Caravel Minerals is launching into the nickel space with Mt William farm-in

Caravel has reached a farm-in agreement for the Mt William nickel-PGM prospect in WA Pic: Getty Images

Special Report: Caravel is jumping on the nickel bandwagon with the execution of an agreement to a 51 per cent interest in the Mt William prospect near Waroona, WA.

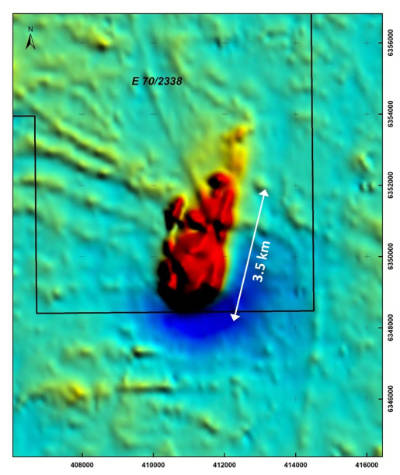

Mt William is a 3.5km long magnetic feature that is interpreted to be a layered mafic complex with potential for nickel and platinum group metals (PGM) mineralisation.

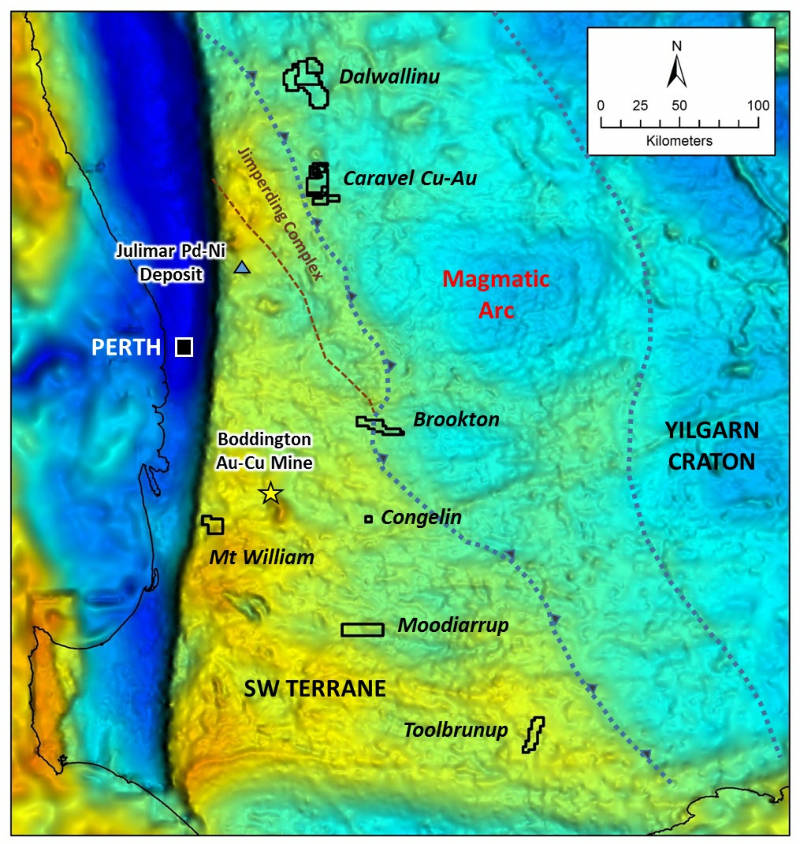

This is particularly exciting for Caravel Minerals (ASX:CVV) given the discovery of the Julimar nickel-copper-PGM deposit in the Gonneville layered mafic complex, which sits in a similar geological setting within the South West Yilgarn Terrane as the Mt William magnetic complex.

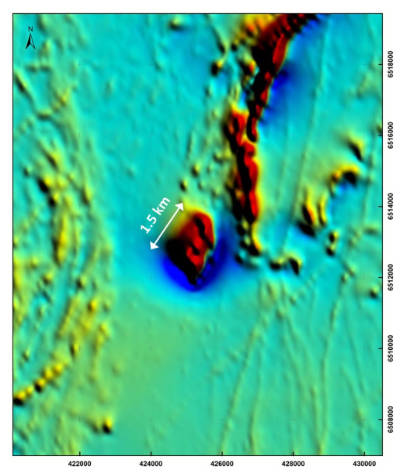

The Mt William magnetic anomaly shows discrete layering and a character consistent with the chonolith style of intrusion at Gonneville though it is considerably larger at 3.5km of strike compared to about 1.5km.

Speaking exclusively to Stockhead, Alasdair Cooke said the company’s decision to farm into Mt William was sparked by its interest in having a portfolio of other projects besides its flagship Caravel copper project.

“We had a lot of opportunity to look at this southwest area before it became fashionable with the discovery of the Julimar discovery,” he noted.

“In fact, we have been aware of this anomaly that is the key focus at Mt William for a long time and had pegged that ground 20 years ago.

“But that was subsequently taken over by Soul Pattinson and so are joint venturing back in on the licence looking for nickel and PGM.”

Nickel potential

The Mt William prospect area is dominated by deep laterite weathering profiles typical of the Darling Plateau, with no outcrops present in the area to identify basement geology and the source of the magnetic anomaly.

Additionally, there is no recorded previous exploration or drilling in this area other than shallow drilling for bauxite exploration to the north.

Caravel added that while no ages have been determined for the layered intrusions, the Jimperding Metamorphic Belt that Gonneville lies within is considered to be of similar age and origin to the Balingup Metamorphic Belt that hosts the Mt William intrusion.

Both belts are believed to have similar origins and histories and have metamorphic ages dated around 3.2 to 2.8 billion years old.

“There are very few magnetic features that look like what they call the Gonneville intrusion at Julimar and this is this is without doubt the most similar, but it’s also nearly three times larger,” Cooke said.

“It is in the same rock type and the same kind of structural setting in terms of proximity to the major Darling Fault.”

He added that Caravel will take a page out of Chalice Gold Mines’ (ASX:CHN) successful playbook at Julimar.

“The first phase of exploration would be an EM survey over the magnetic anomaly to define drill targets and then we would we go in and test those targets.”

“So, it’s a very straightforward program of exploration and can be done very quickly.”

Farm-in and option agreement

Under the agreement, Caravel can acquire 51 per cent of Mt William from Round Oak Minerals, a wholly-owned subsidiary of investment house Washington H. Soul Pattinson & Co Ltd, by spending $500,000 within two years.

On completion of the farm-in, Caravel may then elect to enter a joint venture with Round Oak Minerals with an initial 51 per cent interest following which the two companies may elect to contribute according to their respective interests or dilute.

Further details will be released once the final document is executed.

This article was developed in collaboration with Caravel Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.