Bulk Buys: So will Simandou ever get built?

Picture: Getty Images

- Guinea’s mines minister has told Rio and other Simandou miners to stop work on the giant iron ore deposit

- It says plans to share infrastructure for the major high-grade development are taking too long to be completed

- Iron ore futures lift on news after falling below US$110/t on weak Chinese steel demand on Monday

Two weeks ago Guinea’s military leaders, who ousted octogenarian President Alpha Conde in a coup last year, issued an ultimatum to some of the world’s biggest miners.

Come to an agreement on infrastructure for Africa’s enormous Simandou iron ore mine or else.

According to reports from Reuters, we’ve now seen that “or else” come into play, as Mines Minister Moussa Magassouba issued a stop work order on development of the mines, touted as the largest orebody of high grade iron ore in the world.

Specifics about Simandou are hazy. Analysts estimate it could add between 60-200Mt of iron ore into the seaborne market by the time it is in full swing.

Rio Tinto (ASX:RIO), owns 45.05% of two blocks at the deposit having made the initial discovery back in the mid-1990s.

Its major shareholder Chinalco owns 39.95% with the rest in the hands of the Guinean Government.

Two other blocks, previously expropriated by Guinea, are supposed to be developed by a Chinese-backed consortium called SMB Winning, which wants to help China reduce its reliance on iron ore from Australia and to a lesser extent Brazil.

Guinea’s military rulers have set ambitious, and many would say unachievable deadlines for the companies to not only come together to agree a sharing deal for the 670km of rail and port infrastructure needed, but also to have that work completed by the end of 2024.

Mining is supposed to take place in the March quarter of 2025, despite the project’s remoteness, long history of inactivity and allegations of community and environmental problems.

The latest word from Guinea’s leaders is another example of the temperamental nature of the jurisdiction, which has emerged as a major bauxite exporter in recent years.

“Despite the significant concessions the Guinean State has been kind enough to make, it is clear the obstruction is being maintained by both your companies, to the detriment of the interests of the project,” Magassouba said in a letter reproduced by Reuters.

Iron ore lifts

That news provided a handy little kick for iron ore prices, with battered futures markets turning positive during the day.

Dalian iron ore was up 1.36% at 5.10pm AEST, while 62% Fe Singapore futures lifted 3.19% to US$112.20/t.

The big three iron ore miners were all slightly in the green, with Fortescue Metals Group (ASX:FMG) up a handy 1.47% yesterday.

Iron ore prices have been tumbling in recent days, dipping under US$110/t on Monday after more virus cases emerged in China.

Lockdowns have proven to be an economy killer in the Middle Kingdom, with reduced demand for reinforced bar used in property construction and infrastructure in China sending steel prices lower since Mid-June.

A number of mills have entered maintenance due to large steel stockpiles and low prices, which are sending margins negative when coupled with high coking coal prices.

MySteel continued to report falling rebar prices this week, down 2% on Monday to US$638.59/t, while mill utilisation is also on the slide.

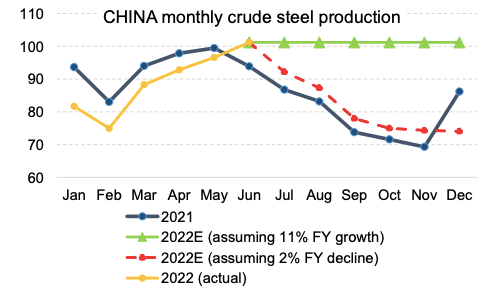

Along with falling mill margins, there are also concerns iron ore could see similar impacts to the second half of last year due to plans from Chinese authorities to keep crude steel production below 2021 levels.

Goldman Sachs estimates Chinese steel output from July to December would need to fall 22% on the monthly rate in June 2022 to end the year 2% below 2021 levels (1.035Bt).

Iron ore needs to fall: Dhar

Commbank metal man Vivek Dhar says those sorts of stats suggest iron ore prices will need to fall heading into the back end of the year.

Steel production has remained high despite China’s economic rebound being mercilessly delayed by Xi Jinping’s commitment to a hardline “Covid Zero” policy.

He says Chinese steel margins have been negative for much longer than is normal in a typical down period.

“The fall in iron ore prices is consistent with the state of China’s steel sector,” he said.

“China’s steel mill margins have remained negative since 13 June 2022, suggesting that oversupply conditions are pervasive in China’s steel sector.

“For context, margins typically only remain negative for a short period of time as steel mills tend to respond to negative margins fairly quickly by cutting production.

“Negative margins though have persisted for around 29‑34% of the calendar year‑to‑date. We think negative margins have been tolerated more than is typically the case because steel mills have largely looked ahead at future demand expectations as policymakers have flagged significant infrastructure investment.”

