Canary Capital sees solid upside for these gold and health stocks for 2024

Pic: via Getty Images

Canary Capital recently published two research reports on two companies that executive director Paul Hart says have ‘significant upside’ for the year ahead.

The first pick is gold explorer Auric Mining (ASX:AWJ) whose flagship Munda gold deposit in the prolific Widgiemooltha-Norseman region of WA hosts a sizeable indicated and inferred mineral resource of 198,700 ounces at 1.38g/t gold.

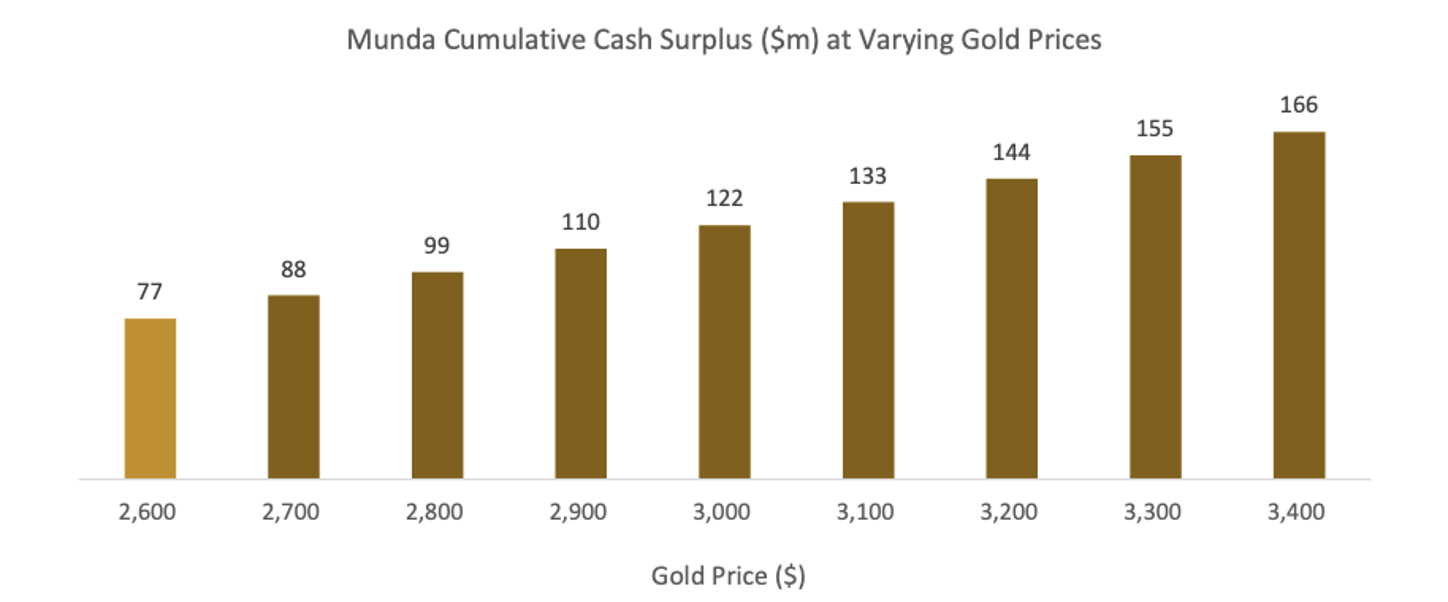

A scoping study released mid-2023 outlined some solid economics, with a projected positive cashflow of $76.9m over a 13-quarter mine life based on a conservative gold price assumption of A$2,600/ounce.

It’s that cash flow potential that caught the eye of Hart and the team at Canary Capital, with the company transitioning from listing on the ASX to mining and generating cash in under three years.

“The potential surplus cash flows are substantially higher at current gold prices around $3,000/ounce,” the report notes.

“Based on the scoping study, AWJ will commence operations at Munda with a starter pit with a mine life of three months and a low capital investment of $1.3m.

“The starter pit will also require a working capital investment of ~$6.0m and is expected to produce $8.7m in surplus cash.”

Cash flow potential for Munda

This is all thanks to the company’s Jeffreys Find gold mine, which has already produced 9,741 ounces from Stage 1, leaving AWJ with a tidy $4.8m cash surplus after the funds were split with partner BML Ventures who’re mining and tolling the ore.

