Bulk Buys: Stanmore closes $1.7 billion BHP coal buy; founder looks to repeat winning formula at emerging junior

Pic: Getty

- Stanmore has completed its ambitious US$1.2 billion ($1.7b) acquisition of BHP’s Poitrel and South Walker Creek coal mines

- Its founder Nick Jorss is aiming to repeat his success at new coal producer Bowen Coking Coal

- Jorss says steelmaking coal will be in demand for years to come

As Stanmore Coal (ASX:SMR) completed its ambitious US$1.2 billion ($1.7b) acquisition of BHP’s stake in the BMC coal business in Queensland, the man who founded the company ‘at his kitchen table’ is planning to repeat the success off the back of the coal boom.

Indonesian-backed Stanmore announced the deal almost seven months ago and ran a gauntlet with its main shareholder, the Widjaja family’s Golden Energy and Resources, to secure the debt and equity funding to finalise the deal from fossil fuel want-away BHP.

Initially priced at 5.6 times its then $280 million market cap, Stanmore is now a $2.3 billion company about to turn from a 2Mtpa producer of metallurgical coal for Asian steelmakers to a 10-12Mtpa miner overnight.

For Nick Jorss, who launched the company by spending $1 on the Isaac Plains mine in Moranbah in the Bowen Basin in late 2015, seeing Stanmore become a met coal exporter of global scale with its acquisition of BHP’s stakes in the Poitrel and South Walker Creek mines is an example of the importance of timing.

“It’s really good to see from my end, having started Stanmore from my kitchen table with a couple of mates, that it’s kind of kicked on since I left and they’ve bought BMC,” he said.

“That will see them do 10 to 12 million tonnes a year which is a pretty significant enterprise in world coal export terms and some fantastic quality metallurgical coal.

“Isaac Plains was a fortunate deal that we picked it up for a dollar and we got a lot of support from the vendors to get it going, financial support.

“But there’s a lot of timing in this market, right, I think we found out pretty well because when we close that deal I think coal was like US$87 bucks a tonne and within 12 months it was sort of US$250 heading to US$300.

“I guess you just got to be hanging around when people want to get out, basically.”

Stanmore Coal (ASX:SMR) share price today:

Bowen aiming to time the market

Jorss has since gone on to lead Bowen Coal (ASX:BCB), which is itself looking to grow from a virtual blank canvas two years ago into a 5Mtpa exporter of coking coal.

He is looking to repeat the Stanmore story, and arguably could not have picked a better time to head into production.

Coal prices surged to record highs last year on historic tightness in both metallurgical and thermal markets, confounding negative sentiment from ESG pressures and efforts from governments to increase the penetration of renewables in their energy mix.

But prices have surged since then on continued undersupply in global markets and Russia’s war with Ukraine.

While governments have been reluctant to place sanctions on Russia directly, many buyers appear to be boycotting Russian cargoes, leaving huge supply gaps in markets like Europe, Japan and South Korea which collectively imported 90Mt of thermal coal for heating and energy and 25Mt of met coal for steelmaking from Putin’s Russia in 2021.

According to Fastmarkets MB, premium hard coking coal sold free on board from Australia’s Dalrymple Bay Coal Terminal was fetching a touch under US$520/t on Friday.

Thermal coal sold on the Newcastle index is shipping at around US$325/t, far above pre-pandemic records from a decade ago.

Bowen has already begun mining at the Bluff PCI mine it picked up last year from liquidated coal miner Carabella Resources via its former mining contractor MACA, and yesterday appointed and mobilised mining contractor BUMA Australia to the Broadmeadow East mine.

Waiting in the wings are the Burton mine and Lenton project acquired in late 2021 from New Hope Corporation (ASX:NHC).

Bowen’s share price has grown 433% over the past year, putting it on the cusp of breaking the magic $500 million market cap barrier.

“The mantra is growth and I think there is a tremendous opportunity because a lot of the larger players are reassessing their position,” Jorss said.

“We were fortunate we picked up the bulk of our assets last year when coal prices had kind of dipped down and I think we bought them well.

“Now coal prices are extremely high and we’re turning them on. So, I think that’s kind of got us to first base if you like, but now, the way I think about it, we’ve got a platform for growth, we’ll be a meaningful coal exporter, heading up for 5 million tons annualised.

“And that gives us an ability to grow further and I think certainly as a board and my approach is we’ve got to be a little opportunistic here.”

Bowen Coal (ASX:BCB) share price today:

Russia’s war alters coal dynamics

Some of the impacts of Russia’s war with Ukraine has been to distort the traditional dynamics of coal pricing.

