Carawine: Chasing more exploration successes in 2020

Pic: Getty

Special Report: In 2020, Carawine Resources is looking to follow-up on its exploration success at the Hill 800 deposit and it has a busy dance card across Australia with which to achieve this objective.

Continued exploration successes at its Hill 800 deposit in Victoria and reaching deals worth up to $12m with mining giants Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) to explore its Paterson tenements are Carawine Resources’ (ASX:CWX) major achievements in 2019.

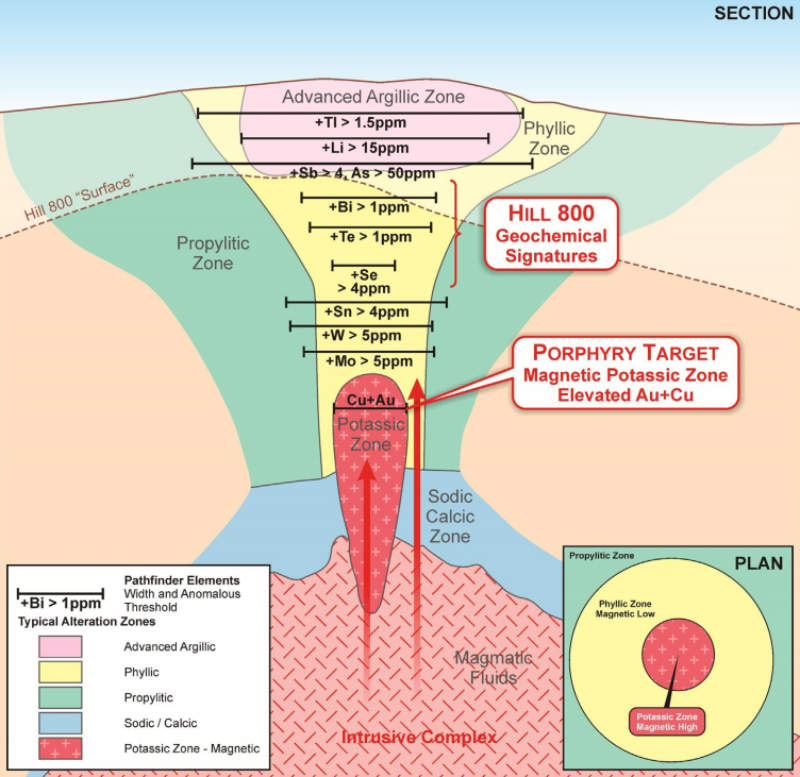

The company’s work at Hill 800 has not only established the continuity of excellent copper-gold grades, it has also found a porphyry source to its mineralisation and identified the potential for large porphyry systems at the broader Jamieson project.

Drilling at Hill 800 previously produced some expectation busting results such as 62m at 2.13 grams per tonne (g/t) gold including 17m at 6.62g/t gold and 0.3 per cent copper.

A separate hole hit 43m at 4.24g/t gold from 177m, including a 5m intersection grading 24.1g/t gold from 203m.

Jamieson covers an area of about 120sqkm near the township of the same name, a historical gold mining region.

Carawine’s work on the Paterson tenements near Rio’s Winu and Greatland Gold’s Havieron gold and copper discoveries also generated more high priority targets than expected.

This prompted Rio and FMG to sign separate joint ventures with Carawine, while the company maintained a strong position in the region by acquiring four new wholly owned tenements.

Rio is required to pay the company $200,000 in cash, subscribe for $300,000 worth of CWX shares and spend at least $5.5m on exploration within six years to earn a 70 per cent interest in the Baton and Red Dog tenements.

Meanwhile, FMG will pay Carawine $125,000 in cash and will have the right to earn up to 75 per cent stake in its eastern Paterson project tenements by spending $6m in two stages.

Legend Mining’s recent nickel-copper discovery at the Mawson prospect in the Fraser Range has also increased the prospectivity of the company’s Big Bang tenement.

Throughout this entire period, the company has kept a tight register with just under 75 million issued shares and about $3.6m in cash as of the end of November.

2020 Outlook

So just what are some of milestones that Carawine is working towards in 2020?

Managing director David Boyd told Stockhead that new discoveries in one or more of the company’s Paterson, Fraser Range or Victorian projects could substantially re-rate the company’s share price.

And the company has a busy work program ahead.

First assays from deep diamond drilling targeting extensions of known gold mineralisation at Hill 800 are expected early in the first quarter of 2020.

Meanwhile, a second phase of diamond drilling targeting nearby, deeper porphyry targets is expected to start in the first quarter of 2020.

The company also expects to start drill testing of the Rhyolite Creek prospect about 5km south of Hill 800 and start target generation on its new wholly owned Paterson tenements in the second quarter of 2020.

Now read:

Carawine identifies more copper-gold targets in Victoria

Carawine goes deep for gold, copper mineralisation in Victoria

This story was developed in collaboration with Carawine Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.