‘Cash is King’: This is how advanced ASX explorers are aiming to profit while lithium demand is insatiable

Pic: Kameleon007, iStock / Getty Images Plus

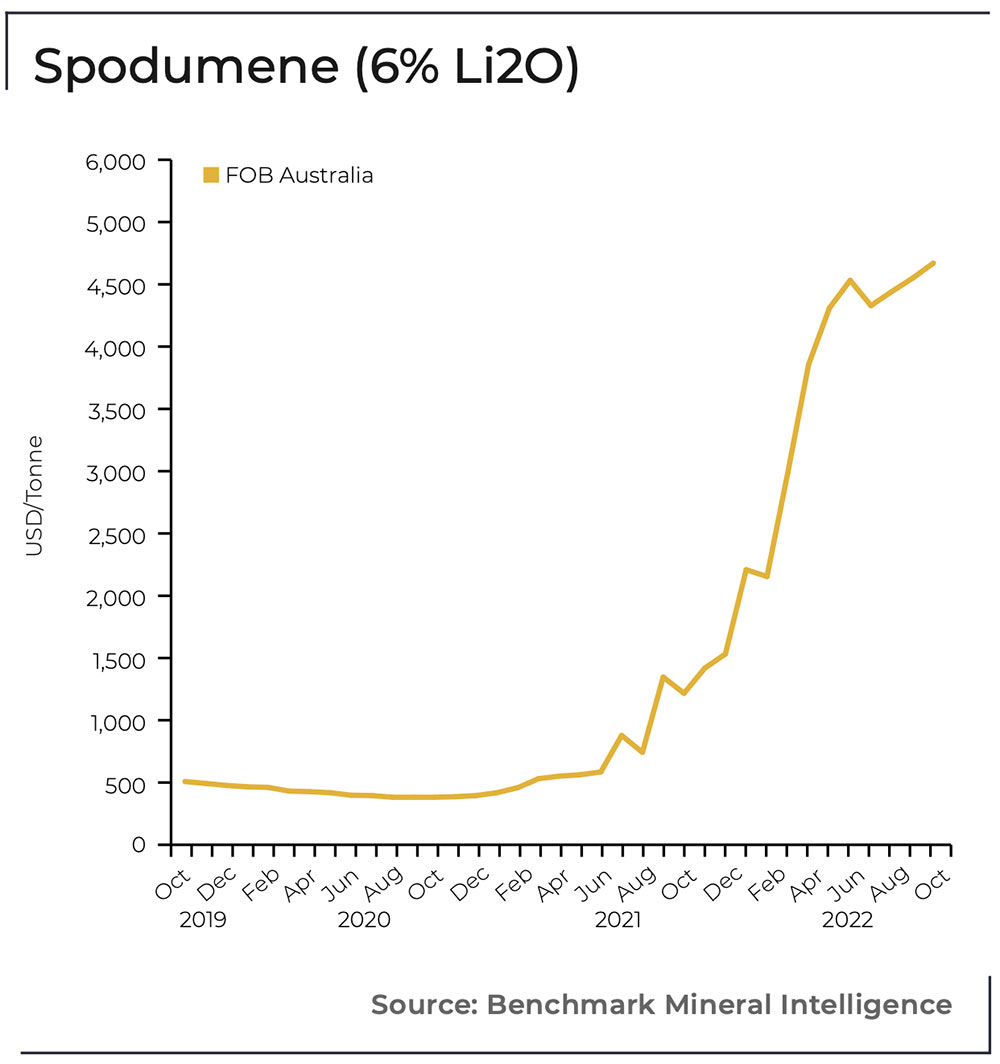

With lithium prices like these it’s no surprise miners are making super profits.

In the September quarter, Pilbara Minerals (ASX:PLS) more than doubled its cash balance from $591.7m to $1.375 billion in just three months to September, a radical $783.7m increase in a touch over 90 days.

Albermarle, the world’s top lithium producer, reported a 152% increase in quarterly net sales totalling $US2.1bn. That’s almost $US1m per hour.

But, while the medium and long demand outlook for lithium is bullish, these abnormally high lithium prices aren’t going to last forever.

Right now, there is a window of opportunity for near-term hard rock producers to enjoy these super profits.

How big is that window? No one knows, but the quicker these juniors can get into production, the better chance they have of setting themselves up for long term success.

DSO: the fast track to early profits

One-way companies are looking to fast-track cashflows is via the export of direct shipping ore (DSO).

This ore, usually around 1-2% lithium, is relatively unprocessed compared to the industry benchmark 6% spodumene concentrate (or SC6) and hence fetches a lower price. But it is also a lot cheaper and easier to produce; companies don’t need five years of studies or a +$200m processing plant.

It’s not a new concept. During the last lithium boom, companies including MinRes (ASX:MIN) and Pilbara Minerals exported DSO to China for processing as they were ramping up operations.

Last month, emergent producer Core Lithium (ASX:CXO) took advantage of spot market desperation by selling a cargo of 15,000t spod DSO with an average grade of just 1.4% for US$951/t. Insane prices.

This handy $US14m cash injection will help commission all logistics processes and procedures between CXO’s Finniss mine site and Darwin Port, in advance of concentrate production (6%) in H1 2023.

Another much smaller lithium stock aiming to take advantage of high demand and prices by selling into the DSO market is Red Dirt Metals (ASX:RDT), which recently announced a 12.7Mt at 1.2% Li2O resource at the Mt Ida project in WA.

RDT’s mantra is ‘speed to market’ and part of that strategy involves selling DSO while it completes mining studies on a bigger, more advanced operation.

Managing director Matthew Boyes says there is large amount of capacity in China to treat DSO which was installed during the last lithium boom.

RDT are now looking at ripping a small pit down at Mt Ida to get some cashflow.

“We aren’t talking about digging the whole resource; let’s say a year’s worth of production at a rate of 30-40,000t a month,” he told Stockhead.

“Why wouldn’t you? It’s fantastic money; ridiculous money. You’re making four times the money of an iron ore mine.”

Mt Ida is also on a granted mining lease, making the pathway to early DSO production relatively trouble-free.

“We just have a whole heap of permitting to do, but that permitting can start now, and then we can be in a position to put a mining plan in place in six months,” Boyes says.

“And if we can do some cheap beneficiation, like running an ore sorter on site to get rid of some quartz, then we might be selling a 2.5%-3% product.

“Then it becomes really valuable.”

RDT share price chart

How many ASX stocks can take advantage? Not many

Fellow junior-but-advanced lithium stock Essential Metals (ASX:ESS) is also looking to go down the DSO path, Boyes says.

But despite the number of ASX stocks pouring into lithium there are only 14 hard rock JORC resources in Australia, which puts advanced exploration stocks like RDT, ESS and Global Lithium (ASX:GL1) in rarefied air.

There also aren’t going to be additional Aussie hard rock lithium resources for quite a while, Boyes says.

“It takes a long time to find them and drill them out,” he says.

“Is there another company in WA drilling out a lithium resource in the next 12 months? I can’t think of anybody.”

ESS, GL1 share price charts

‘Cash is King’

It doesn’t matter if RDT are earning $10m, $20m or $30m a month – once the company is in profit it changes the ballgame, Boyes says. Especially if equity markets tighten up, and the cost of borrowing goes through the roof.

“You look at equity markets, or lithium markets; they could change tomorrow,” Boyes says.

“You just have to capitalise while prices are high.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.