Challenger Gold’s Colorado-V resource drilling is off to a flying start

Resource drilling is off to a great start at Challenger’s Colorado-V project. Pic: Getty Images

- Resource drilling at Challenger’s Colorado-V project returns 500m+ intersections of gold, silver and copper

- Drilling will complete initial earn-in, giving the company 50% interest in the project

- Company plans to monetise its Ecuadorian assets, which includes the 4.5Moz El Guayabo project

Special Report: Initial assays from resource drilling at Challenger Gold’s Colorado-V project in Ecuador have returned thick, 500m-plus intersections of gold, silver and copper mineralisation, a positive sign for a coming maiden resource estimate.

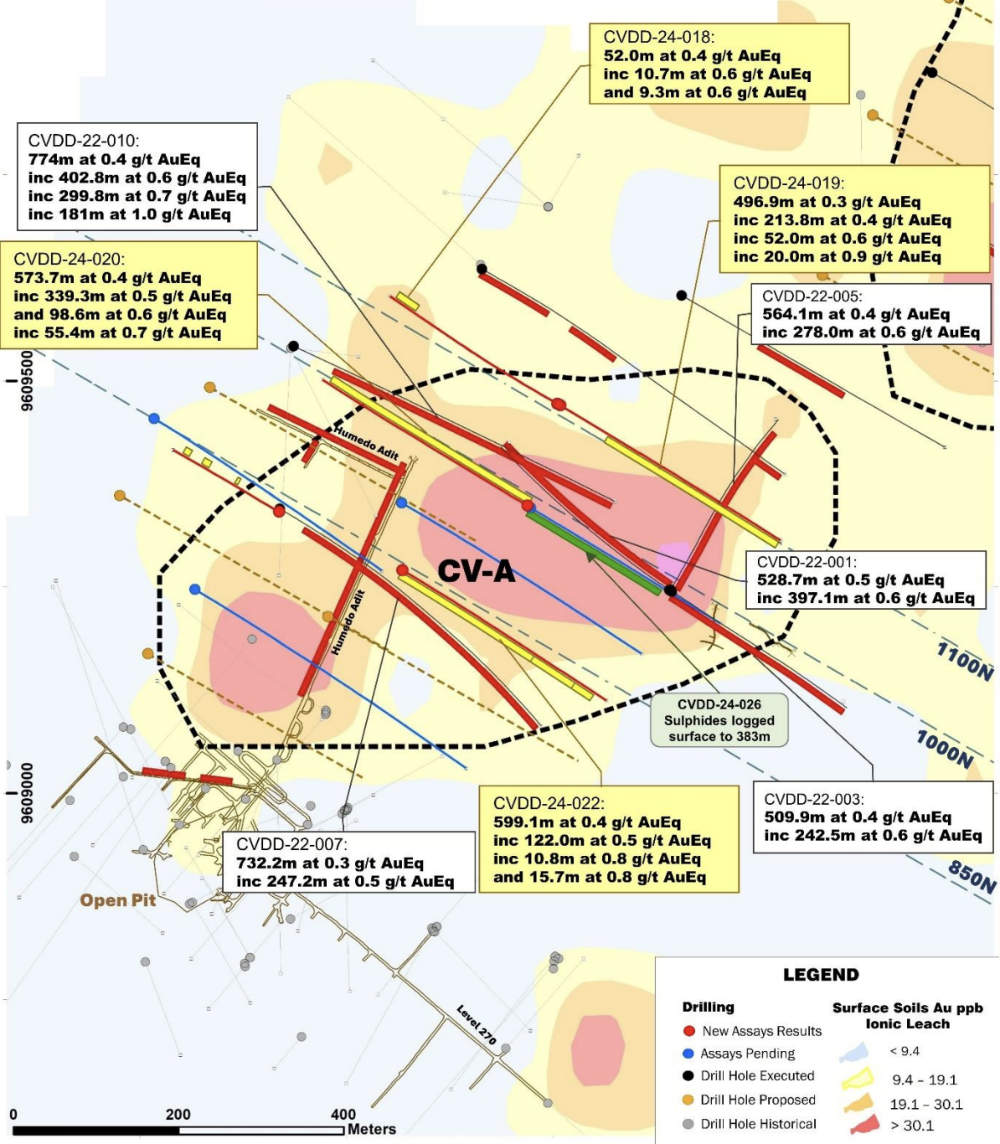

The first five holes, totalling 2617m of an 8000m drill program, were drilled into the eastern half of the CV-A anomaly, which covers 800m by 400m, and represents a series of 125m to 200m step-outs from earlier drilling.

Notable assays from these initial holes include:

- 573.7m at 0.4 g/t gold equivalent (AuEQ) – 0.2g/t gold, 1.9g/t silver and 0.1% copper from surface (CVDD-24-020)

- 599.1m at 0.4 g/t AuEq – 0.2g/t gold, 1.4g/t silver and 0.1% copper from surface (CVDD-24-022); and

- 496.9m at 0.3 g/t AuEq – 0.2g/t gold, 1.7g/t silver and 0.1% copper from 122.6m (CVDD-24-019).

To date, Challenger Gold (ASX:CEL) has completed 5100m of the planned 8000m program, which will also test the CV-B anomaly and is being carried out to fulfill its initial earn-in commitments. The explorer will earn 50% in the project by investing US$8m.

The results add to previous drilling carried out by the company that also returned very thick intervals such as 528.7m at 0.5g/t AuEq and 773.9m at 0.4g/t AuEq.

“Our resource drilling program in Ecuador is off to an excellent start with a series of 500 metre intersections. These broad intersections are from holes designed to step the mineralisation out 125-200 metres along strike, up-dip, and down-dip from earlier drilling,” managing director Kris Knauer said.

“The results show, as we had hoped, the entire eastern half of the CV-A anomaly is consistently mineralised.

“Drilling is now extending into the Western half of the anomaly and if further drilling continues to yield expected results, we anticipate a significant maiden mineral resource estimate upon completion of the drilling program.”

Focus on Argentina

While the results are likely to be positive for the initial resource estimate for the Colorado-V project, CEL still plans to monetise its Ecuadorian assets once that estimate is available as it believes that the market is attributing little value to them.

This includes the existing 4.5Moz resource at the wholly-owned El Guayabo project, which is directly adjacent to Colorado V.

Selling the Ecuadorian assets will also allow the company to focus on the near-term high-grade production opportunity at its flagship Hualilan gold project in Argentina.

Hualilan has a resource of 2.8Moz AuEQ including a high-grade core of 1.6Moz at 5g/t AuEq.

A recent scoping study outlined the potential for the project to produce 116,000oz gold, 440,000oz silver and 9175t of zinc (141,000oz AuEq) annually to deliver $1bn in earnings over a seven-year mine life at low all-in sustaining costs of US$820/oz.

This low production cost coupled with high gold prices led a prominent Argentinean businessman to inject $5.6m into the company through a private placement and led to a further $4m placement by a new investor on the same placement terms.

Independent modelling has also found that the project will have the lowest carbon intensity of any gold project on the ASX with emissions of about 0.1t carbon dioxide equivalent per ounce – about six times lower than the Australian average emissions intensity of 0.62t CO2e/oz and 50% lower than the next lowest producer.

This article was developed in collaboration with Challenger Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.