Challenger’s upcoming scoping study will highlight Hualilan’s potential as Argentina’s next gold mine

The company plans to progress into production with a PFS starting Q3 2023. Pic: via Getty Images.

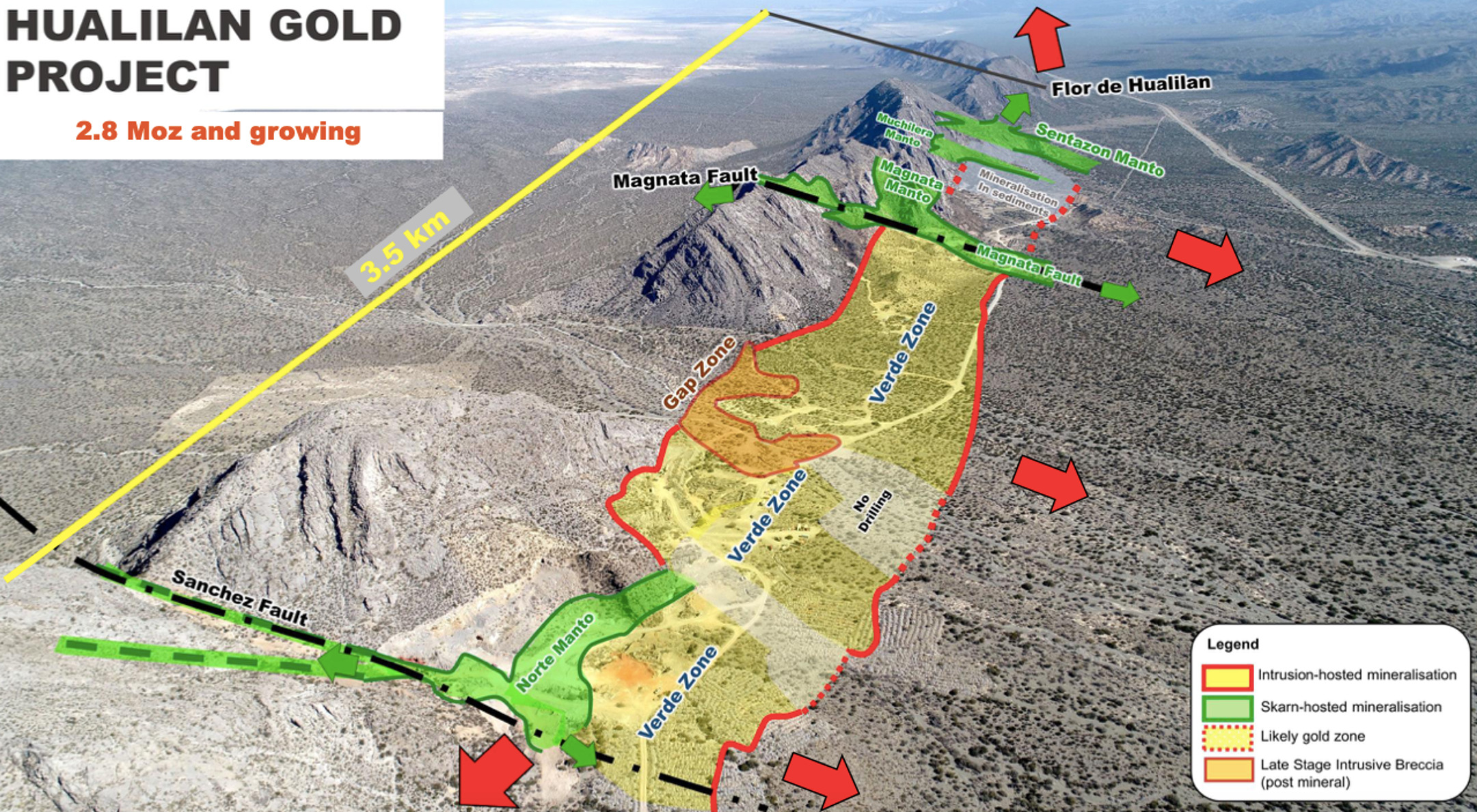

Challenger Gold has eyes on progressing its Hualilan gold mine in Argentina into production, with a scoping study nearing completion.

The study is focused on the 2.8-million-ounce resource on the project (upgraded in March this year) but it’s more specifically targeting the higher-grade core of 1.6 million ounces at 5g/t gold equivalent – 80% of which is gold.

The aim is to reduce up front capital requirements and provide options for staged start-up at the project.

And once the scoping study is complete, the company will start the Pre-Feasibility Study (PFS) at Hualilan which is due to start in Q3 and is expected to lead directly into a Bankable Feasibility Study (BFS).

Aiming to be Argentina’s next mine

Challenger Gold (ASX:CEL) MD Kris Knauer says the ultimate focus is getting Hualilan into production.

“The project has critical mass, and when the scoping study comes out it will show that Hualilan will be Argentina’s next mine,” he said.

“It’s high grade, it should be low cost to get it in production, and it’ll create a lot of cash flow.

“Really, this scoping study is just the starting point.

“We’re focusing on the high-grade core but post the scoping study, it’ll be the opportunity to recover a lot more of the lower grade gold as well.

“This is just step one – we wanted to show we have an economic project and then step two is the pre-feasibility where we’ll look at a few more scenarios once we’ve done a bit more test work.”

There’s also the added bonus of a non-binding Memorandum of Understanding (MOU) signed with YPF Luz in May for the supply of renewable power to the project.

“I think we’ve got the ability to be one of the lowest carbon footprint gold mines in the world,” Knauer said.

Plus, access to a sustainable and low-cost power source will support project economics while the access to this power source via a reliable grid connection significantly de-risks the project.

Building a district scale gold footprint

Knauer said the company also has regional work underway at Hualilan, with the resource remaining open in all directions.

“We’ve got 30km of trend there, and we’ve got almost 3 million ounces on 3km of that trend and we’re just now getting around to exploring that other 30km,” he said.

“So, there should be some exciting things that will come from that as well.

“Discoveries like Hualilan seldom occur in isolation, you just don’t find three-million-ounce ore bodies sitting there by themselves.”

The company is also working towards building a district scale 600km2 footprint, with 235km granted and 329km pending approvals.

Upcoming catalysts mean a potential re-rate

Notably, Challenger trades at a significant discount to its peer group – at $40/oz compared to Australian developers at $120/oz.

Knauer says there’s a re-rating opportunity here as the company is accepted into this peer group via the pending scoping study and PFS studies.

“San Juan in Argentina where Hualilan is located, has recently been voted the number one mining jurisdiction in South America in the Fraser Institute survey, and we’re trading at the moment as if it’s one of the worst jurisdictions in South America,” he said.

“The market, with this sort of wash-out of how they’re pricing developers compared to producers, means we’re trading with 30 cents in the dollar. There are catalysts to turn around that sentiment for Argentina, there’s an election coming up in October with both the current and potentially incoming government desperate to get mines up and running.

“At the moment we’re trading at $40/oz based on the 2.8 million ounces at Hualilan alone, whereas most Australian developers are trading at north of $100.”

This article was developed in collaboration with Challenger Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.