California’s San Bernardino County proves irresistible for ASX critical minerals plays

California's San Bernardino County is a sweet treat for ASX critical minerals companies. Pic: Getty Images

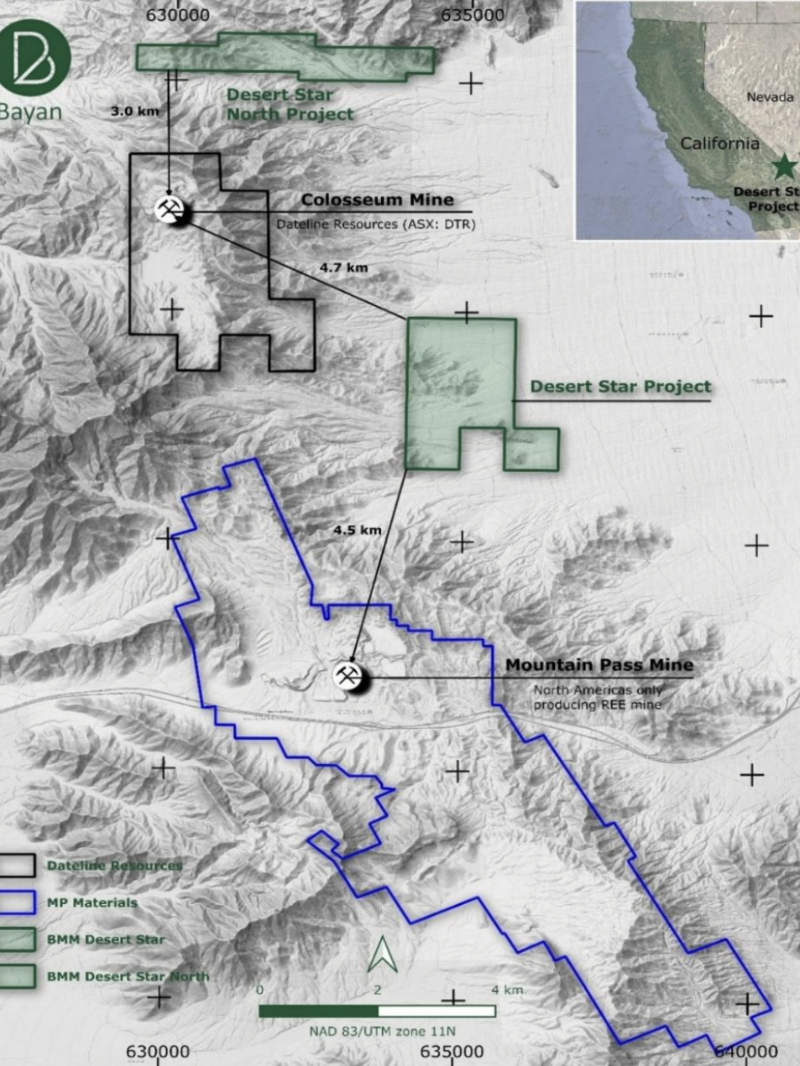

- Australian companies drawn by the Mountain Pass mine flocking to California’s San Bernardino County for rare earths

- Move comes as US moves to secure critical minerals, reaches framework with Australia on locking down supply

- Bayan’s Desert Star project sits 4.5km from Mountain Pass with similar geology and surface assays of up to 26,286ppm TREO

Securing supply chains for critical minerals is a key objective of the US Government and where domestic supplies of rare earths are concerned, the focus has primarily been on the state of California.

While it is not the only state with rare earths potential, California does host North America’s only producing REE mine – MP Materials’ Mountain Pass in the eastern Mojave Desert.

Once known as one of the world’s richest and most reliable sources of REEs, it faced years of underinvestment and operational challenges around the turn of the century, which led to production being idled in 2015.

However, MP Materials was founded in 2017 to bring the mine back into operation and has since hit all the right milestones to become a significant producer.

