Caravel strikes to ignite interest from the majors

Pic: Schroptschop / E+ via Getty Images

Special Report: With eye-watering global copper demand forecast, Caravel Minerals Australian project could attract one of the bigger players.

Robust technical and development studies have boosted the size of the resource (which is now at 1.86Mt of contained copper – at 0.15 per cent Cu cut-off) and set the project up to become a new, large-scale, long-life producer.

Potential re-rate on the horizon

As we saw with news of the Sandfire Resources (ASX:SFR) and MOD Resources (ASX:MOD) tie-up, corporate deals with the larger producers can significantly re-value a junior.

Prior to the deal being announced, MOD had a share price of 31c, valuing the company at around $94m.

But Sandfire offered 45c per share in scrip and cash — a nice 45 per cent premium.

On top of that, MOD shares have since risen to almost level with the offer price.

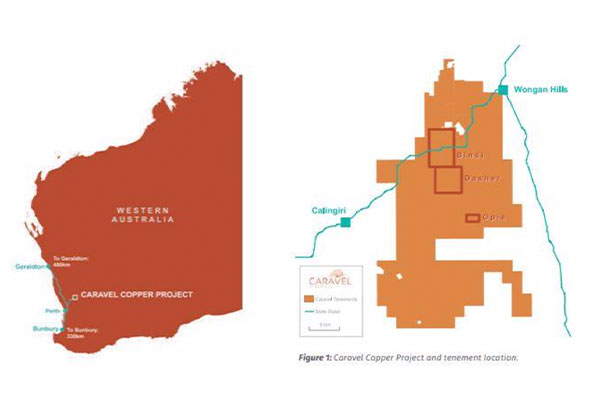

As well as the very large resource, one of Caravel’s biggest advantages is the project location, only 150km north of Perth, Western Australia – one of the world’s best mining jurisdictions.

The project has access to existing infrastructure, such as grid power, roads, rail and services further adding to the attractive economics compared to remote projects required to self-fund similar works.

Caravel also has the option of two ports – Geraldton and Bunbury – for export of the copper concentrate products.

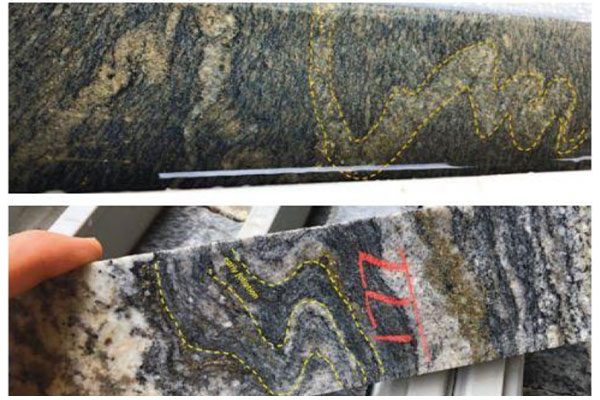

The world’s largest, most profitable copper mines are open-pit porphyry deposits with simple chalcopyrite metallurgy. These are geared to be developed as low to mid‐cost operators with a very long mine life.

With copper grades declining around the world and new major discoveries proving elusive, experts forecast the price could be much higher — which would enhance the Caravel project even further.

>Read: Expert guide: everything you need to know about copper stocks

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with Caravel Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.