Challenger Gold sniffs out cost-effective gold-silver concentrate upgrade into doré for Hualilan

Metallurgical test work has found a range of cost-lowering measures for Hualilan. Pic via Getty Images

- Metallurgical work outlines simple pathway to produce doré on site

- Opportunity to revise scoping study with better project economics

- PFS underway with recent test work to be incorporated

Special Report: Metallurgical test work has found a way to upgrade gold-silver concentrates into doré from its Hualilan project in Argentina, providing an opportunity to improve project economics outlined in a recent scoping study.

Steaming ahead to become one of Argentina’s next gold producers, Challenger Gold (ASX:CEL) is targeting lowering capital costs and de-risking measures prior to releasing feasibility studies for its Hualilan project.

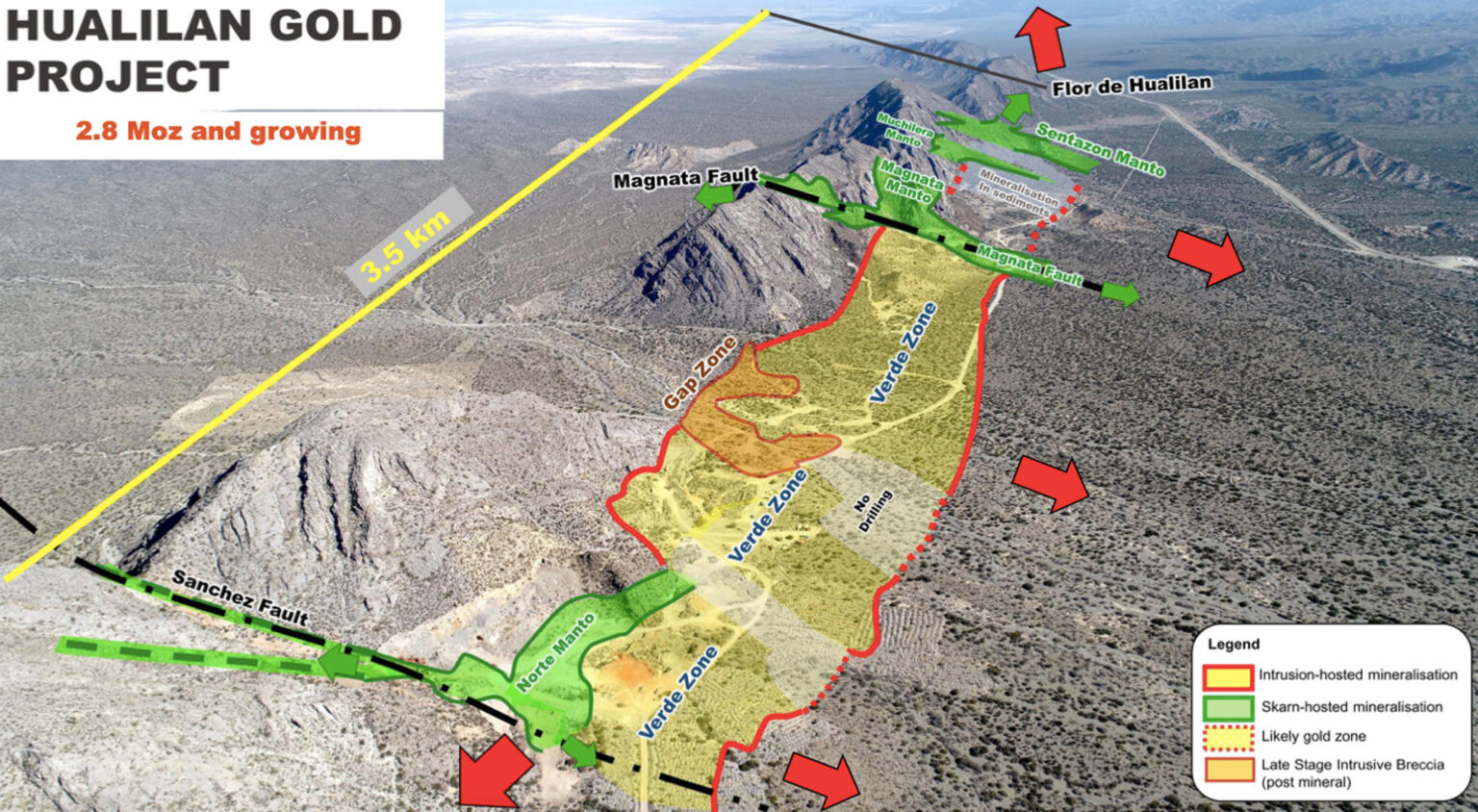

A recent scoping study for Hualilan focused exclusively on the 2.8Moz project’s high-grade core of 1.6Moz @ 5g/t gold equivalent (AuEq) that will deliver 116,000ozpa gold, 440,000ozpa silver and 9,175t of zinc for 141,000oz AuEq, raking in $1 billion in earnings over a 7-year mine life.

Hualilan comes with a relatively low capex of just $211.1m with a 1.25-year payback period and low AISC of just $1,291/oz.

Improved recoveries, increased payability

Metallurgical work conducted is showing room for further improvements to project economics after CEL discovered it could convert the gold-silver concentrate produced by the flotation circuit into doré on site, thereby reducing transport and refining and processing costs, as well as increasing payability of gold from 95% to 99.5% and payability on silver from 60% to 97.5%.

It’s also considering the inclusion of a heap leach alongside a floatation or CIL circuit, to capture value from the low-grade portion of the Hualilan orebody, a measure excluded under the low-risk/high-grade/low-tonnage scoping study strategy.

CEL is also looking at a reduction in the cut-off grade of zinc ore fed into the flotation circuit, based after finding that economic zinc concentrate can be produced from low-grade zinc samples, leading to additional recoveries from 263,000t zinc resource beyond the 70,000t recovered as per the scoping study.

To add to this, CEL also recently signed an MoU with Argentina power YPF S.A to purchase renewable power for Hualilan which further lowers capital costs and reduces emissions.

CEL MD Kris Knauer says the test work demonstrates a clear and simple pathway to produce gold doré on site, which has several benefits for the project.

“Firstly, it removes some $100 million in costs associated with the transport and treatment of gold-silver concentrate,” Knauer says.

“Secondly, it increases the payability on the gold produced and removes the delay associated with payment for gold sold via a concentrate reducing working capital requirements.

“This is an excellent outcome from the first of a series of metallurgical tests targeting several material opportunities we have identified to improve the already attractive Hualilan scoping study economics.”

Knauer says that the company hopes to have the testwork that will determine if heap leaching is a viable option for the million ounces of low-grade mineralisation out to market before the end of the year.

“This is the wildcard that could increase the scale of the project beyond the current 140,000ozpa AuEq.”

Optimisation work and further exploration on the horizon

Next steps will involve additional intensive-leach tests on the representative concentrate sample to optimise for grind size and reagent consumption against gold-silver recovery to maximise the improvement in projected economics from the production of doré on site.

CEL is also currently working on its PFS for Hualilan and conducting regional exploration along the previously unexplored 30km prospective stratigraphy.

This article was developed in collaboration with Challenger Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.