In the quarter ending June 30, 2025, the mine produced 13,145 tonnes of REEs, its second best quarterly output. This includes 597t of valuable magnet REEs neodymium and praseodymium.

While still dwarfed by Chinese production, the significant output makes California a natural destination for companies keen to capitalise on the opportunity.

Why California

Speaking to Stockhead, Bayan Mining and Minerals (ASX:BMM) non-executive chairman Agha Shahzad Pervez said California had many attractions that made it prospective for REEs with Tier 1 infrastructure such as Interstate 15, high-voltage power and Union Pacific Rail, and a well-established mining workforce.

“Geologically, the district (San Bernardino County) comprises Paleoproterozoic basement intruded by Mesoproterozoic alkaline/carbonatite bodies, with major structures (Ivanpah and Clark Mountain fault zones) that control REE mineralisation, precisely the setting we’ve secured at Desert Star,” he added.

“Policy-wise, California projects benefit from a broader US critical-minerals push that is accelerating domestic supply-chain build-out.”

Pervez notes that BMM and other Australian companies operating in the US could benefit from measures such as Federal and corporate commitments of more than US$900m to secure US rare earth supply chains while initiatives such as the neodymium and praseodymium price floor improves revenue certainty.

“This creates a de-risked environment for explorers/developers positioned to supply U.S. defence, energy and technology markets,” he added.

Australian companies could also benefit from the FAST-41 program, which is designed to improve the timeliness, predictability and transparency of the federal environmental review and permitting process.

Post-interview, talks between Prime Minister Anthony Albanese and US President Donald Trump resulted in the signing of a critical-minerals framework that will see each country throw in about US$1bn over the next six months into projects here, including a gallium plant in WA and a rare earths mine up in the NT.

Standing out from the pack

These attractions have drawn Australian companies to San Bernardino County in much the same way that bush flies are drawn to unprotected humans in the middle of summer.

Some examples are Locksley Resources (ASX:LKY) with its Mojave project and Dateline Resources (ASX:DTR) Colosseum gold project.

Locksley recently produced an antimony ingot at Hazen Research – one of the US’ most respected metallurgical and process development laboratories – using ore sourced from Mojave.

It is also working with Rice University in Texas to develop DeepSolv, an innovative green hydrometallurgical solvent system for extracting and recovering antimony from stibnite ores and concentrates, which could underpin plans for a pilot-scale demonstration plant.

Dateline recently completed an independent geophysical assessment that refined the ranking of six previously identified breccia pipe gold targets for upcoming drilling.

For Bayan, its Desert Star and Desert Star North projects stand out due to their similarity to Mountain Pass.

The two projects comprise 117 federal lode claims covering 9.75km2 in the same host rock system and structural corridor as Mountain Pass, which is just 4.5km away and gives a direct analogue for discovery.

“Early work shows strong radiometric (potassium-thorium-uranium) anomalies consistent with REE-bearing carbonatites/alkaline intrusions, and reconnaissance assays with exceptional TREO values (up to 26,286 ppm),” Pervez said.

“Combined with immediate access to road, power and rail, Desert Star offers both discovery potential and a practical development path tied to U.S. supply-chain demand.”

Planning is underway for drilling following acceptance of the company’s Plan of Operations by the US Bureau of Land Management.

It is also wrapping up high-resolution magnetic, radiometric and gravity surveys across both Desert Star project areas and will start the process of stitching those datasets together with the recent desktop geophysics review to tighten up the drill plan.

This is aimed at understanding the geometry, depth and structural controls of the targets so that maiden drill collars can be locked in alongside the already reported high-grade surface results of up to 26,286ppm total rare earth oxides.

Additionally, Bayan is advancing contractor negotiations to secure rigs, scheduling and field logistics, compressing the timeline between final approvals and drill start.

Pervez adds the company is advancing US downstream evaluation partners that are aligned to both defence and magnet supply chains.

At Stockhead, we tell it like it is. While Bayan Mining and Minerals and Locksley Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.