Bulk sampling underway at Sovereign’s ‘significantly upscaled’ Kasiya, one of the largest natural graphite deposits outside China

Bulk sampling is a vital move towards scaling-up the development of its Kasiya graphite and rutile project. Pic via Getty Images.

- Bulk sampling program underway to produce >1,000kg of flake graphite for testwork

- SVM and strategic partner Rio Tinto focused on producing spherical purified graphite (SPG)

- PFS has confirmed a potential 244ktpa operation at a low US$404/t cost

Rio Tinto-backed Sovereign Metals has commenced a pivotal bulk sampling program at its 1.8 billion tonne Kasiya project in Malawi to provide potential customers with product samples.

Demand for graphite production is projected to skyrocket, as less than two weeks ago China announced companies would require export permits for some graphite products including natural graphite and associated products critical to EV production.

China is the world’s top graphite producer and exporter, refining ~90% of the world’s graphite into the material that is used in virtually all EV battery anodes –and the announcement has left manufacturers scrambling for supply.

China’s commerce ministry said the move was “conducive to ensuring the security and stability of the global supply chain and industrial chain, and conducive to better safeguarding national security and interests”.

Planned downstream work

In July, Rio Tinto (ASX:RIO) made a significant $40.4m investment into Sovereign Metals’ (ASX:SVM) Kasiya project, becoming a 15% strategic investor in the company.

Together they aim to produce 244,000tpa of graphite and 222,000tpa of rutile for an initial 25-year mine life out of the project – which would make it the largest rutile and second-largest flake graphite project in the world.

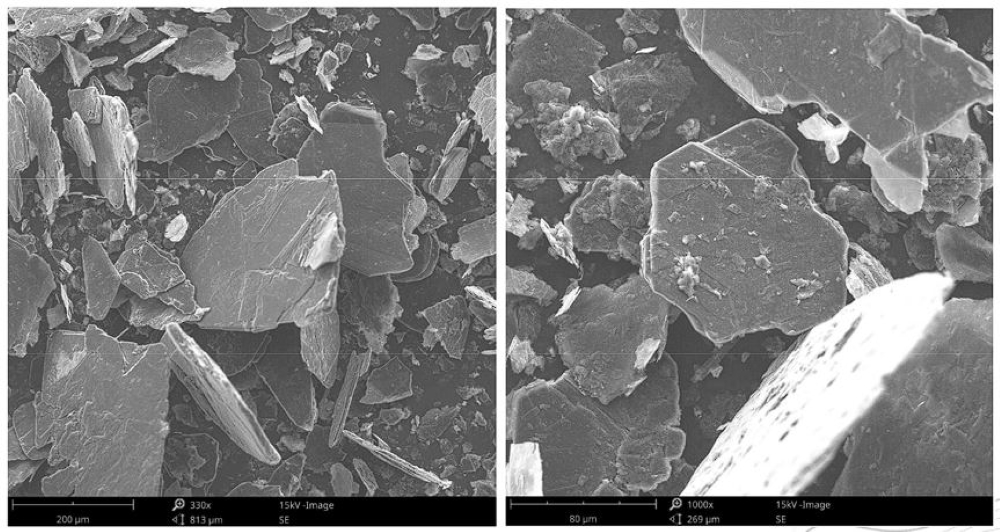

The bulk graphite samples of flake graphite will be used for downstream testwork and initial product qualification for customers in the battery anode sector – of which initial tests have already indicated very high purity and suitability for use in Li batteries.

Final processing will then be completed at commercial metallurgical laboratories in Canada and Australia.

The graphite pre-concentrate will undergo traditional flotation and polishing processes to target >96% concentrate product for lithium-ion battery anode feedstock.

The stages include:

- Purification via an optimised HF-free reagent scheme to >99.95% concentrate.

- Micronisation

- Spheronisation

- Carbon coating

- Anode production

- Electrochemical characterisation

Raw flake graphite products plus final CSPG (coated spheronised graphite product) will be then provided to potential off-takers for assessment and pre-qualification.

“Through Sovereign’s well-established experience in graphite, the company has built a strong understanding of the product’s market and developed relationships with well-established off-takers and customers,” SVM says.

“Further downstream testwork is planned that will use the graphite concentrate produced from this current bulk sampling program.”

Optimisation work is ongoing in lead-up towards a definitive feasibility study (DFS).

PFS confirms leading market position

Compelling metrics from SVM’s pre-feasibility study of the Kasiya project show significant upside potential with an NPV8 of US$1.6bn and post-tax IRR of 28%.

It also declared an enormous initial probable ore reserve of 538Mt, yet SVM says that figure only accounts for 30% of the total mineral resource.

Forecast cash costs come in at a low US$404/t and once into production, would make it the lowest-cost producer of both rutile and graphite in the world.

While Rio has a 15% stake at the moment, it has an option to increase its position to 19.99% – which would provide further cashflow for development.

As part of its investment, Rio will provide technical and marketing assistance using its reach as one of the world’s biggest mining companies.

This article was developed in collaboration with Sovereign Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.