That has not come… not yet at least.

“It’s worth highlighting that steel demand in China picked up in June as lockdowns were eased in Shanghai,” he said.

“The construction sub component of the non‑manufacturing PMI rose from 52.2 in May to 56.6 in June, likely signalling a pick‑up in infrastructure projects. China’s COVID‑zero policy though has raised doubts whether this level of demand growth can be sustained.

“The required cuts to China’s steel output suggests iron ore prices needs to fall.

“The same policy was responsible for the massive fall in iron ore prices from $US233/t in mid‑May 2021 to $US87/t in mid‑November 2021. The need to cut steel output last year was more severe given the boom in China’s steel production in H1 2021.”

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 WEEK RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.046 | -23% | -15% | -23% | -10% | $ 21,437,255.02 |

| ADY | Admiralty Resources. | 0.011 | -15% | -15% | 10% | -35% | $ 13,035,791.53 |

| AKO | Akora Resources | 0.19 | -19% | -21% | 3% | -27% | $ 12,934,873.52 |

| BCK | Brockman Mining Ltd | 0.038 | -3% | -22% | 12% | -10% | $ 287,687,196.06 |

| BHP | BHP Group Limited | 40 | -14% | 6% | -3% | -7% | $ 201,986,695,281.00 |

| CIA | Champion Iron Ltd | 5.2 | -34% | -8% | -3% | -21% | $ 2,698,279,992.72 |

| CZR | CZR Resources Ltd | 0.016 | 0% | 129% | 33% | 60% | $ 59,267,495.71 |

| DRE | Dreadnought Resources Ltd | 0.047 | 15% | 18% | 18% | 88% | $ 139,095,494.00 |

| EFE | Eastern Resources | 0.024 | -17% | -55% | 0% | 50% | $ 21,877,605.88 |

| CUF | Cufe Ltd | 0.022 | -27% | -48% | 16% | -58% | $ 21,089,472.03 |

| FEX | Fenix Resources Ltd | 0.3 | -6% | 5% | 0% | -17% | $ 157,445,245.60 |

| FMG | Fortescue Metals Grp | 17.32 | -19% | -13% | -3% | -27% | $ 52,557,931,150.26 |

| FMS | Flinders Mines Ltd | 0.43 | 2% | -28% | 19% | -49% | $ 72,604,888.11 |

| GEN | Genmin | 0.2 | 8% | -11% | 21% | -17% | $ 56,657,570.00 |

| GRR | Grange Resources. | 1.165 | -31% | 48% | -7% | 120% | $ 1,342,512,889.68 |

| GWR | GWR Group Ltd | 0.12 | 4% | -23% | 30% | -65% | $ 38,545,998.60 |

| HAV | Havilah Resources | 0.26 | -4% | 53% | 8% | 18% | $ 79,149,802.50 |

| HAW | Hawthorn Resources | 0.082 | -29% | -8% | -4% | 86% | $ 27,348,280.27 |

| HIO | Hawsons Iron Ltd | 0.475 | -15% | 179% | -7% | 125% | $ 340,125,151.25 |

| IRD | Iron Road Ltd | 0.155 | -14% | -24% | 7% | -38% | $ 119,848,695.60 |

| JNO | Juno | 0.13 | 18% | 8% | 8% | -33% | $ 16,278,960.12 |

| LCY | Legacy Iron Ore | 0.019 | -16% | -5% | 0% | 36% | $ 115,322,871.58 |

| MAG | Magmatic Resrce Ltd | 0.06 | -15% | -43% | 5% | -56% | $ 15,269,207.88 |

| MDX | Mindax Limited | 0.059 | 0% | 51% | 0% | -17% | $ 113,911,163.12 |

| MGT | Magnetite Mines | 0.022 | -19% | -31% | 5% | -70% | $ 83,418,783.93 |

| MGU | Magnum Mining & Exp | 0.04 | -23% | -56% | 8% | -75% | $ 21,223,645.52 |

| MGX | Mount Gibson Iron | 0.52 | -26% | 16% | 0% | -44% | $ 623,442,537.00 |

| MIN | Mineral Resources. | 45.51 | -25% | -22% | -7% | -18% | $ 8,695,690,231.32 |

| MIO | Macarthur Minerals | 0.2 | -30% | -42% | -2% | -55% | $ 32,250,697.60 |

| PFE | Panteraminerals | 0.13 | 0% | -38% | 8% | 0% | $ 6,565,000.00 |

| PLG | Pearlgullironlimited | 0.047 | 74% | -40% | 18% | 0% | $ 2,196,092.32 |

| RHI | Red Hill Iron | 3.31 | 3% | 6% | 4% | 365% | $ 204,250,076.80 |

| RIO | Rio Tinto Limited | 100.78 | -13% | 1% | -3% | -20% | $ 37,396,321,398.36 |

