Bulk metals: Tolga Kumova-backed Canyon finds more high-grade bauxite in Africa

Pic: Schroptschop / E+ via Getty Images

Africa is proving fruitful for junior explorer Canyon Resources (ASX:CAY), which has put its foot on more high-grade bauxite at its Minim Martap project in Cameroon.

The latest drilling program has delivered “thick, high-grade, low contaminant bauxite from surface”, Canyon told investors this morning.

- Scroll down for more ASX bulk metals news >>>

Drilling delivered multiple hits of over 50 per cent aluminium oxide, with grades up to 56.76 per cent.

To put that into context, Rio Tinto’s (ASX:RIO) Weipa mine in Queensland and Gove mine in the Northern Territory have close to 50 per cent available alumina and they are among the world’s highest grade deposits.

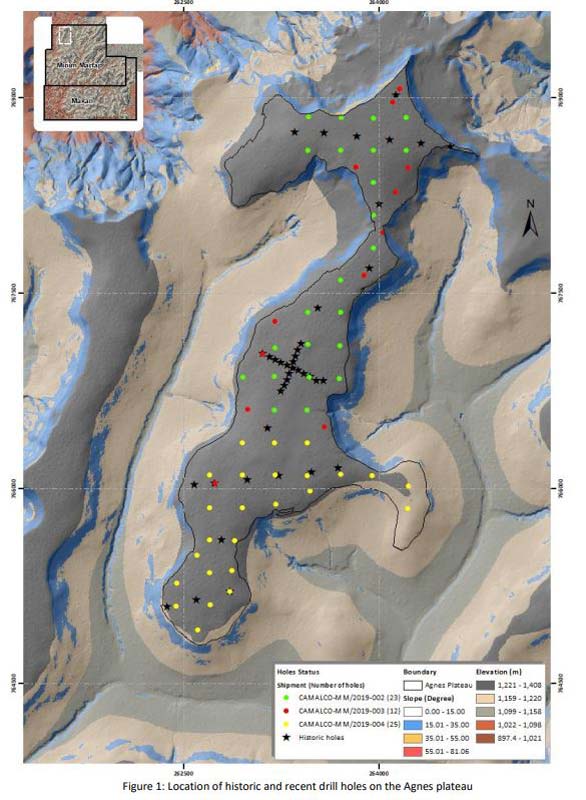

The drilling was done in the “Agnes plateau”, which currently has an inferred resource of 33.46 million tonnes at 46.99 per cent aluminium oxide.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

Canyon said this new drilling had resulted in higher grades, lower silica and deeper mineralised results than the previous Agnes resource, similar to the results from drilling at the Beatrice plateau earlier in the year.

Chief geologist Dr Alexander Shaw said the results confirmed that Canyon’s drilling may be contributing to the improvement of the scale and grade of the Minim Martap resource.

“A number of holes were stopped in high-grade material due to wet drilling conditions which prevented further penetration using the air-core rig,” he said.

“An assessment will be made, in the future, as to whether additional drilling will be required on the Agnes plateau in order to better define the base of mineralisation.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Late last year Canyon brought in successful mining investor Tolga Kumova to help with the development of the Minim Martap project.

Stockhead columnist Barry FitzGerald spoke to Kumova last month about his investment in Canyon.

Kumova reckons Canyon has the potential to repeat the success of graphite miner Syrah Resources (ASX:SYR).

READ: Barry FitzGerald: Why Tolga Kumova reckons Canyon can repeat Syrah’s success

Shares edged up 2.6 per cent to 20c on Friday morning.

In other bulk metals news:

Kazakhstan Potash (ASX:KPC) told investors today that it planned to convert its outstanding debt with China-Asia Resources Fund to shares. The company originally issued $30m worth of replacement convertible notes to the fund in June 2017. Shareholders still have to approve the conversion to shares.

On top of that, Kazakhstan Potash has struck another deal with China-Asia Resources Fund to enter into a new $10m convertible note agreement. The company said the cash would be used to finalise the Satimola Limited acquisition and for working capital.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.