Charger Metals pieces together ownership and funding blocks for Lake Johnston lithium project

CHR is looking to benefit from Rio Tinto’s farm-in to Lake Johnston. Pic via Getty Images

- Charger to receive $1.7m next month as part of its lucrative farm-in with Rio Tinto

- Farm-in agreement sees Rio spending up to $42.5m to earn 75% in Lake Johnston

- Simultaneously, CHR to pay $2m to secure 100% of the Lake Johnston project

Special Report: Charger Metals has met funding conditions for Rio Tinto to grab up to 75% of its Lake Johnston lithium project and potentially spend up to $42.5m across the largely underexplored tenure.

Simultaneously, Charger Metals (ASX:CHR) has entered a binding agreement to pay $2m to Lithium Australia to increase its interest in Lake Johnston to 100%.

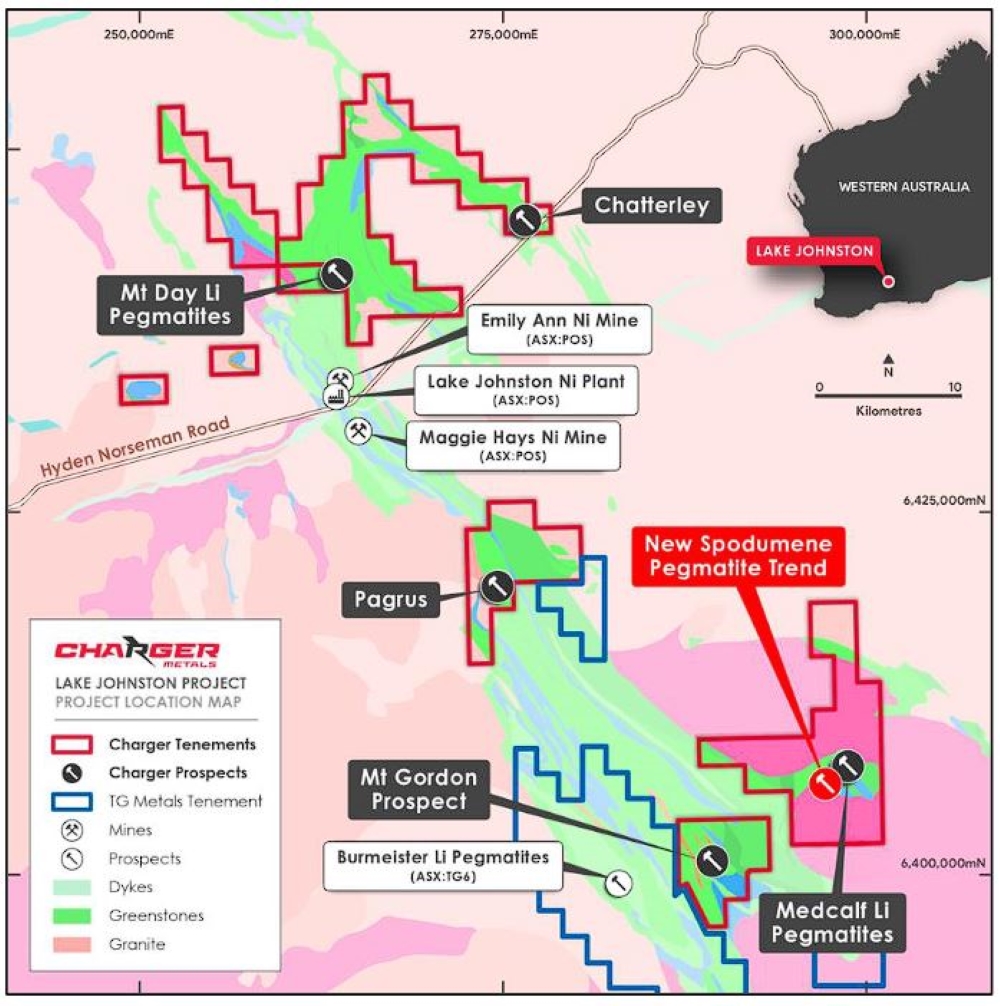

Located east of Norseman, Lake Johnston is best known for Poseidon Nickel’s (ASX:POS) mothballed Maggie Hays and Emily Ann nickel mines and the Lake Johnston plant, and comes after a rush into the region started by TG Metals (ASX:TG6) proving up its Burmeister spodumene prospect.

Rio’s farm-in has been spurred on by three rock chip assays from a newly discovered pegmatite that all showed high-grade lithium results of 4.2%, 3.7% and 3.6% Li2O over a 1.2km trend towards the project’s Medcalf prospect.

Agreement terms

CHR is confirmed to receive $1.2m from Rio Tinto’s (ASX:RIO) exploration arm RTX and another $500,000 before the farm-in starts, where $3m will be spent on exploration over the next 12 months.

The funds will give RTX a 6.08% stake in CHR, which will only increase over exploration spending and time markers.

Preparations are well-advanced in that realm, with drilling to recommence at Lake Johnston next month.

CHR MD Aidan Platel says the farm-in agreement with Rio is an excellent result for the company and its shareholders, and validation the Lake Johnston Project can host a large-scale lithium deposit.

“The planned significant investment by RTX will allow thorough systematic exploration over the entire project tenure, with initial exploration focused on fast-tracking the Medcalf spodumene prospect as well as progressing the Mt Day and Mt Gordon lithium prospects,” Platel says.

“The RTX farm-in agreement and recent placement ensures CHR will be well funded going forward with only ~73 million shares on issue.”

This article was developed in collaboration with Charger Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.