Can you dig it? We’ve unearthed the best value miners from across Morningstar’s entire universe

Via Getty

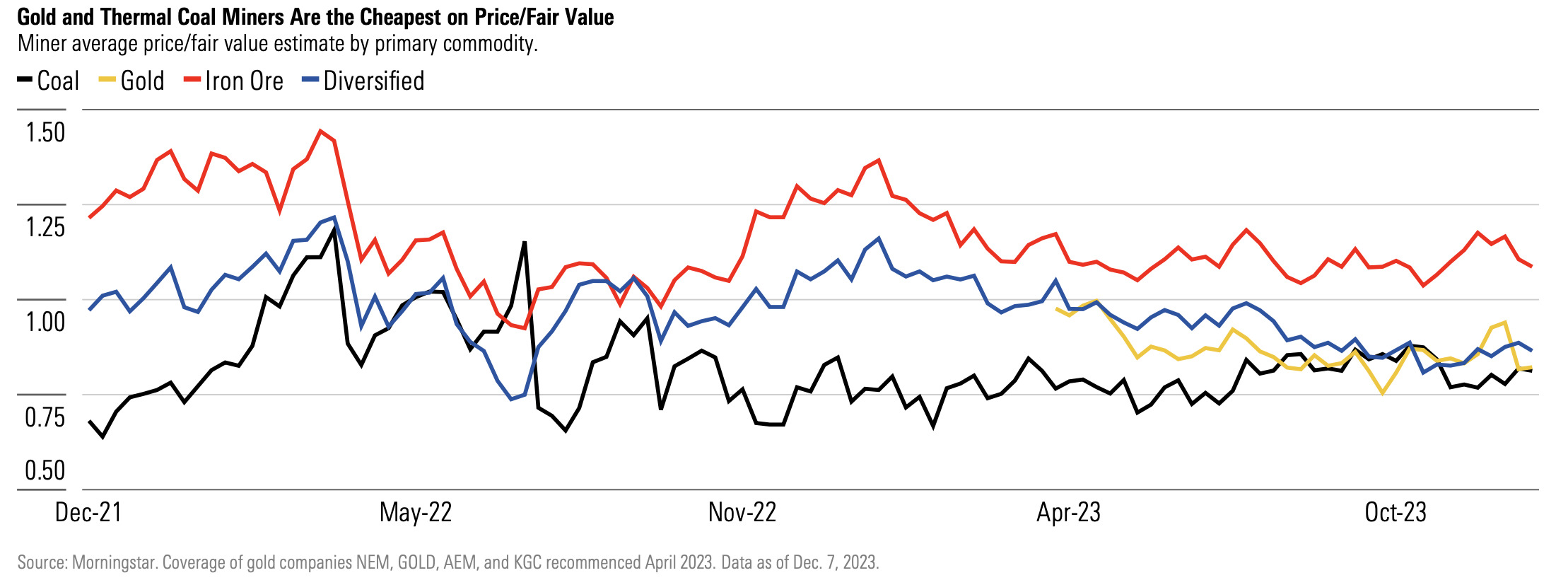

Right now, it’s the gold and thermal coal companies which feature heavily among the world’s cheapest, according to Morningstar mining analyst Jon Mills.

But before we go any further – it might be best to retrace some Morningstar nomenclature (inspired as it is by that doyen of stock pickers, Mr Warren Buffet). First up is the concept of the “economic moat,” popularised by Ohama Buffett, and referring in short to a company’s ability to maintain competitive advantages over its competitors.

Also, instead of a “price target (PT)” you’ll hear Jon and his peeps talk about “Fair Value” estimates. Same thing.

Making an asset out of commodity price assumptions

Morningstar’s mining doyens led by Jon Mills have updated their 2024 commodity price assumptions.

All the diggers below offer variations on a theme – going into the new year these are the company’s which operate from a position of strength, yet offer something attractive within their current valuations.

Jon says Morningstar sees renewed potential in most of the core commodities Australian miners have become regarded for.

“We’ve increased our near-term iron ore prices just because near-term futures have gone up materially recently, and that’s basically due to strong Chinese steel production.

“We also increased our copper price, both near-term and also mid-cycle or long-term assumed price. We just think that inflation is pushing up and stinging the cost curve, and there’s also been supply issues in various mines around the world. So, we see long-term copper prices being higher than we previously assumed.

“Other than that, we’ve pushed up gold on optimism that global interest rates are close to a peak. Traditionally, there has been an inverse relationship between interest rates and gold prices.

“And probably the other big change is thermal coal prices, which have been very volatile, have come down a bit,” Jon says.

Cheap as chips

Newmont Corporation (NYSE, ASX:NEM)

Newmont comes in with a large golden bullet as the cheapest commodity producer in Morningstar’s coverage universe, Mills says.