Aside from prices flying super high, Russia was a big supplier of specific types of coal to specific places, notably the niche pulverised coal for injection product to steelmakers in Europe.

This has traditionally traded around 70-73% of the benchmark hard coking coal price. It’s now fetching around 92% and briefly traded at a premium in March.

That is good news for both Bowen and Stanmore, who will be selling that product from Bluff and the BMC assets, respectively.

The discount for the PCI and semi-soft coking coal produced at BMC compared to BHP’s met coal division’s flagship BMA mines is ironically one of the reasons BHP was happy to let the assets go.

“PCI is probably a market that not everybody wants to be in, right, some people see it as having a shorter lifetime in terms of met coal, but we’re kind of comfortable with the outlook for it,” Bowen’s Jorss said.

“As you say it’s really tightened up now and its relativities are spectacular to hard coking coal.”

Longer term Jorss sees a strong future for steelmaking coal demand.

“I don’t know exactly how long we’ll have these very strong conditions, I suspect looking at the forward curve … we’ll be seeing very elevated prices for at least 6-12 months, if not longer,” Jorss said.

“But what I do know is that supply has been very constrained with limits of capital, regulatory constraints in terms of approvals in a lot of jurisdictions where you just can’t get a mine up; like in Canada these days it’s probably almost impossible.

“What we do is we get things up and running, and Queensland’s a pretty good jurisdiction for that.”

If it ever will be economic, green steel remains a long way off, and steel ironically will be needed to help decarbonise other areas of the global economy.

“In terms of how long has met coal got? I’m absolutely bullish on longer term because the steel is essential to economic growth and decarbonisation,” Jorss said.

“If that’s the way the planet is going which it looks like it is then we need a lot more steel and a lot more met coal to make it.”

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.012 | -14% | -8% | 9% | -40% | $ 18,666,685.83 |

| CKA | Cokal Ltd | 0.155 | -6% | -16% | 0% | 142% | $ 154,926,581.70 |

| NCZ | New Century Resource | 2.35 | 9% | 20% | 1% | -15% | $ 297,348,918.51 |

| BCB | Bowen Coal Limited | 0.32 | 5% | 14% | 88% | 420% | $ 478,870,859.88 |

| LNY | Laneway Res Ltd | 0.0045 | -10% | -18% | -6% | -22% | $ 31,510,082.05 |

| GRX | Greenx Metals Ltd | 0.19 | -5% | -3% | -20% | -9% | $ 48,187,888.16 |

| AKM | Aspire Mining Ltd | 0.1 | 12% | 11% | 19% | 18% | $ 50,763,698.50 |

| PAK | Pacific American Hld | 0.014 | -18% | -13% | -18% | -35% | $ 6,690,283.63 |

| AHQ | Allegiance Coal Ltd | 0.54 | -8% | 14% | 15% | -14% | $ 210,502,875.60 |

| YAL | Yancoal Aust Ltd | 5.27 | 10% | 15% | 95% | 152% | $ 6,773,854,311.81 |

| NHC | New Hope Corporation | 3.54 | 7% | 2% | 89% | 204% | $ 2,904,926,216.18 |

| TIG | Tigers Realm Coal | 0.015 | 0% | -17% | -35% | 88% | $ 209,067,237.89 |

| SMR | Stanmore Resources | 2.54 | 20% | 49% | 175% | 317% | $ 2,127,260,807.28 |

| WHC | Whitehaven Coal | 4.82 | 3% | 16% | 103% | 277% | $ 4,926,993,153.45 |

| BRL | Bathurst Res Ltd. | 1.22 | 9% | 18% | 61% | 239% | $ 210,270,496.29 |

| CRN | Coronado Global Res | 2.37 | 6% | 17% | 85% | 316% | $ 3,839,079,041.70 |

| JAL | Jameson Resources | 0.084 | 0% | 2% | -1% | -12% | $ 29,249,078.21 |

| TER | Terracom Ltd | 0.57 | -5% | 19% | 217% | 488% | $ 425,788,310.95 |

| ATU | Atrum Coal Ltd | 0.012 | 0% | -14% | -71% | -75% | $ 8,296,420.03 |

| MCM | Mc Mining Ltd | 0.155 | -3% | 35% | 55% | 11% | $ 30,845,354.24 |

&nsbp;

Iron ore prices in wait and see mode

China’s on holiday but for many people in the country of 1.4 billion, that’s being spent in lockdown as the Communist Party’s hardline Covid Zero stance continues to hammer its economy.

