Cannindah raising $4mn in bid to ramp up search for giant Queensland copper deposit

Copper finds are hot property right now. And Cannindah wants to drill a big one. Pic: Getty Images

- Cannindah Resources is expected to exit a trading halt today

- Chasing ~$4m in entitlement offer to set up next round of drilling

- Chasing extensions to 14.5Mt at 1.09% CuEq resource at Mt Cannindah, as well as two ‘tier-1’ copper-gold targets at Queensland leases

Cannindah Resources (ASX:CAE) is restocking its coffers, tapping the market for a planned $4 million raising as it looks to resume drilling in the hunt for Australia’s next major porphyry copper discovery.

The junior explorer entered a trading halt on Tuesday, with Canaccord Genuity on deck to run a 1 for 2.7 non-renounceable entitlement offer to raise ~$4m at 1.5c a share, according to a term sheet seen by Stockhead.

It comes ahead of a new drilling campaign to expand the known resource at Mt Cannindah expected to start in the next 2-4 weeks.

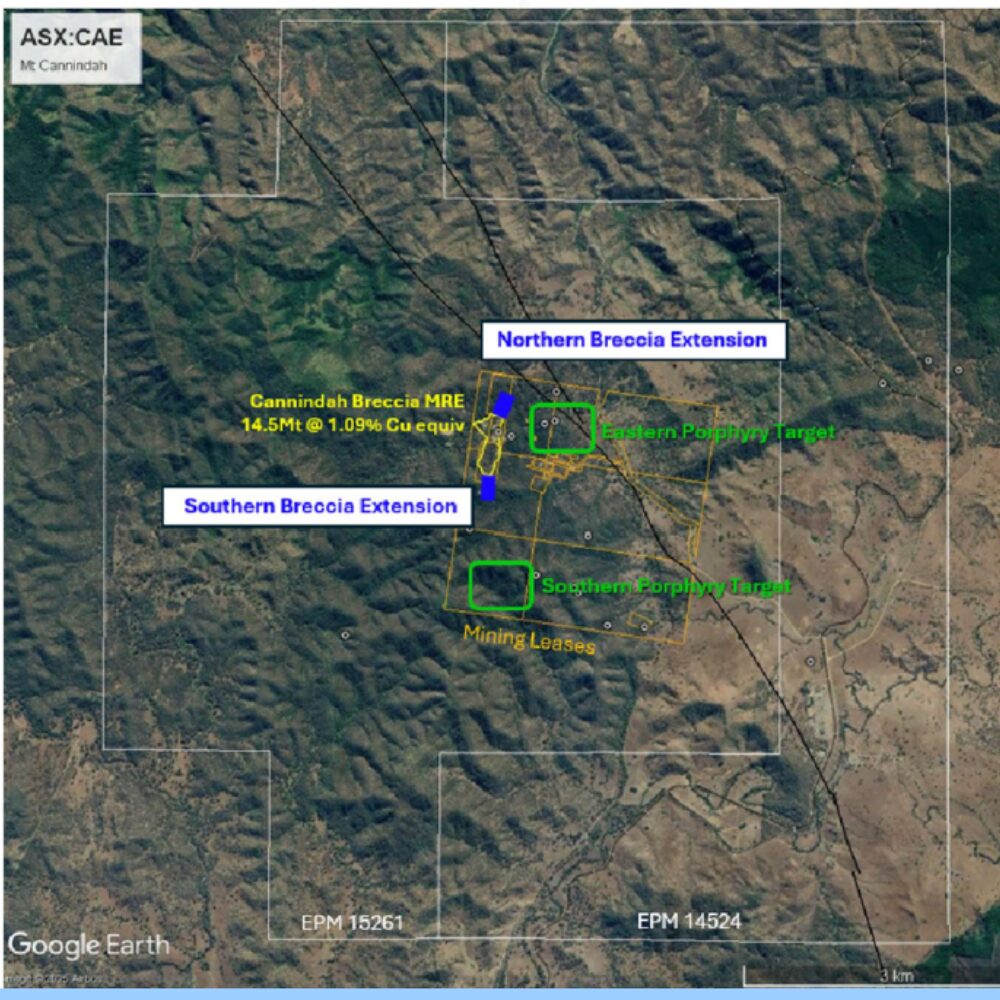

Drilling is set to focus on northern and southern extensions to the 14.5Mt at 1.09% copper equivalent resource, which the company believes reflects only a small and shallow component of what could be a much larger porphyry discovery.