And there’s more cash to come.

AWJ management expects to commence Stage 2 of mining Jeffreys Find around February, 2024 with first cash flow projected during the third quarter of 2024.

The final pit is expected to generate surplus cash to Auric of between $3.3m and $6.6m, to total between $8.1m to $11.4m cash flow to the company over the project duration of roughly 18 months.

However, despite the significant cash flow potential of these projects, the current market capitalisation of AWJ is just $17.66m, Canary Capital says.

“We view this as presenting investors with an opportunity to invest in AWJ at a fraction of the real intrinsic value of the company.

“With its projects either operational or about to come online, no debt, upcoming catalysts, and a strong management team, the company offers a compelling investment case with significant upside.

“AWJ is our preferred ASX listed company to participate in the current favourable macro environment for gold.”

Canary has given AWJ a discounted cash flow valuation of $0.34-0.37 per share (based on a gold price of $2,600 per ounce) which it says indicates “substantial upside from the current share price.”

“This valuation does not take into account the potential for higher gold prices to be realised versus the $2,600 per ounce in our modelling,” they said.

AWJ share price today:

Biome Australia (ASX:BIO)

Canary Capital’s second pick for 2024 is probiotic product developer Biome Australia, whose products are backed by double blinded placebo controlled clinical research programs that demonstrate their efficacy.

The company currently has a range of 14 probiotic products on the market – and it’s a global market which was valued at a whopping US$47.6 billion in 2021.

The ability to offer clinically proven condition-specific probiotic products is what the report notes places BIO as a leading-edge provider of quality probiotics.

In the past two years alone, the company has seen a substantial increase in sales of 78% (FY2022 vs FY2021) and 75% for FY2023 versus FY2022.

For the period from July to November 2023, $5m in sales has been achieved, which is up 70% on the same period last year.

“Biome has demonstrated in the last two years it has a highly scalable business model,” Canary Capital says.

“Since the IPO, the number of distribution points has increased by more than 50% to over 3,000 in Australia and New Zealand.

“With 370 high-volume service-based pharmacies, Priceline Pharmacy was a recent major distribution agreement signing, with sales beginning in the 2nd quarter of 2023.

“While the growth in distribution points has been impressive the same store pharmacy sales growth has been exceptional.

“Terry White Chemmart (TWCM) has recorded a 59% growth in same store sales in the first half of 2023.”

Based on this growth to date, Canary Capital predicts BIO’s Australian pharmacy revenue of $4.7m in FY2023 will grow to $7.4m in FY2024, representing year on year growth of 90% and 56% in FY2023 and FY2024, respectively.

In FY2028, the Australian pharmacy distribution channel is forecasted to generate $33.6m in revenue from revenue implying a 6-year CAGR of 54%.

Australian practitioner revenue is expected to reach $2.0m in FY2023 and $3.8m FY2024, growing at a CAGR of 47% to reach $14m by FY2028.

Room to grow in the UK and Europe

While the focus since the IPO has been on expanding the ANZ business, Canary Capital says significant opportunities exist in the United Kingdom and the rest of Europe.

“The high margin, shelf stable (non-refrigerated), long life (2+ years) product is ideal and cost effective for distribution and sales in overseas countries,” they said.

“While only $293k was generated in overseas revenue in FY2022, we expect this number to grow significantly as the company continues to invest into its overseas strategy.

“The ramping up of sales and distribution efforts is predicted by Canary to result in overseas revenue growing at a CAGR of 74% from $293k in FY2022 to $8.3m in FY2028.”

Plus, the company is working on a range of new products in the dental health market (valued at US$7.6 billion in 2021 and expected to grow to ~US$12.2 billion by the end of 2031), the Australian sports supplement market (worth A$1.4 billion in 2021 with an expected 9.8% CAGR to 2028) and the global constipation market (valued at US$17.04 billion in 2020 and projected to reach US$29.04 billion by 2028).

“The financial modelling prepared by Canary Capital shows an increasing level of operating leverage is expected to continue in future years resulting in EBITDA turning positive during FY2025,” the report notes.

“We expect the company to become free cash flow positive during FY2024 as revenue continues to scale.”

Canary Capital gives Bio a discounted cash flow valuation of $0.66 share and an equity valuation of $126.2m – up from the current market cap of $48.75m.

BIO share price today:

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.