| RLC | Reedy Lagoon Corp. | 0.018 | -22% | -53% | 6% | 13% | $ 9,476,257.50 |

| SHH | Shree Minerals Ltd | 0.009 | -5% | 0% | 29% | -31% | $ 11,146,382.03 |

| SRK | Strike Resources | 0.11 | -31% | 0% | -4% | -58% | $ 32,400,000.00 |

| SRN | Surefire Rescs NL | 0.027 | -18% | 125% | 29% | 93% | $ 37,840,813.27 |

| TI1 | Tombador Iron | 0.025 | -24% | -24% | -4% | -74% | $ 27,998,758.45 |

| TLM | Talisman Mining | 0.145 | -19% | -12% | 12% | -28% | $ 27,222,227.07 |

| VMS | Venture Minerals | 0.032 | -20% | -30% | 0% | -77% | $ 51,768,685.35 |

| EQN | Equinoxresources | 0.14 | -18% | -33% | -15% | 0% | $ 6,300,000.14 |

Indo coal miner on the rise

The biggest gainer in the ASX-listed coal space was unheralded Cokal (ASX:CKA), which is planning to sell its first cargo from the 60% owned Bumi Barito Mineral operation in Indonesia this quarter.

The Domenic Martino chaired firm, which has a market cap of $150 million and is up around 166% over the past year, recently said goodbye to its Australian based CEO James Coleman.

The mine will be led by Indonesian based executives while the search for a new CEO begins. Cokal has completed the acquisition of 347 hectares at its Pit 3 mining area, with land clearing expected to begin this month.

Indonesian coal trades at a discount to Australian Newcastle grade energy coal (which is fetching around US$385/t), but is still near record highs with S&P Global Platts assessing May contracts at US$275.64/t owing to worldwide shortages of the energy product.

A rare premium has recently opened for thermal coal over coking coal, with Fastmarkets MB reporting premium hard coking coal FOB Dalrymple Bay Coal Terminal in Queensland on Monday at US$286.58/t.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 WEEK RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.007 | -30% | -36% | 17% | -46% | $ 8,615,393.46 |

| CKA | Cokal Ltd | 0.16 | 14% | 10% | 28% | 158% | $ 150,231,836.80 |

| NCZ | New Century Resource | 1.64 | -25% | -28% | -4% | -51% | $ 210,895,047.93 |

| BCB | Bowen Coal Limited | 0.235 | -36% | 36% | -6% | 254% | $ 354,642,738.96 |

| LNY | Laneway Res Ltd | 0.005 | 25% | -13% | 25% | 4% | $ 31,510,082.05 |

| GRX | Greenx Metals Ltd | 0.195 | 11% | -17% | 8% | -27% | $ 48,187,888.16 |

| AKM | Aspire Mining Ltd | 0.0815 | -6% | -1% | -1% | 12% | $ 41,118,595.79 |

| AVM | Advance Metals Ltd | 0.008 | -27% | -53% | -20% | -52% | $ 3,823,019.22 |

| AHQ | Allegiance Coal Ltd | 0.5 | -11% | -3% | 2% | -28% | $ 179,317,264.40 |

| YAL | Yancoal Aust Ltd | 5.1 | -7% | 82% | -2% | 152% | $ 6,747,445,523.07 |

| NHC | New Hope Corporation | 3.61 | -7% | 56% | 8% | 99% | $ 2,996,485,495.20 |

| TIG | Tigers Realm Coal | 0.018 | -22% | -14% | 6% | 157% | $ 235,200,642.62 |

| SMR | Stanmore Resources | 1.89 | -28% | 95% | -2% | 195% | $ 1,712,625,226.20 |

| WHC | Whitehaven Coal | 4.83 | -11% | 75% | 1% | 143% | $ 4,702,167,691.20 |

| BRL | Bathurst Res Ltd. | 1.07 | -31% | 44% | -5% | 149% | $ 204,754,964.60 |

| CRN | Coronado Global Res | 1.635 | -24% | 37% | -5% | 98% | $ 2,774,530,923.15 |

| JAL | Jameson Resources | 0.07 | -7% | 0% | 0% | -20% | $ 24,374,231.84 |

| TER | Terracom Ltd | 0.625 | -27% | 213% | 4% | 381% | $ 490,678,734.62 |

| ATU | Atrum Coal Ltd | 0.007 | -30% | -77% | 0% | -73% | $ 4,839,578.35 |

| MCM | Mc Mining Ltd | 0.125 | -17% | 33% | 25% | 9% | $ 24,706,858.75 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.