Challenger Gold Colorado-V resource drilling hits thicker, higher-grade mineralisation

Mining

Mining

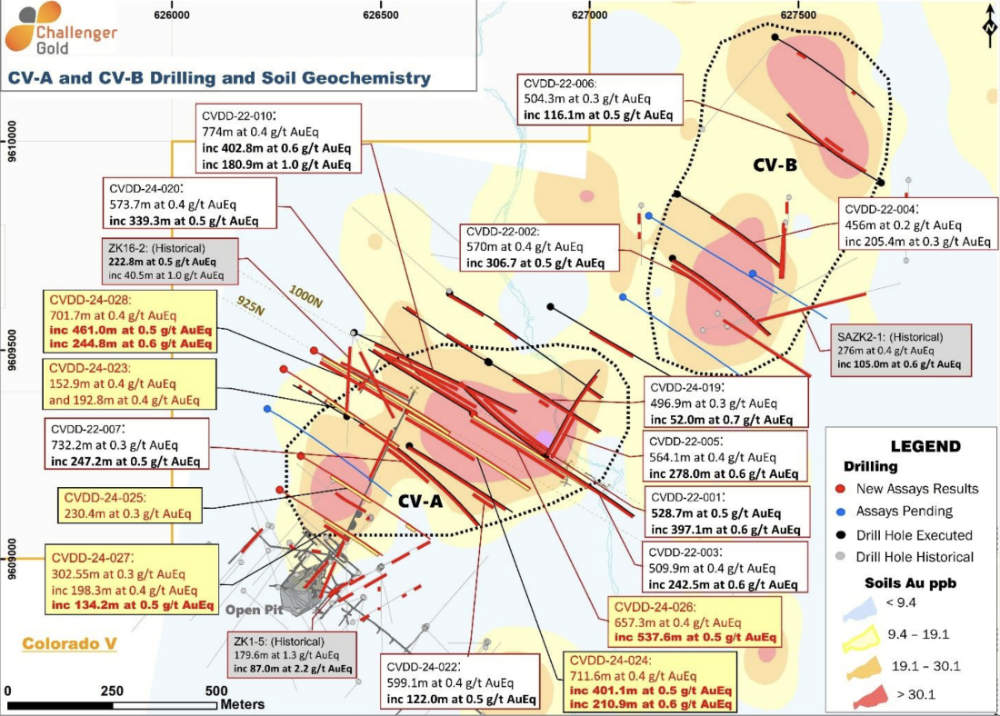

Special Report: Challenger Gold’s resource drilling at its Colorado-V project in Ecuador has returned more ultra-thick, gold, silver, and copper intersections that are higher grade than the initial holes in the program.

Topping the list of assays is hole CVDD-24-026 with a 537.6m intersection grading 0.5g/t gold equivalent (AuEq) – 0.3g/t gold, 2.6g/t silver and 0.1% copper – from surface including three intervals of 60.9m, 54.4m and 60m from depths of 42.1m, 243.7m and 348.4m with gold equivalent grades of 0.6g/t.

Along with intersections such as hole CVDD-24-024 with a 401.1m intersection at 0.5g/t AuEq, the results from the latest batch of six holes confirms Challenger Gold’s (ASX:CEL) belief that the entire 400m by 800m CV-A anomaly is mineralised from surface.

Both intersections are located within broader intersections of 657.3m at 0.4g/t AuEq (CVDD-24-026) and 711.6m at 0.4g/t AuEq (CVDD-24-024) from surface.

Initial holes from the 15-hole program, of which 11 holes have been drilled to date, had returned assays such as 573.7m at 0.4g/t AuEq (CVDD-24-020) and 599.1m at 0.4g/t AuEq (CVDD-24-022) from surface.

“Our resource drilling program in Ecuador continues to deliver positive results. These intersections are higher grade and wider than those from the first holes in the program,” said Managing Director Kris Knauer.

“This round of drilling has produced intersections of over 700m and confirms that the entire CV-A anomaly covering an area of 400m x 800m is mineralised from surface and open at depth.”

The results are expected to deliver a positive maiden resource for the Colorado-V project, which is adjacent to the company’s 4.5Moz AuEq El Guayabo Project.

This will, in turn, increase the value of the Project ahead of CEL’s plan to monetise its Ecuadorian assets as CEL focuses on the near-term, high-grade production opportunity at its flagship Hualilán Gold Project.

Hualilán is one of the largest undeveloped gold projects in Argentina with a resource of 2.8Moz AuEq, more than 75% of which is in the higher confidence indicated category.

It also hosts a high-grade core of 9.9Mt at 5g/t AuEqu, or 1.6Moz contained AuEq, which underpins a toll milling agreement that will accelerate its entry into production.

Environmental approvals are also in place after Argentina’s government signed off on the Environmental Impact Assessment – the first for a gold project in the San Juan Province in 17 years.

This article was developed in collaboration with Challenger Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.