Cameroon government keeps Sundance waiting, shares tumble 25pc

Troubled iron ore play Sundance Resources has resumed trading on the ASX — but still has no answer on whether the Cameroon government will extend an agreement over its Mbalam-Nabeba project.

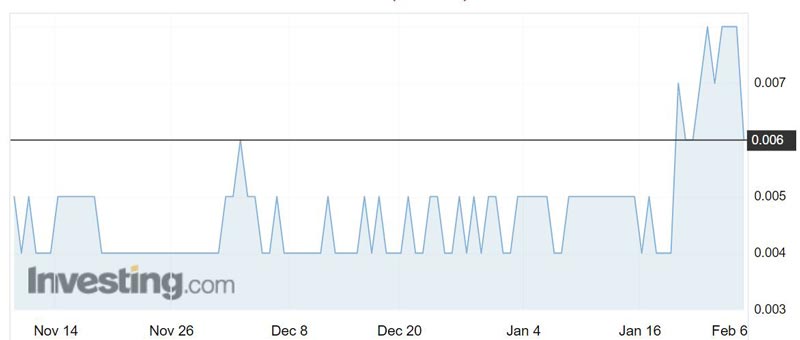

Investors were not happy, driving down the share price a further 25 per cent on Wednesday to 0.6c.

The shares have lost 50 per cent of their value since mid-February last year when they reached a 52-week high of 1.2c.

The junior explorer (ASX:SDL) has been in a trading halt since January 29 pending the release of the government’s decision on whether it would grant another extension to the convention covering the project.

The Mbalam convention was signed by Sundance and the Cameroon government back in 2012 and paved the way for the development of the project.

An initial six-month extension to the convention expired on January 26 and Sundance was required to show substantial progress on funding the $1 billion project either by itself or with a credible partner before it could secure a further extension.

Just four days before the deadline, the company announced it had inked a binding memorandum of understanding with private Chinese firm Tidfore Heavy Equipment Group, which has agreed to help it secure financing for the project.

“No decision has been made as yet regarding the extension by the government,” Sundance told the market.

However, the company plans to continue work on the Mbalam-Nabeba project in the meantime.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.