last week at $9.68 not hold.

This makes for a moderately favourable risk return on entry in the $10.10s.

Recent lows chime in at $9.40 earlier this year, not that far away.

Northern Star is closer to its recent lows on a relative basis than its immediate counterparts, Silver Lake (ASX:SLR) and Ramelius (ASX:RMS), which whilst not even close to buying rationale by itself, is something we keep an eye on.

Gold also is well off recent highs at US$1,900/oz, whilst the 10-year yield in the US is showing some broader signs of weakness after failing to hold onto 150bp (lower real yields being positive for gold).

Price action in the realm of crypto is bearish in the short term also (potentially liberating the marginal buyer there), whilst tax-loss selling, should such a thing exist, is almost over.

As always, we run these positions with stops, and liquidity is happily never a concern when it comes to our friends at Northern Star.

Steve Collette of Collette Capital Pty Ltd (ABN 56645766507) is a Corporate Authorised Representative (No. 1284431) of Sanlam Private Wealth (AFS License No. 337927), which only provides general advice.

Collette Capital only makes services available to professional and sophisticated investors as defined by the Corporations Act, Section (s)708(8)C and 761G(7)C.

The Collette Capital Wholesale IMA Strategy has returned +26.51% p.a. net of all fees as at the end of May 2021 since inception in January 2015 (using the Time Weighted Return method of calculating returns).

Learn more at www.collette.capital

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.