Bulk tonnage gold mining and the ASX junior playing in the big leagues

Pic: John W Banagan / Stone via Getty Images

SPECIAL REPORT: “Grade is king” is a well-worn adage in mining circles, the assumption being that the higher the grade, the more financially robust the mine will be.

But a quick look at some of the big gold mines in Alaska’s multi-million ounce Tintina Belt tells you the adage does not hold true in every circumstance as geology and geometry come first.

Operations such as Kinross Gold’s Fort Knox mine in Alaska and Victoria Gold’s Dublin Gulch mine in Canada run at grades well under a gram of gold per tonne (g/t). In Fort Knox’s case, the resource grade is 0.32g/t.

Yet they are highly profitable at US$1500 gold, each producing more than 200,000 ounces of gold a year at all-in sustaining costs (AISC) of US$570-850 an ounce.

This is the type of operation Nova Minerals (ASX:NVA) envisages establishing at its Estelle Camp, another large, near-surface, intrusive-related gold system (IRGS) on the Tintina Belt in Alaska.

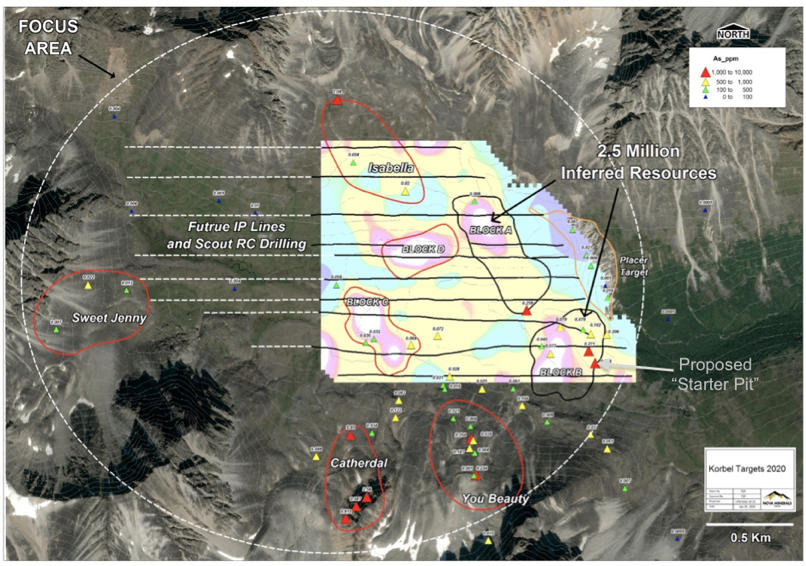

Nova is at an early stage with Estelle, but it has already established a 2.5 million-ounce resource over a small area that is open in all directions at the Korbel deposit and has another 14 known targets within the tenements ready to test with drilling.

In a research note published in January, Martin Place Securities noted that Estelle was well placed to join the ranks of high margin, bulk tonnage Tintina Belt operations and that Nova could be on to a “20Moz district resource”.

“Comparable Tintina Belt projects have current or projected mining costs of <$US6/t for heap leach operations which equates to <0.15g/t,” the Sydney-based broking firm said.

“At Korbel’s 0.43g/t with 76 per cent recovery, this gives a cash operating margin of 53 per cent.”

Korbel deposit inferred resource estimate

Using a gold price of $US1500 gold and a 53 per cent cash margin, MPS calculated a 10Mt/100,000-ounce-a-year operation at Korbel could generate $US80m.

That figure would double to $US160m if throughput was increased to 20Mt to produce 200,000 ounces of gold a year.

The gold price started this week in excess of $US1700/oz.

One of the keys to the robust economics of Fort Knox, Dublin Gulch and mines like them is that they employ bulk mining, where large tonnages are moved and a large portion of the material qualifies as ore.

Both Fort Knox and Dublin Gulch use a cut-off grade of 0.1 and 0.15g/t respectively, meaning that any material above this grade can be mined economically.

They are essentially big earthmoving exercises with very low strip ratios (the amount of waste material that has to be moved to get the same amount of ore) of around 1:1 or less and low mining costs of less than $US2.20 per tonne.

By contrast, mineralisation in some higher grade gold deposits is found in narrow vein structures that can only be mined in association with a lot of waste, leading to higher strip ratios and higher mining costs.

The other key to keeping costs low at operations like Fort Knox and Dublin Gulch is that the mineralisation is amenable to heap leaching, whereby ore is stacked in a heap and a chemical solution is spread over the heap to help liberate the gold from the ore.

Fort Knox gold mine, Alaska heap leach pad

It is considerably cheaper in terms of capital and operational expenditure than conventional milling and better suited to lower grade ore bodies as the lower the grade, the less solution required.

Nova has already confirmed through laboratory testing average gold recovery of 76 per cent from Korbel ore processed via heap leaching and CEO Chris Gerteisen only expects that figure to increase through further metallurgical testwork.

The company began the much-anticipated 2020 exploration program at Estelle in late April and plans to complete 7,000-12,000m of RC and diamond drilling at Korbel before delivering a resource upgrade mid year.

Feasibility studies on a mining operation using feed from a higher grade “starter pit” and baseline environmental assessment at Korbel are expected to start later this year.

This story was developed in collaboration with Nova Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.