Cameroon’s star is on the rise. These are the minerals fuelling it

The market is sitting up and taking notice of Cameroon's mining sector. Pic: Getty Images

- Cameroon’s mining sector is starting to attract global attention

- Growing bauxite and rutile endowment shows there are giants to be found

- Interest could deliver rich rewards to companies at the forefront

When one considers mining destinations in Africa, countries such as Mali, Cote d’Ivoire, Namibia and Tanzania are normally at the top of the list. In years gone by, Cameroon has barely made the cut.

The country’s mining sector is still dominated by small-scale artisanal mining, while industrial-scale operations that can truly benefit the economy are at a nascent stage.

At least part of that might stem from hesitation towards investing in one of two countries that pulled the rug out from under Australian iron ore hopeful Sundance Resources.

The now delisted company had sought to develop the giant Mbalam-Nabeba project that straddled the border between Cameroon and the Republic of Congo but first had the former fail to implement the exploitation permit in late 2020 and the latter revoke its mining permit and award it to a little known company with Chinese backing.

While the Republic of Congo has since settled with Sundance, Cameroon allegedly declined to turn out for an arbitration hearing in late January 2025 and that matter is still in limbo.

Despite this, investors are starting to sense the winds of change.

Canaccord Genuity mining analyst Tim Hoff – who has had an excellent run of predicting winners with his Diggers and Dealers stock selections – says Cameroon has not been seriously explored for some time.

This is despite the country having interesting geological features that weren’t obvious in retrospect, which resulted in exploration never quite hitting the point where the market sat up and took notice.

This is also why there are world-class assets sitting outside of the mainstream just waiting to be picked up.

“I think that’s probably the largest driver of why Cameroon is shaping up as an emerging country to look for these things,” Hoff, one of a handful of local analysts to have traversed the West African country, said.

“We’ve also seen shifts in regulatory policy and a convergence of significant discoveries, financial backing and policy changes to present an opportunity.

“I think the (Cameroon) Government is keenly aware that forestry, which is one of their major export markets, is not sustainable in its current form and it’s going to look to ban the export of uncut wood over the next few years.

“The Government has taken a positive step to look at their resources and say how can we attract investment and how can we shift our economic outlook, and resources has certainly come to the front there.”

DY6 Metals chief executive officer Cliff Fitzhenry added the company saw Cameroon as a highly prospective mining jurisdiction that remained vastly underexplored despite its significant endowment in a range of minerals.

“The Cameroonian government is pro-business and is actively promoting the mining sector (new Mining Code in 2023) as a key pillar of its National Development Strategy,” he added.

“Historically oil & gas focused, the country is courting investment from public and private operators, and has welcomed delegations from a range of mid-tier and large mining companies over the past year.”

Fitzhenry noted that the underexplored nature of Cameroon and the potential to make a significant discovery of scale attracted DY6 to the country.

Attention incoming

Cameroon’s days of obscurity might be coming to a close though with two notable projects operated by Australian juniors having demonstrated that there are indeed world-class resource deposits present in-country.