It’s the world’s largest gold miner, with a portfolio reflecting three major deals in recent years.

“First, it acquired fellow gold producer Goldcorp for a relatively mild premium in 2019. Not only did it avoid paying a high price, Newmont also extracted better performance at mines where Goldcorp struggled.

“Second, it combined its crown jewel Nevada assets with Barrick Gold’s in a joint venture called Nevada Gold Mines, or NGM, also in 2019.”

With Barrick as the operator, Newmont owns 38.5% of the love-in, which cut costs given the proximity of mines owned by the joint venture.

Then of course, Newmont also acquired the ASX gold miner Newcrest Mining (ASX:NCM) last year.

“We forecast Newmont to increase attributable gold sales to around 8.8 million ounces in 2027, up from roughly 7.3 million in 2023 pro forma for Newcrest on an annualised basis,” Mill says.

“The increase is driven by higher gold production from its 38.5% and 40% stakes in the Nevada Gold Mines NYSE: NGM), and its JVs with Pueblo Viejo and Barrick, respectively at Lihir, Penasquito and its mines in Ghana.

“About 70% of Newmont’s mid-cycle production in 2027 comes from the US, Canada, Australia and Ghana.”

Jon says that as a commodity producer, Newmont is a price taker.

“This means it really needs low-cost mines with long lives and a low installed capital base to support the longer-term excess returns needed to justify an economic moat.

“We assign a no-moat rating to Newmont (it) is placed around the middle of the gold industry AISC curve.

“Due to the flatness of the industry cost curve, only miners in the lowest quartile tend to enjoy a material operating cost advantage. And that would need to be paired with an efficient invested capital base and long reserve life to warrant a moat. Newmont’s costs are not low enough to justify a moat, and so we don’t think Newmont exhibits a low-cost advantage.”

NEW is currently trading at a 30% discount to Morningstar’s fair value, according to Jon.

Other goldies glitter

Further afield, Mills says that Morningstar’s estimates for (no-moat) Barrick (NYS: GOLD), Agnico Eagle (NYS: AEM), and Kinross (NYS: KGC) “modestly” rise to US$21.50 US$54.00, and US$5.50 respectively.

“However, our fair values for no-moat Northern Star Resources (ASX:NST) , Evolution Mining (ASX:EVN) , and Perseus Mining (ASX:PRU) are unchanged at $11.30, $3.00, and $2.00, respectively.

Jon adds that a stronger AUD/USD rate “broadly offsets” a higher US dollar gold price.

Coal: ‘Materially undervalued’

Thermal coal miner Whitehaven Coal (ASX:WHC) remains materially undervalued, which Jon reckons reflects the many investors shunning coal investment.

“Lower thermal coal prices and a stronger Australian dollar drive our estimates for no-moat Whitehaven and New Hope Corp (ASX:NHC) , down 5% to $9.50 and down 7% to $5.70, respectively,” he says.

Meanwhile, over in London, Jon adds that the lower thermal coal and nickel prices more than offset higher copper and zinc prices along with a stronger British pound, driving no-moat Glencore’s (LON: GLEN) estimate down 3% to £500.00.

Morningstar also retains no-moat Teck’s (NYS: TECK) $34 US estimate, with increased copper prices offset by a stronger Canadian dollar.

Iluka: Resistance is rutile

Closer to home, Aussie mineral sands specialist Iluka Resources’ (ASX:ILU) is only momentarily on the back foot according to Mills.

China’s massive property sector remains in a downturn impacting demand for mineral sands such as zircon, rutile, and synthetic rutile.

“Iluka and other major mineral sands suppliers have responded by reducing production and building inventory to try to stabilise prices. Even so, Iluka’s near-term zircon sales are likely to be affected by its strategy to sell more lower-grade zircon-in-concentrate while zircon markets remain subdued.”

“As such, we now assume zircon prices average around US$1,720 per metric ton in 2024, down from roughly US$1,810, before reverting to our unchanged assumed mid-cycle price of roughly US$1,610 per metric ton from 2027.”

Rising interest rates and slowing housing markets in the west are also a headwind for Iluka, Jon adds.

“Iluka’s estimate falls 10% to $9.50, driven by reduced near-term zircon prices, the increased cost of its Eneabba rare earths refinery, and a stronger Australian dollar.”

“However, we think these concerns are more than reflected in its share price. Longer-term, maturing mines and a lack of large, high-grade, undeveloped resources are likely to support mineral sands prices. The company’s proposed rare earths refinery at Eneabba is an option on elevated rare earths prices, and we think Iluka has cut a good deal with the Australian government, which is funding much of the refinery’s construction cost.”