Those tonnes –159,000t CuEq in metal equivalent – have been added at a discovery cost of just 3.5c per pound, with major targets across 95% of the mineralised system at the project near Gladstone in Central Queensland still to be tested.

According to the pitch, drilling will target northern and southern extensions of the Mt Cannindah resource, including a new target called Little Wonder which is at the southern end of a 700m stretch untested by drilling.

Cannindah, which had $1.18m in the bank at June 30, has pulled in the support of some of its big guns for the raising, which could come in fully or partly underwritten.

Tony Fung’s Aquis Finance, CAE’s largest shareholder with a 34% stake, will subscribe for its full $1.35 million entitlement, with the junior’s board of directors including recently appointed NED and former Azure Minerals boss Tony Rovira, NED John Morrison and non-exec chair Michael Hansel sub-underwriting a further $475,000 on a priority basis.

Canaccord was seeking underwriting commitments for the balance of the issue, amounting to around $2.2m, with the company leaving open the option to accept oversubscriptions for the offer, which clocks in at a 21.1% discount to its last traded price of 1.9c.

Cannindah is expected to exit a halt this morning to announce the outcome of the entitlement offer, based on its initial notice to the ASX.

Size of the Prize

The raising sets up the first new drill program at Mt Cannindah since the appointment of Cameron Switzer as the company’s exploration manager.

Switzer previously led exploration for Newcrest Mining across the Asia-Pacific, running programs across major porphyry operations like Cadia, Lihir and Gosowong, with Switzer also closely involved with the 8Moz Havieron discovery near Newcrest’s Telfer operation, the future centrepiece of the province for new owner Greatland Gold.

Those are exactly the sought of finds Cannindah believes it can emulate.

Not only is Mt Cannindah open along strike and at depth, but Cannindah has also uncovered two large targets external to the main resource area called the Southern and Eastern targets.

The first in the south is a 1400m by 100-400m soil anomaly with grades of more than 1000ppm copper, 0.1ppm gold and 70ppm molybdnum on top of coincident IP and magnetic anomalies.

The Eastern is an under cover IP anomaly and magnetic anomaly across 1700-400m with a halo of copper mineralised drill holes.

The feeling is they could be ‘transformational’, dwarfing the scale of the anomaly under which Cadia, both the second largest gold and copper producing mine in Australia until a tail off in output this year, was originally found.

While the deepest drilling in the new target areas has only extended to 300m, with most 30-60m deep, both pencil and bulk porphyry deposits are typically defined to over 1500m in depth.

Copper dreams

Cannindah drew serious attention in October 2024, when it revealed Chile’s state copper miner Codelco had floated a proposal to conduct due diligence over its Mt Cannindah project, the first exploration push the copper giant, once the world’s largest individual producer, had made into Australia.

There is no shortage of interest in large scale copper assets in Australia, with prices of US$4.50/lb predicted to roll higher as demand runs ahead of supply in the coming years.

MAC Copper’s (ASX:MAC) proposed $1.6bn sale to South Africa’s Harmony Gold has shown the interest in local assets ahead of an expected crunch in copper supply, with demand expected to lift 70% to 50Mt by 2050 as electrification and urbanisation accelerates.

This week BHP’s economists said 1oMt of additional supply would need to be developed 2035 to keep pace with demand. That’s equivalent to 10 replicas of its Escondida mine, the largest deposit in the world, suggesting prices will need to rise even further to justify marginal developments.

High grade gold mineralisation has also been found at Mt Cannindah, a handy by-product given the current run in gold prices to all time highs of more than A$5000/oz.

At Stockhead, we tell it like it is. While Cannindah Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.