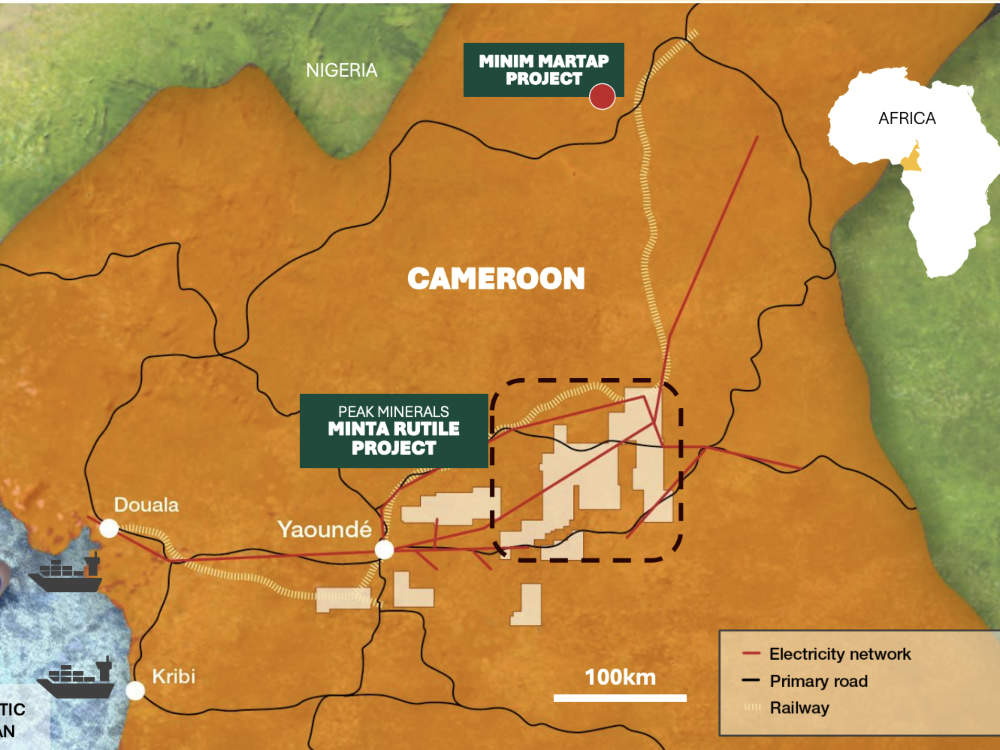

Canyon Resources’ (ASX:CAY) Minim Martap bauxite project is unarguably the poster child for the path towards minerals development in Cameroon with progress underway on key infrastructure workstreams and an updated definitive feasibility study due in August 2025.

This is aimed at bringing Minim Martap, which has a resource of 1027Mt grading 45.3% Al2O3, into production in early 2026 with the first bauxite shipment in H1 2026.

Highlighting the confidence that Cameroon has in the project, AFG Bank Cameroon provided the company with a medium-term syndicated credit facility of US$140m to fund infrastructure for the project.

“I think the country will use Minim Martap as a flagship project to say, we permitted a mine, we’ve been supporting this company with debt, we have been supporting the company with its plans around expanding our rail and so on,” Hoff said.

Rutile interest growing

While Minim Martap is drawing attention to Cameroon as a mining destination, bauxite is by no means the only mineral of interest.

Interest in natural rutile – a high-value titanium mineral – has been growing steadily thanks in no small part to Sovereign Metals’ (ASX:SVM) progress with the Tier 1 Kasiya project, which has a resource of 1.8 billion tonnes grading 1% rutile, in Malawi.

Mining giant Rio Tinto already has a large stake in Sovereign and its Kasiya project and is reported to be interested in increasing its exposure to titanium supply.

While there is no confirmation that Rio might be interested, rutile is starting to come into its own as a mineral resource of interest in Cameroon.

This was sparked by Lion Rock Minerals (ASX:LRM) – then known as Peak Minerals, which discovered the titanium feedstock at its ~8800km2 Minta project early in 2025.

Its exploration has identified high-priority zones across a 3500km2 area that’s prospective for mineral sands rich in rutile, zircon and monazite rare earths.

Rutile grades of up to 69.8% have been noted at Minta while Minta East has seen zircon grades of up to 21%.

More importantly, drilling has confirmed the continuity and scale of the rutile-rich mineralisation at the project with every one of the 330 holes drilled to date that had reported assays having intersected heavy minerals.

This has extended the defined mineralised footprint to a rather mind boggling 2125km2.

Rutile-dominant deposits are incredibly rare and Hoff says it is exactly this kind of mineralisation that Lion Rock’s exploration has been turning up.

“When you’ve got a high rutile content, it essentially equals a high value deposit,” he added.

“And this is starting to stand out in a big way from its peers, from what we’re seeing to date.

“It’s one of these fantastic stories where we have a small explorer that (has) gone in and taken the risk early and is now delivering results.”

Hoff adds that when a discovery of global significance is made, the companies making them often hit an inflexion point where the market becomes very supportive, highlighting WA1 Resources (ASX:WA1) and its Luni niobium find in Western Australia.

“No one knew niobium would be in the West Arunta. There’s no historical precedence. But they found it nonetheless and now we have a company that is looking to develop a globally significant niobium project,” he said.

“The analogy you draw from it is nobody thought we would find a globally significant rutile deposit in Cameroon and now we need to go through the process of developing a project like this.

