Bullish: Rio-backed lithium explorer Charger Metals raises $2.7m to attack Lake Johnston

$2.7m has been raised to further prove up Charger’s Lake Johnston and Bynoe lithium projects. Pic via Getty Images.

- Charger has received commitments for $2.7m for exploration at Jake Johnston

- It recently inked a farm-in deal with Rio Tinto’s exploration arm, potentially worth up to $42.5m

- RTX will spend a minimum of $3m in exploration over the first 12 months at Lake Johnston

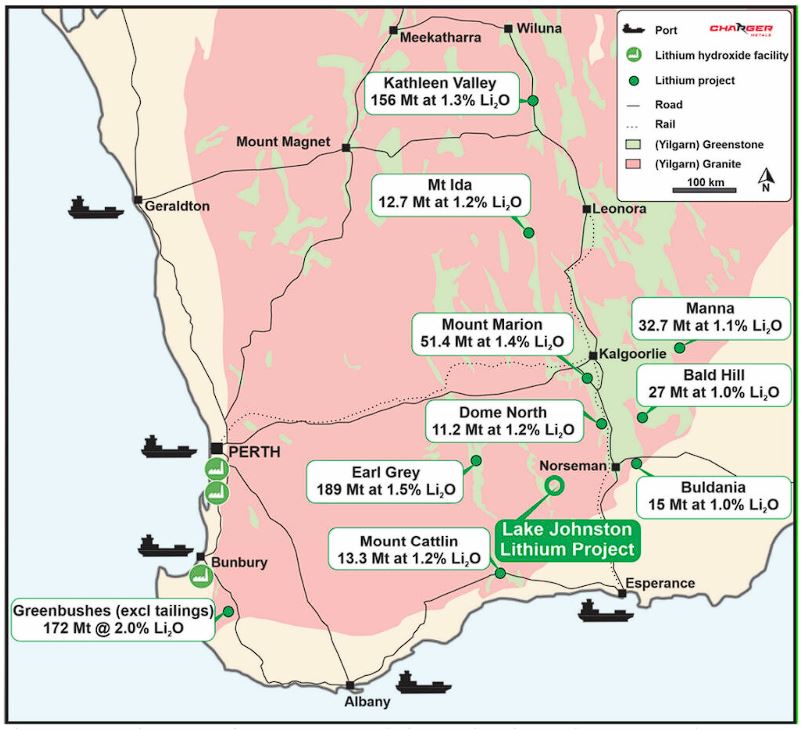

Special Report: Lithium explorer Charger Metals is raising $2.7m to accelerate its Lake Johnston project in WA, where it recently inked a farm-in agreement with Rio Tinto’s exploration arm that could see $42.5m worth of investment for a 75% stake.

With binding commitments from institutional investors, Charger Metals (ASX:CHR) is using the funds to cover its Lake Johnston acquisition costs and for general working capital.

The Lake Johnston Greenstone belt is famous for multiple spodumene discoveries such as the Company’s Medcalf discovery and more recently TG Metals’ (ASX:TG6) Burmeister discovery.

Previous drilling has highlighted the potential of the Medcalf prospect, showing intersections such as 5m @ 2.55% Li2O from 68m and 6m @ 1.56% Li2O from 19m, allowing the explorer to delineate spodumene-bearing pegmatites up to 13m thick.

Other target areas include the Mt Gordon prospect and much of the Mount Day lithium-caesium-tantalum pegmatite field, which is prospective for lithium and tantalum minerals.

In cometh Rio

Earlier this week, CHR inked a binding farm-in agreement with Rio Tinto’s (ASX:RIO) Rio Tinto Exploration (RTX) subsidiary for its Lake Johnston lithium project in the southern portion of WA’s Yilgarn Craton.

RTX will pay the company $500,000 and invest $1.2m prior to the commencement of the farm-in, which will see RTX spend at least $3m on exploration over the first 12 months.

It can then earn 51% by sole-funding $10m for exploration work and paying CHR a minimum of $1.5m in further cash payments.

On top of this, sole funding a further $30m in exploration expenditure or completing a definitive feasibility study (DFS) will see RTX earn a 75% stake in Lake Johnston.

Aidan Platel says the company is pleased with the strong level of demand for the cap raise.

“Together with the recently announced farm-in agreement with Rio Tinto for our Lake Johnston lithium project, the funds will allow us push forward with systematic exploration at our highly prospective Lake Johnston and Bynoe Lithium projects.

This article was developed in collaboration with Charger Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.