Carnavale could have a ‘Tier 1 scale’ tin project in Uganda

Cristiano Ronaldo's hat-trick sent Juventus through to the UCL quarterfinals with a hat-trick against Atlético Madrid. Picture: Getty Images

Special Report: The latest update from Carnavale Resources’s Kikagati tin project in Uganda are boosting the company’s confidence in the project’s scale and potential

Carnavale (ASX: CAV) told investors this morning it had identified multiple occurrences of fine grained to coarse grain cassiterite, a tin bearing mineral, at Kikagati.

The Kikagati tin project is a large-scale walk-up drill target that has never been previously drill tested.

The aggressive 2,000m drilling program is testing the 3km-long ridge.

Drilling is close to 70 per cent complete, with over 1350m drilled so far.

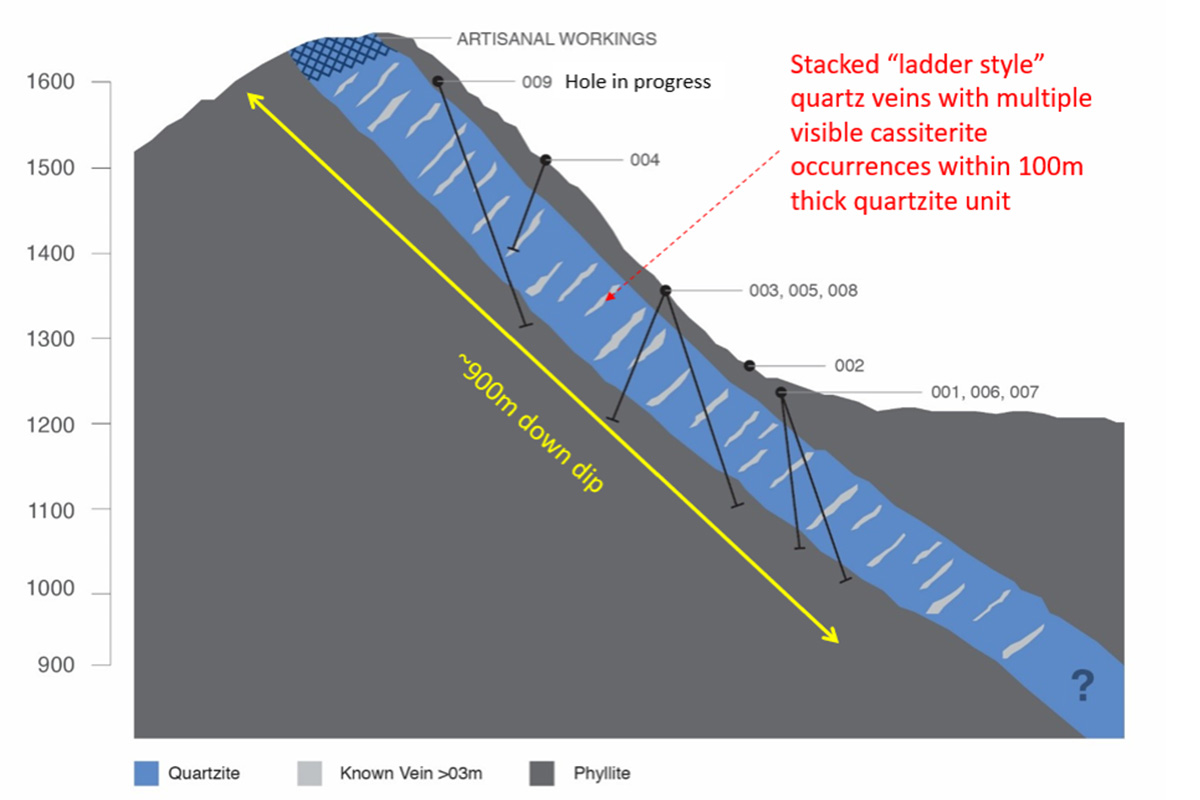

The most recent drill holes were designed to intersect the stacked “ladder style” quartz veins which are located within a quartzite host approximately 100m thick, revealing multiple occurrences of visible cassiterite.

Most of the world’s supply of tin is obtained by mining cassiterite.

Carnavale says the results demonstrate that the project has Tier 1 scale and that it represents an exciting large-scale exploration drill target with potential to define a significant tin resource.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

More to come

Carnavale is now focused on the remaining drilling activity, including a hole that will provide the uppermost demonstration of down dip and northern most along strike potential.

The grade of the individual veins and the potential of the parallel shear alteration remains to be confirmed.

Initial drill core samples for the first six holes have been submitted to the ALS laboratory in South Africa and results are expected in the coming weeks.

The remaining drill core samples are currently being processed in preparation for dispatch to the laboratory.

Timing is right

Timing appears to be on Carnavale’s side as tin demand remains steady.

Plus, the growing battery market and demand for new technologies is expected to drive an increase in demand for the commodity.

Boston’s Massachusetts Institute of Technology forecasts that tin will edge out the favoured lithium and cobalt battery metals as the metal most likely to be impacted by new technology.

Innovations including autonomous and electric vehicles, advanced robotics, renewable energy, and advanced computing and IT are all predicted to play a role in driving future demand.

The tin price is getting ever closer to its 2018 peak of $US22,100 ($31,280) per tonne, up over 59 per cent since January 2016 and is sitting around $US21,100 per tonne.

This story was developed in collaboration with Carnavale Resources a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.