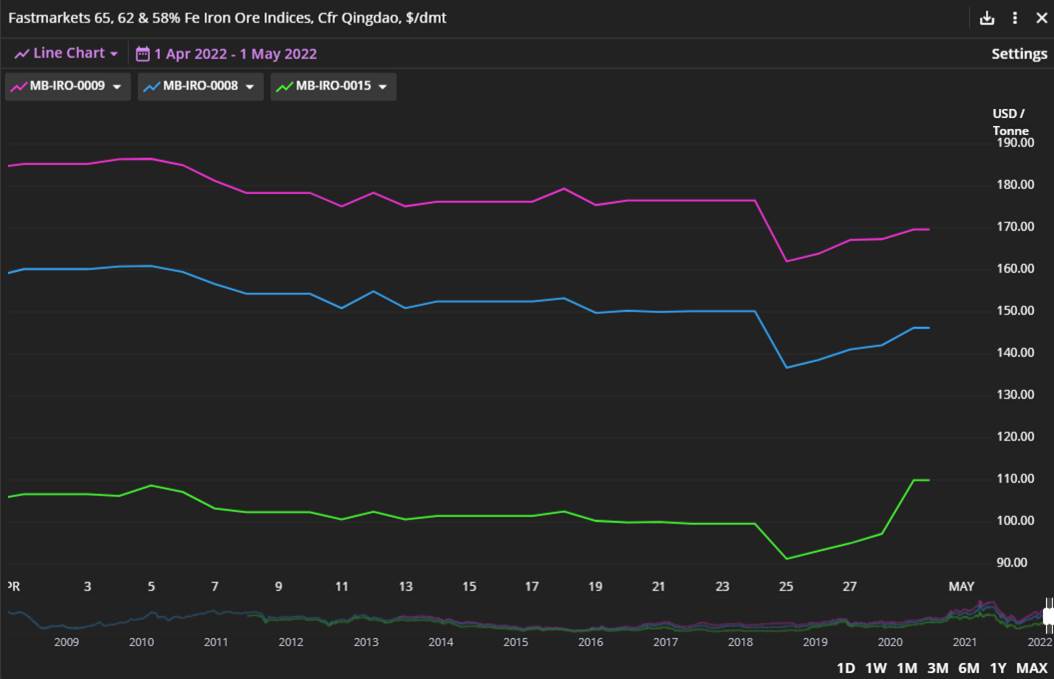

Iron ore prices were trading around US$145/t before the Labour Day holiday kicked in over the weekend.

That means we haven’t seen the true impact yet on iron ore prices of some pretty poor economic statistics out of China, with its weakest purchasing managers indexes since the start of the pandemic.

Singapore has given us some indication, with futures for 62% fines falling 2.02% yesterday to US$143.80/t.

That will hardly put the fear of god into Australian miners. Even with massive inflation the unit costs of the big three of BHP, Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) are around or below the US$20/t mark.

Interestingly, and positively for FMG at least, lower grades of iron ore have made up some of the big gap in price realisation to the benchmark 62% fines index we saw earlier in the year.

One reason could be high costs of steelmaking inputs like iron ore and particularly coking coal, which have trimmed steel mill margins in China at a time downstream steel demand has been slipping.

The big event in iron ore this week will be Rio Tinto’s Australian AGM tomorrow in Melbourne following its forum in London last month.

At the junior end of the industry Legacy Iron Ore (ASX:LCY) and Hawthorn Resources (ASX:HAW) were two of the big movers after confirming the start of their JV over the Mt Bevan magnetite project in WA with Gina Rinehart’s Hancock Prospecting.

The initial investment of $9m gives Hancock a 30% interest in Mt Bevan, with $8m cash being paid to LCY and HAW in proportion to their interest in the project (Legacy $4.8m and Hawthorn $3.2m).

The remaining $1m will be working capital.

LCY will hold 42% and HAW will hold 28% upon completion of the initial investment.

Hancock can earn an additional 21% by funding the completion of a pre-feasibility study, which is due for completion in the first quarter of 2024.

