Caldeira REE resource upgrade adds weight to Meteoric’s early production outlook

Meteoric Resources’ early production scenario for Caldeira is looking increasingly likely. Pic: Getty Images

- Caldeira resources up >21% to 740Mt at 2,572ppm TREO with valuable MREO remaining at 23.1% of the total REE content

- Figueira deposit now has a high-grade domain of 47Mt at 4,763ppm TREO including 1,093ppm MREO

- This could provide additional high-grade feed to Meteoric’s early production plan

Special Report: Already known as one of the world’s highest-grade ionic clay rare earth assets, Meteoric Resources’ Caldeira project is now looking even more likely to be an early production candidate after achieving a significant resource upgrade.

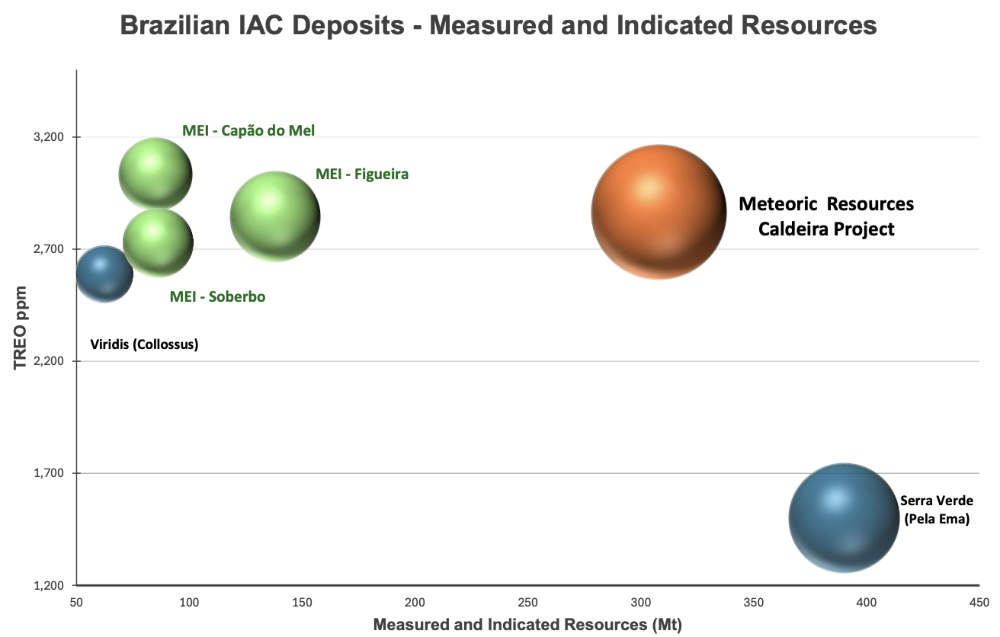

Resources at the project saw both size and confidence increase with Caldeira now boasting an overall resource of 740Mt grading 2,572 parts per million (ppm) total rare earth oxides (TREO) while about 42% of this figure, or 308Mt at 2,864ppm TREO, is now in the higher confidence measured and indicated categories.

While the increase from the previous 619Mt at 2,538ppm TREO is undoubtedly welcome for Meteoric Resources (ASX:MEI), the company is also likely to take no small amount of comfort from confirmation that valuable magnet rare earth oxides (MREO) make up a goodly 23.1% of the TREO content.

MREOs are of course valued for their use in permanent REE magnets that are used in electric vehicle motors and wind turbines.

This upgrade stems almost entirely from the company increasing resources at the Figueira deposit from 50Mt at 2,811ppm TREO by a hefty 234% to 170Mt at 2,766ppm TREO with >80%, or 138Mt at 2,844ppm TREO, in the indicated category.

What’s of particular importance to MEI is the high-grade domain of 47Mt at 4,763ppm TREO including 1,093ppm MREO, which provides upside for potential early production at Caldeira.

Early production plans

“Today’s announcement of the update to the existing mineral resources estimate for the Figueira mining licences results in a significant upgrade in the size and geological confidence of our overall Caldeira project resource and serves to further validate the project’s position as the world’s premier ionic clay-hosted rare earth element development,” chief executive officer Nick Holthouse said.

“We expect the additional 47Mt at greater than 4,000ppm TREO included in this update to drive further upside into our future early-stage, high-grade production profile.

“We remain committed to our goal of being the lowest-cost, scalable supplier of rare earth elements to the growing western supply chain and remain on track to deliver a Pre-Feasibility Study for the Caldeira Project.”

MEI’s proposed early feed strategy combines the use of the project’s abundant high-grade feed with the strong metallurgical response to an ammonia sulphate wash at atmospheric pressure and temperature with a pH of 4.

This work by ANSTO (Australian Nuclear Science and Technology Organisation) had produced a mixed rare earths carbonate (MREC) with 57.3% TREO with MREO’s making up 31.5% of the mix – and 94% of the basket value – thanks to high recoveries of praseodymium (74%), neodymium (73%), dysprosium (50%) and terbium (53%).

The company expects this to enable a high recovery of TREO per tonne of ore feed to significantly reduce projected operating costs.

Standing out from the pack

MEI adds that with the upgraded resource, Caldeira continues to stand out by virtue of its exceptional grades and significant tonnages.

Of particular interest is the significant inventory of high-grade material in the measured and indicated categories, which will form the basis for a pre-feasibility study that is scheduled for completion in December 2024.

The scoping study released less than a month ago had already outlined very attractive economics with a low operating C1 cash cost of just US$7/kg of recovered TREO in a MREC for a 5Mtpa project over 20 years from 2027.

Initial capex is estimated at US$297m with a modelled 35% contingency for a project that will produce 11,000t TREO over the first five years.

This is based on a mine plan that includes just 16% of the global resource at that time, which outlines the potential for extending the mine life or expanding processing capacity.

This article was developed in collaboration with Meteoric Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.