FMG and the lore of iron ore in ’24

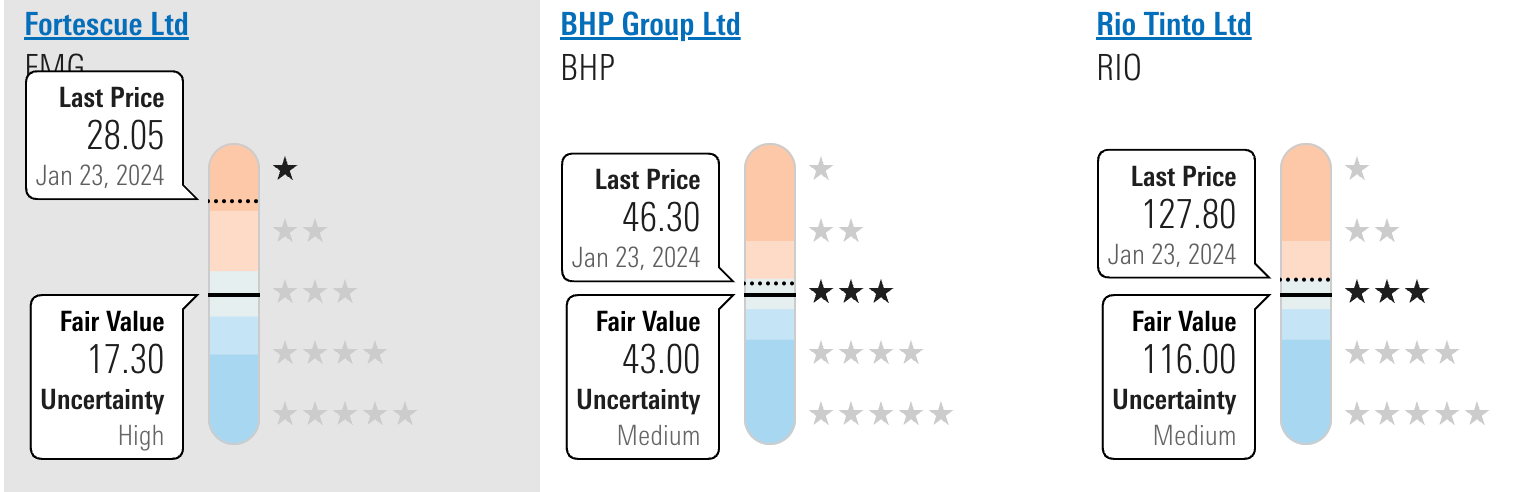

Higher iron ore prices drive Jon’s increased estimates for Morningstar’s “no-moat” Fortescue (ASX:FMG) and “wide-moat” Deterra Royalties (ASX:DRR), where targets rise 8% to $17.30 and up 5% to $4.40, respectively.

Morningstar now sees iron ore averaging at about US$120 per metric ton from 2024 to 2026 based on the futures curve, up from roughly US$95 previously.

“Our assumed midcycle iron ore price remains roughly US$60 per metric ton from 2027, based on our estimate of the marginal cost of production – acknowledging the rising costs across the industry due to inflation, along with supply discipline from the iron ore majors and mine depletion likely meaning the marginal cost is determined by smaller, higher-cost mines.

Jon says that estimate also considers the recovery of Vale’s output and Simandou starting production.

“We forecast around 2.1 billion metric tons of global steel production in 2026, with production from China around half of this as its economy moves away from one reliant on fixed-asset investment to a more consumption-based economy, and as its scrap-based production increases.”

“Along with higher copper prices, we raise our estimate for no-moat BHP (ASX:BHP) by 5% to $43, and reiterate our $116 estimate for no-moat Rio Tinto (ASX:RIO) , which we increased for similar reasons.

However, the Aussie iron ore majors fall outside the bargain box category – although the fair value estimates have been raised, all three remain at the higher end or above Morningstar’s fair value target.

With China remaining iffy over infrastructure investment, a local market correction could offer punters a chance to get in on these Aussie majors at the right price.

Copper shines

“We raise our assumed midcycle copper price to roughly US$3.60 per pound from 2027, up from around US$3.10. This is based on our updated estimate of the marginal cost of production, driven by inflation pushing up and steepening the industry cost curve.” Jon told Stockhead.

Ongoing supply issues are also a bit of a contributing factor here, Jon reckons, with the main problems out of Chile and Peru, the world’s two biggest exporters of the red metal.

“For example, Anglo American recently materially downgraded forecast copper production from its Chilean operations, while global mined supply has been further reduced by 1.5%-2.0% due to the Panamanian government forcing the closure of the Cobre Panama mine.”

Closer to home, no-moat South32 (ASX:S32) estimate falls 3% to $3.80, with lower nickel and silver prices along with a stronger Australian dollar more than offsetting higher copper and zinc prices.

The views, information, or opinions expressed in the interview in this article do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.