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.06 | 0% | 0% | 9% | 58% | $ 27,961,636.98 |

| ADY | Admiralty Resources. | 0.016 | -11% | 0% | 23% | -20% | $ 20,857,266.45 |

| AKO | Akora Resources | 0.27 | -10% | -31% | 32% | -26% | $ 15,238,142.25 |

| BCK | Brockman Mining Ltd | 0.041 | -13% | -5% | -15% | -34% | $ 380,489,517.37 |

| BHP | BHP Group Limited | 47.66 | -2% | -9% | 34% | 0% | $ 242,890,266,656.20 |

| CIA | Champion Iron Ltd | 7.16 | -4% | -8% | 69% | 5% | $ 3,771,266,694.80 |

| CZR | CZR Resources Ltd | 0.015 | -6% | 88% | 88% | 15% | $ 52,294,849.16 |

| DRE | Dreadnought Resources Ltd | 0.043 | -2% | 10% | 13% | 105% | $ 124,902,076.24 |

| EFE | Eastern Resources | 0.046 | -8% | -12% | -13% | 360% | $ 45,744,085.03 |

| CUF | Cufe Ltd | 0.031 | -3% | -9% | -9% | -46% | $ 30,675,595.68 |

| FEX | Fenix Resources Ltd | 0.315 | -7% | 17% | 47% | -13% | $ 162,607,384.80 |

| FMG | Fortescue Metals Grp | 20.61 | -3% | -2% | 48% | -9% | $ 66,659,590,474.70 |

| FMS | Flinders Mines Ltd | 0.505 | -5% | 4% | -27% | -55% | $ 81,047,316.96 |

| GEN | Genmin | 0.19 | -5% | 0% | 15% | -41% | $ 56,657,570.00 |

| GRR | Grange Resources. | 1.345 | 2% | 18% | 185% | 172% | $ 1,585,554,016.26 |

| GWR | GWR Group Ltd | 0.15 | -9% | -3% | 36% | -51% | $ 43,364,248.43 |

| HAV | Havilah Resources | 0.19 | 3% | 3% | 3% | -16% | $ 57,314,250.05 |

| HAW | Hawthorn Resources | 0.19 | 23% | 111% | 265% | 239% | $ 56,697,654.21 |

| HIO | Hawsons Iron Ltd | 0.72 | 22% | 157% | 835% | 1427% | $ 632,821,860.75 |

| IRD | Iron Road Ltd | 0.175 | -3% | -3% | -19% | -40% | $ 135,646,431.62 |

| JNO | Juno | 0.13 | 0% | 37% | 4% | 0% | $ 17,635,540.13 |

| LCY | Legacy Iron Ore | 0.029 | 4% | 45% | 123% | 61% | $ 166,577,481.17 |

| MAG | Magmatic Resrce Ltd | 0.077 | -9% | -9% | -19% | -57% | $ 19,595,483.45 |

| MDX | Mindax Limited | 0.059 | 0% | 0% | 18% | 1867% | $ 112,672,163.12 |

| MGT | Magnetite Mines | 0.029 | -6% | -6% | 31% | -46% | $ 91,632,659.55 |

| MGU | Magnum Mining & Exp | 0.072 | -11% | -4% | 6% | -56% | $ 35,792,651.23 |

| MGX | Mount Gibson Iron | 0.7 | 7% | 14% | 75% | -24% | $ 841,344,782.94 |

| MIN | Mineral Resources. | 56.08 | -8% | 3% | 49% | 17% | $ 10,784,472,219.00 |

| MIO | Macarthur Minerals | 0.395 | -14% | -23% | 7% | -12% | $ 65,307,662.64 |

| PFE | Panteraminerals | 0.175 | 0% | 9% | -40% | 0% | $ 8,080,000.00 |

| PLG | Pearlgullironlimited | 0.065 | -19% | -7% | -43% | 0% | $ 3,568,650.02 |

| RHI | Red Hill Iron | 4 | 13% | 12% | 38% | 661% | $ 245,738,373.65 |

| RIO | Rio Tinto Limited | 111.85 | -2% | -7% | 26% | -8% | $ 42,166,449,748.26 |

| RLC | Reedy Lagoon Corp. | 0.029 | -17% | -17% | -3% | 38% | $ 16,999,074.13 |

| SHH | Shree Minerals Ltd | 0.012 | -20% | -25% | 20% | -25% | $ 14,666,842.70 |

| SRK | Strike Resources | 0.195 | 39% | 44% | 77% | -36% | $ 45,900,000.00 |

| SRN | Surefire Rescs NL | 0.048 | 60% | 200% | 269% | 78% | $ 53,581,415.50 |

| TI1 | Tombador Iron | 0.039 | -9% | -3% | 0% | -59% | $ 43,600,063.18 |

| TLM | Talisman Mining | 0.165 | -6% | -3% | 14% | 14% | $ 32,854,411.98 |

| VMS | Venture Minerals | 0.054 | -8% | -21% | 20% | -49% | $ 91,847,667.56 |

| EQN | Equinoxresources | 0.175 | -10% | -9% | -19% | 0% | $ 7,762,500.17 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.