“Rutile has a more visible profile than niobium so it should be much simpler for investors to understand.”

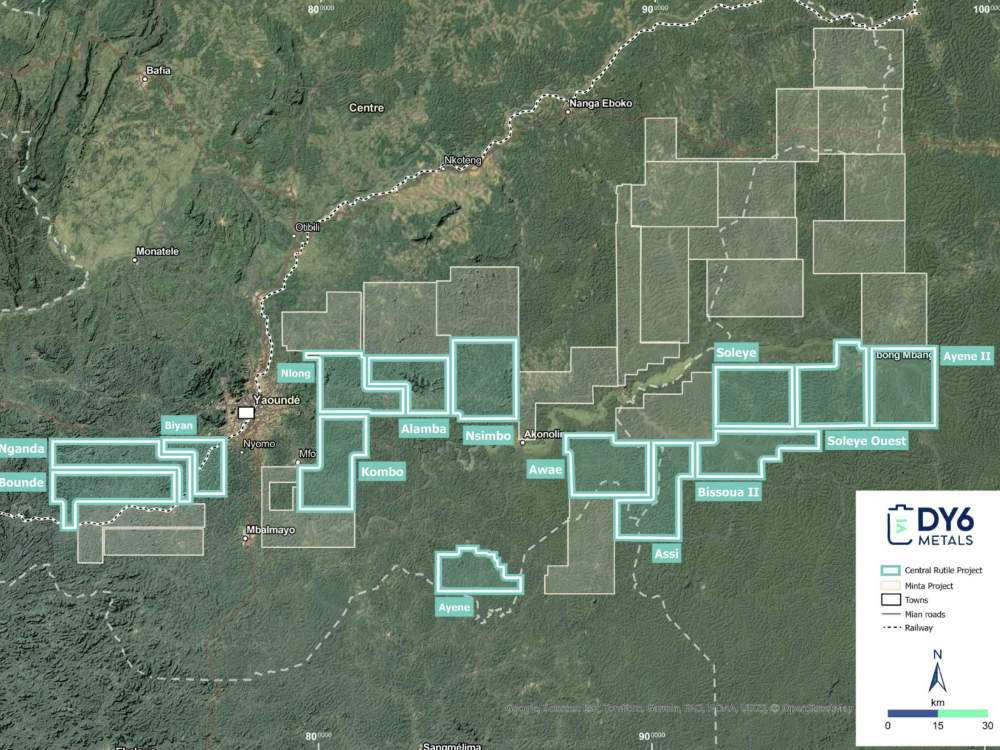

DY6 Metals (ASX:DY6) is also on the rutile bandwagon and has made quick progress since picking up the Central Rutile and Douala Basin projects in the country in April 2025.

The two projects cover a total area of 7554km2 – including recent additions at Central Rutile – and are highly prospective for HM and rutile.

Central Rutile sits within the Central Cameroon area that is known for historical production of high purity rutile recorded from artisanal mining of the alluvial deposits around Nanga-Eboko between 1935 and 1955.

Recent studies have highlighted the similarities of the region to the Lilongwe Plain of Central Malawi, where Sovereign Metals is en route to developing the Kasiya project.

Fitzhenry said the company saw the Central region of Cameroon as developing into an emerging, globally significant rutile province with high potential to host Tier 1 residual, high purity, natural rutile deposits.

“The Central Rutile project is our flagship project and is a large landholding highly prospective for residual natural rutile deposits,” he added.

“We are rapidly advancing our exploration efforts and have embarked in a project wide soil geochemical survey. This will allow us to map out the highest grade areas of the project which will be the early focus of our maiden drilling campaign.”

Early reconnaissance exploration by the company had identified visible natural rutile from both alluvial and eluvial sources with a 100km2 area of large residual natural rutile nuggets, heavy minerals and residual rutile mineralisation observed at the Bounde licence.

XRF analysis of the rutile nuggets has returned average titanium dioxide grades of 95.64% with low levels of impurities.

While no replacement for laboratory analysis, calibration of the onsite portable XRF analysers will enable accurate, real-time geochemical analysis in the field.

DY6 is also setting up infrastructure including a heavy mineral sands laboratory in Cameroon that will allow it to rapidly and cheaply process in-country.

At Stockhead, we tell it like it is. While DY6 Metals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.