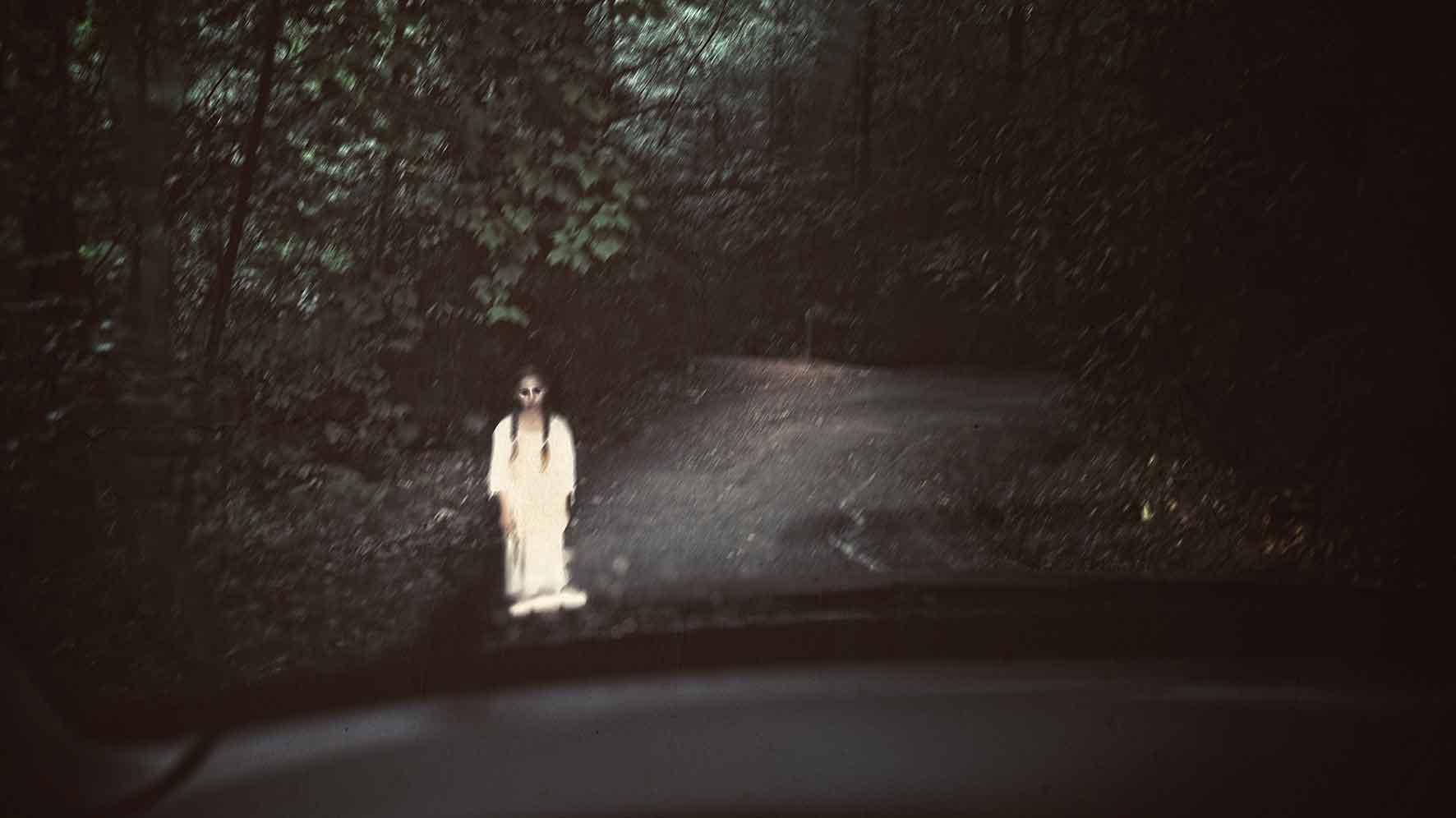

Is Calidus loss just growing pains or a ghost from the past?

Bumps in the night... Calidus says it bought into the old shell company once its last debtors had been cleaned away.

Calidus Resources investors will be hoping the new-look company is not cursed by the past performance of the shell company it took over, after doubling its full-year loss.

In June, gold miner Keras Resources sold a subsidiary into the shell of an old pharma company called Pharmanet which had been in receivership since 2015, and renamed the company Calidus (ASX:CAI).

Calidus’s full-year loss of $2.5 million was 49 per cent higher than the combined unit’s 2016 result, which was $1.6 million in the red.

But that loss could be just a growing pain. Calidus admitted “a decline in profitability”, but said listing and buying the shell cost $713,000.

Managing director David Reeves did not want to comment on the results until the company had finalised a capital raising on Wednesday.

The miner has a tidy $4.4 million in cash in the bank and $3.5 million in working capital.

The Keras subsidiary brought to the union the Warrawoona Gold Project in the Pilbara goldfields district.

This included ownership of a site called the Klondyke Prospect which has an inferred, or yet-to-be proved, resource of 5.6 tonnes with a grading of 2.08 grams per tonne of gold for 374,000 ounces.

Another area called the Copenhagen Prospect has an inferred resource of 180,000 tonne with 6.1 grams per tonne of gold for 36,000 ounces.

By comparison in August Kin Mining upgraded its estimates for an Eastern Goldfields project to 22.3 million tonnes grading at 1.43 grams per tonne gold for 1.02 million ounces of gold.

Calidus went into a trading halt on Monday as it launched a capital raising round. It closed Friday at 4.6c, a figure that represents a 130 per cent climb on the 2c backdoor listing price three months ago.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.