Centrex set to be a top contender in the Asian agriculture boom

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: With production from a trial mine in the near term and a premium product, Centrex Metals is shaping up as a low-cost entry point into the world of Asian phosphate demand.

Centrex Metals’ (ASX: CXM) flagship project is the Ardmore phosphate mine in Northern Queensland, just 90km away from a major railway and also supported by existing road.

The project has a maiden ore reserve of 10.1 million tonnes of phosphate at an average grade of 30.2 percent — making it super high-grade.

A full planned production of 800,000 wet tonnes per annum, across a 10 year mine life is being targeted for the project, which would give it a short payback period of just under two years with an internal rate of return (IRR) of 63 percent.

Those metrics give the project an overall net present value (NPV) of $269 million.

NPV and IRR are metrics used to assess the profitability of a project. The higher the NPV and IRR, the more profitable a project will be.

So far, it’s sounding like a stock-standard phosphate hopeful going about its business — but there are a couple of things that set Ardmore, and subsequently Centrex, apart.

The first is its location.

Location, location, location

As with real estate, a major part of what makes a mining project fly is location — and Centrex’s project has an enviable street address.

With a clear route to a major port through both road and rail, the Ardmore project has the advantage of easy access to the market.

All it really needs to do is truck its product to an existing rail siding at Duchess.

From there the product can be railed to Townsville on flatbed containers using the existing Mount Isa rail line.

But it also has a major advantage over rival sources of phosphate supplies into Australia and New Zealand, namely, that the project is in Australia.

A lot of the phosphate imports into Australia and New Zealand currently come from Northern Africa, and as you’d expect, shipping from Northern Africa to Australia and, increasingly, Asia, comes at a premium.

In fact, because Ardmore is close to an existing port in Australia, shipping costs are as much as 50 percent less on a comparative basis to Moroccan imports.

Its initial customers are expected to be based in Australia, New Zealand and India which already gives it a huge advantage over the incumbent source of supply — but it also has a couple of other advantages.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Fantastic rocks

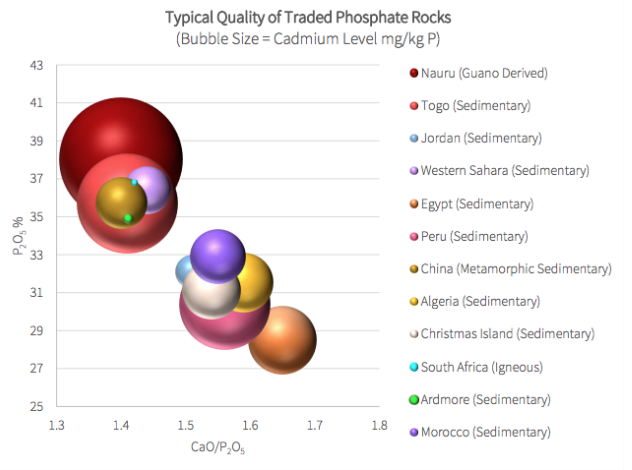

In comparison to supply from Morocco, Ardmore’s phosphate ore has a fantastic average grade of 34-35 percent — giving it a cost advantage over rivals.

Typically speaking, phosphate rock has grades of between 27 percent and 34 percent depending on the end use.

But not only is Centrex’s base phosphate high-grade, but it also contains low levels of cadmium — which is increasingly coming under the microscope from regulators around the world.

Because phosphate is largely used in fertilizers and cadmium is toxic, there is the potential for cadmium to be present in crops — which isn’t good for anybody.

The European Commission has agreed a new limit of 60 milligrams of cadmium per kilogram of phosphate, with this set to reduce down to 20mg Cd/kg within 12 years.

Our New Zealand cousins are also looking closely at the issue, with a special management group set up to address the issue.

It all means that end users will need to leach the cadmium out of their phosphate or blend it with other rocks — which adds time and money to the process.

But with a low cadmium cut and a high phosphate grade, Centrex can reasonably market its phosphate as the “no worries” phosphate.

Modular plant to feed offtake volumes

A modular production plant is currently on its way to Australia from the UK and is expected to be on site in Queensland next month — and once it’s commissioned production from the plant will go to a select group of customers that wil will underpin offtake agreements for the full mine development.

The plant is designed to process 70 tonnes per hour with the trial mine planned to produce up to 30,000 tonnes, but can be upgraded to support production of 140tph, which would bring it up to maximum output for the project.

Those 30,000 tonnes will go into the hands of initial offtake customers, and this will have two effects.

It will allow a bit of early cashflow, which is nice — but more crucially it will prove that it can produce a premium product and get it to market.

It will also allow it to market to other potential offtake partners with the actual final product rather than a pitch-deck — and it seems Centrex is coming along at just the right time.

China’s the main game

While Centrex’s initial offtake customers are in Australia, India and New Zealand, Centrex will have an eye on what’s going on in China.

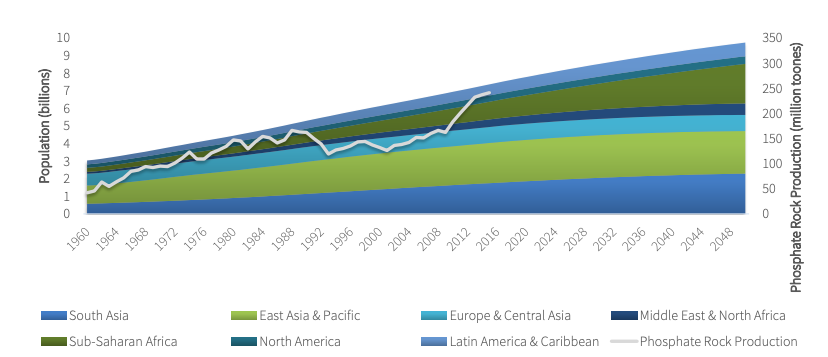

As we’re sure you’ve heard before, China is in the midst of a middle-class boom, and with it the rate of food production is expected to grow exponentially.

Already (well, in 2017 at least), total phosphate rock demand was 203 million tonnes, and China accounted for 40 percent of that demand. It is forecasted that China will become a net importer of phosphate rock in the near term. This is being driven by the Chinese governments continued push to clean up its environment, coupled with the closure of illegal mines

However, only 28 million tonnes is actually traded — as phosphate rock production is usually used locally in fertilizer production — and while that may seem like a limited market, that traded market is growing.

At the moment, Asia-Pacific countries account for 12 million tonnes out of the 28 million tonnes total traded phosphate rock in 2017 — and imports in the region are expected to grow by 5-7 million tonnes over the next five years.

The Ardmore project has a major freight advantage over phosphate from other sources such as Morocco, Jordan, and Egypt.

Currently, these three countries account for 80 percent of the imports to the region, with a further 10 percent coming from Peru and Togo.

If Centrex can prove that it can produce a high-quality phosphate at scale, then its natural advantage in shipping could open the eyes of a few industrial buyers in the region.

The first stage of that grand plan could come to fruition as early as next month, and should everything come together, Centrex will be in a great position to secure funding and become an emerging supplier in the growing Asia-Pacific region.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Centrex Metals, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.