Cazaly goes undercover to unlock mineral prospect with the hallmarks of South American monsters

Pic: Tonya Sims/EyeEm via Getty Images

Cazaly Resources has leapt on the opportunity to become a first mover in a prospective new minerals district in North Queensland, signing a farm-in deal to explore with geologists responsible for the discovery of some of Australia’s largest deposits.

Cazaly (ASX:CAZ) has announced a farm-in and JV deal that could give it up to 90% of the VANROCK project, a geophysical target with polymetallic properties that boasts potential to host a Tier 1 base metals deposit.

Regional work at Vanrock, owned by Lynd Resources, has confirmed Andean silver-tin-zinc-copper-lead mineralisation at similar targets in the district around 350km west of Cairns.

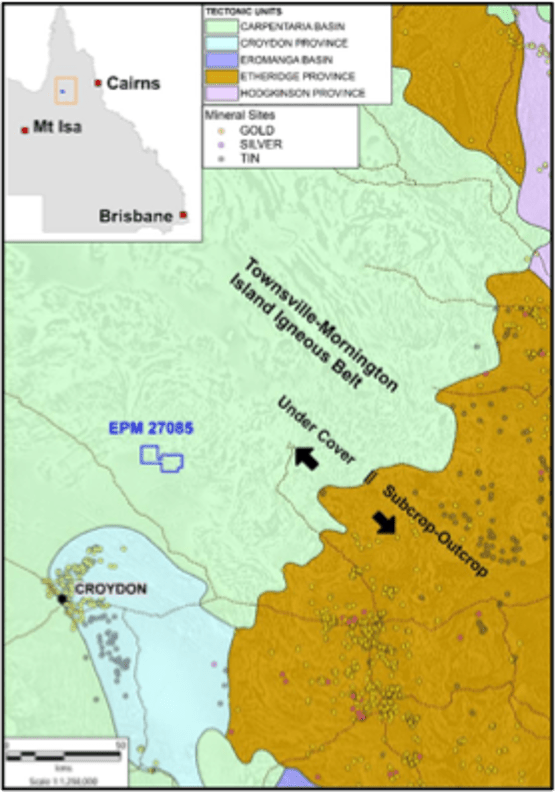

Vanrock sits on an exploration lease on the western end of the Townsville-Mornington Island Igneous Belt (TMIB), a mineral rich belt stretching 700km from Townsville to the Gulf of Carpentaria.

Cover could conceal mineral riches

The TMIB has played host to several multi-million ounce gold discoveries, and 40Moz of gold endowment sits in subcropping and outcropping areas to the southeast of Vanrock, but little modern exploration has been undertaken under the deep cover that would have been impenetrable to the old timers.

It also has a rich history in tin mining for over 100 years, while in recent times Crater Gold Mining in its previous guise as Gold Aura identified massive sulphides at the A1 and A2 prospects to the southwest of Vanrock.

The Vanrock target is characterised by a magnetic high on the margin of a large caldera about 30km in diameter and it has pretty significant analogues in the massive deposits found in South America’s mountainous countryside.

Previous drilling by Lynd Resources in the TMIB has confirmed alteration and mineralisation in the district akin to the Tier 1 Cerro Rico de Potosi deposit in Bolivia, one of the world’s largest silver-tin deposits, which contains 5 billion ounces of silver and 1.5 million tonnes of tin and was mined continuously for 500 years.

Drilling will begin with a single 500m deep hole proposed to start in September part-funded by Queensland’s Collaborative Exploration Initiative, with $171,370 of the drilling costs to be reimbursed.

The drill target is a coincident magnetic and airborne EM anomaly on the edge of a palaeo-caldera, with the initial hole giving Cazaly the opportunity to test its potential before deciding to push ahead with the JV.

“Cazaly is excited to be working together with Lynd’s high quality and successful technical team in testing the potential of the Vanrock project to host a world-class polymetallic system in a newly identified, poorly explored region in central North Queensland,” Cazaly managing director Tara French said.

Tin a critical mineral on the up

Tin prices reached decade highs earlier this year due to falling supply and surging physical demand, with tin’s use in solder and the rise of the electronics sector driving an increase in uptake for the base metal.

It is equally exposed to the energy transition, with EVs, robotics, renewables and energy storage batteries all requiring vast quantities of the metal to be viable.

Demand growth is currently sitting at 23%, with deficits expected from 2026 and the US Geological Survey this year adding tin to its list of critical commodities.

It looms as a great time for Cazaly to enter the space.

“Cazaly identified tin as a priority commodity target to add to our portfolio in our 2021 strategic planning session and now have the opportunity to be a first mover in this new search space,” French said.

“For Cazaly, it is an excellent target ripe for drill testing, highlighted by coincident anomalies. This single drill hole will enable us to assess our position and decide fairly quickly whether or not to pursue the project thereafter.”

All the terms

The key terms of the proposed transaction are as follows.

Cazaly will sole fund the CEI drill hole by November 30 before electing to move forward with the JV.

The explorer can earn 60% of the project by spending $1.5m over three years, 75% by completing a pre-feasibility study and 90% by completing a bankable feasibility study.

Lynd can revert its interest to a 2% smelter royalty if its interest drops below 10%, but has set up to work collaboratively with Cazaly and will have a 25% free-carried equity share to PFS in any new exploration licence Cazaly sets up within an agreed area of influence.

Cazaly will also make a number of small milestone payments including $100,000 per EPM on an economic drill intersection of equal or more than 30m tin equivalent, $250,000 at the completion of a positive scoping study, $500,000 on the completion of a positive PFS and $1m on a decision to mine based on a bankable feasibility study.

This article was developed in collaboration with Cazaly Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.