Chariot picks up four hard-rock lithium projects in Nigeria

The transaction makes Chariot one of the first publicly listed lithium explorers with significant holdings in Nigeria’s emerging lithium belt. Pic: Getty Images.

- CC9 picks up four highly prospective hard rock lithium projects in Nigeria

- The region has similar geology to Brazil’s Lithium Valley

- Acquisition gives company unparalleled access to the Africa-China supply chain

Special Report: Chariot Corporation is acquiring a majority stake in a Nigerian hard-rock lithium portfolio, a move set to propel the company to the forefront in a new lithium hot spot.

Geologically, Nigeria’s lithium-bearing pegmatites are part of the same Late Proterozoic (Pan-African) LCT system as the Borborema Pegmatitic Province (BPP) in northeast Brazil, and of similar age to the renowned ‘Lithium Valley’.

And like Brazil, many of Nigeria’s pegmatite belts were historically and currently mined for tin and columbite-tantalite and semi-precious gemstones, indicating the potential for highly fractionated, lithium-rich LCT pegmatite systems.

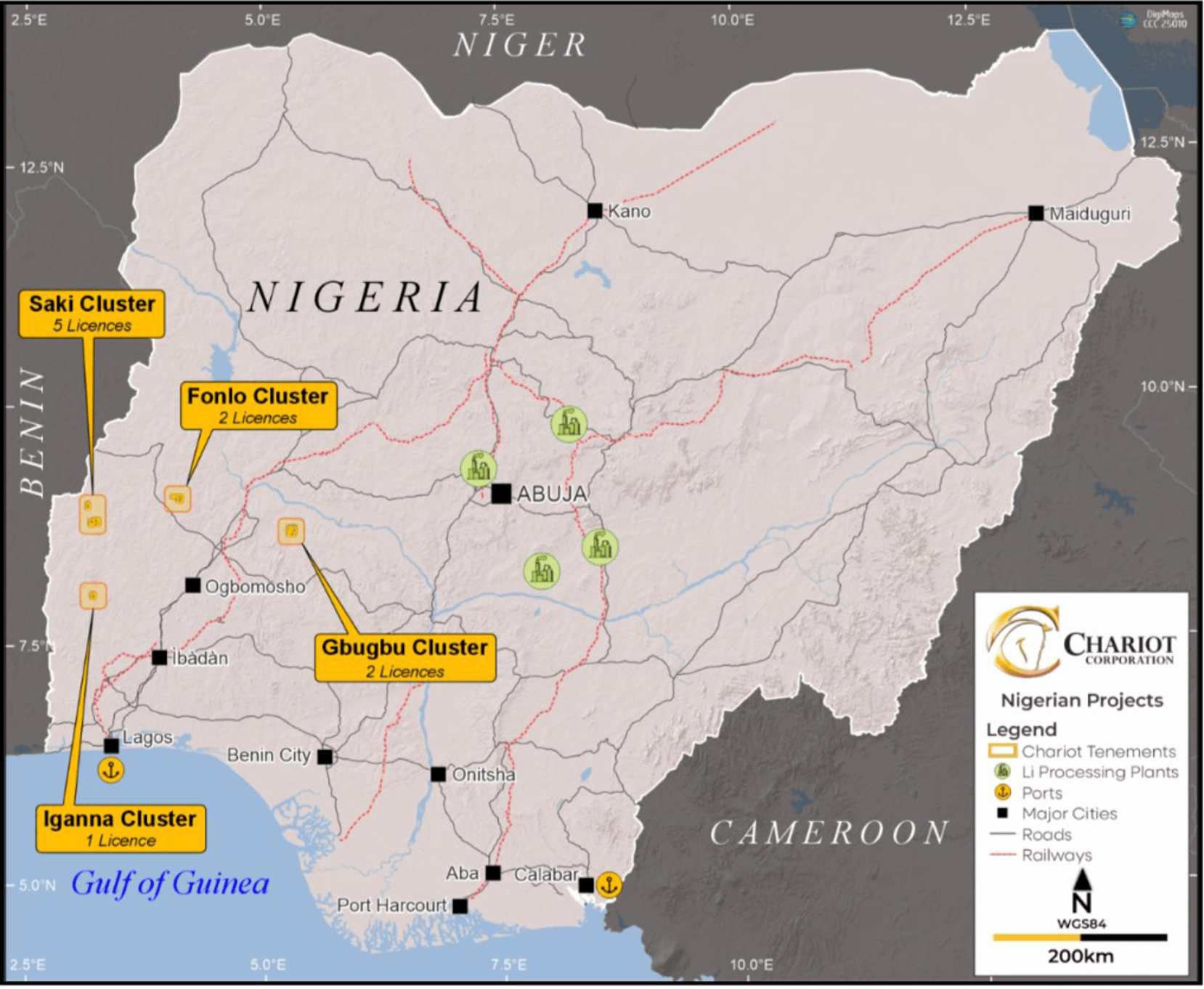

Nigeria is emerging as one of the continent’s fastest-growing lithium regions, with this highly prospective hard-rock lithium portfolio, covering 254sqkm across the Oyo and Kwara states.

It consists of four projects, Fonlo, Gbugbu, Iganna and Saki, and includes eight Exploration Licences (ELs) and two Small-Scale Mining Leases (SSMLs).

Notably, lithium-bearing pegmatites have been identified across all projects including up to 6.59% Li2O from rock chip sampling. And the projects remain undrilled, presenting exploration upside.

The portfolio even has a recent history of ore being exported to Chinese and other customers (several thousand tonnes of concentrate from 2021–2024) validating the quality of mineralisation and existence of buyers for the ore.

Chariot Corporation (ASX:CC9) will acquire 66.7% via a joint venture with early-stage Nigerian mining company Continental Lithium – which will hold the remaining 33.3%.

The consideration is US$1.5m in cash and 42 million shares, plus CC9 will fund a minimum of US$10m for the joint venture.

Access to Africa-China lithium supply chain

The move provides exposure to the rapidly developing Africa-China lithium supply corridor: with growing interest from Chinese buyers for offtake from Nigerian lithium miners.

Despite global lithium price headwinds, artisanal and small-scale mining activity has surged across Africa, driven by robust and sustained Chinese demand.

Also, the Nigerian Government has created a supportive environment for local resource development and attracted significant investment in lithium processing capability (most all of which has been funded by Chinese businesses).

Looking forward, the company will target along-strike and depth extensions of known pegmatites, as well as new pegmatite discoveries within the licence areas with systematic mapping, trenching and drilling.

“With robust community relationships and excellent infrastructure access, Chariot is uniquely positioned to rapidly advance the four projects and take advantage of its first-mover status in one of Africa’s most geologically prospective, yet underexplored, lithium-hosting areas,” the company said.

In addition, the company has entered a binding working capital facility agreement with GAM Company Trust for an unsecured loan facility of $880,000 to refinance its convertible note facility with Obsidian Global GP.

This financing strengthens Chariot’s balance sheet and supports the company’s ongoing exploration and operations.

This article was developed in collaboration with Chariot Corporation, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.