Bulk Buys: Iron ore is now up nearly 50pc in 12 months – but a price drop might finally be coming

Iron ore train on its way to port. Picture: Getty

- Iron ore fines prices traded this week at $US132.30 per tonne, up $US5.50 per tonne on week

- Hard coking coal prices were 50c lower this week at $US90 per tonne at Queensland ports

- China’s reinforcing bar price is at $US618.05 per tonne, down $US11.15 per tonne on a week ago

Iron ore prices surpassed $US130 per tonne this week, but the commodity’s further rise could be stymied by a drop in steel prices in China.

Spot prices have advanced $US5.50 to $US132.30 per tonne ($179.60/t), and are their highest since January 2014 when China was going through a massive construction boom. This time 12 months ago, prices were hovering around the $US88 mark.

“The increase in prices primarily reflects robust demand from China’s infrastructure, property and manufacturing sectors,” said Commonwealth Bank of Australia analyst Vivek Dhar.

A week ago, iron ore cargoes for shipment to China were trading around $US126.80 per tonne, Metal Bulletin said.

Steel rebar prices pull back slightly

A slight decline in steel product prices in China could indicate a turn in the market may lie ahead for iron ore prices.

The price of steel reinforcing bar (rebar), which is used in construction, dipped this week to $US618.05 per tonne.

Rebar prices had been on an upward move for the past few weeks, from $US605 per tonne in mid-November.

China’s steel production has been on a tear and was 12 per cent higher in October on a year on year basis.

Output is expected to slow over the year-end, however, as Chinese blast furnaces are idled as an air pollution reduction measure.

Levels of industrial production in China are now back to where they were before the global pandemic.

China’s consumption of steelmaking raw materials like coal and iron ore is set to gather pace despite a trend for some steel recycling.

Wood Mackenzie expects an additional 200 million tonnes of steel scrap to be used by the world’s steelmakers by 2040.

Even with this additional availability, steel scrap will stay under-utilised and will not displace much primary steel production.

“We estimate that using all available scrap could bring down aluminium and steelmaking emissions by up to 600 million tonnes a year each,” Wood Mackenzie vice chairman, Julian Kettle, said.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| EUR | European Lithium Ltd | 0.048 | 14 | 33 | -42 | $35.6M |

| SRK | Strike Resources | 0.135 | 13 | 53 | 170 | $29.0M |

| FEX | Fenix Resources Ltd | 0.175 | 9 | 40 | 373 | $68.8M |

| FMG | Fortescue Metals Grp | 18.35 | 4 | 6 | 89 | $56.1B |

| MIN | Mineral Resources. | 32.03 | 3 | 28 | 106 | $6.1B |

| MGT | Magnetite Mines | 0.01 | 0 | 11 | 168 | $28.6M |

| CIA | Champion Iron Ltd | 4.53 | 0 | 35 | 101 | $2.1B |

| MGX | Mount Gibson Iron | 0.74 | -2 | 8 | -8 | $889.4M |

| ADY | Admiralty Resources. | 0.014 | -13 | 8 | 40 | $15.1M |

| MAG | Magmatic Resrce Ltd | 0.175 | -13 | -15 | -3 | $31.2M |

| LCY | Legacy Iron Ore | 0.006 | -14 | -14 | 173 | $37.5M |

| TI1 | Tombador Iron | 0.037 | -20 | 19 | 76 | $30.1M |

Soon-to-be iron ore producer GWR Group (ASX:GWR) has signed a deal for a storage facility at the WA port of Geraldton.

The agreement will enable GWR to export iron ore from its Wiluna West project in WA starting in January 2021.

Wiluna West starts production in early December, and is located 700km from Geraldton port.

The port of Geraldton storage facility has a capacity for 100,000 tonnes of iron ore and the site includes a truck unloading station.

GWR has also signed a port services agreement with Geraldton port to utilise its berth 5 ship-loading area.

The port access and service agreement places GWR one step closer to becoming the next iron ore producer on the ASX.

Chinese steel mills seen to diversify coking coal supply

Buying interest for China in spot cargoes of hard coking coal from Australia has thinned dramatically in recent weeks.

Part of the reason for this is that China sets annual quotas for coal imports into the Asian country and these have nearly run out.

“China’s coal imports have plunged in the back half of 2020 as policymakers target an expected ~270 million tonnes of imports this year, given China had imported more coal at the beginning of the year to compensate for lower coal production owing to restrictions in place to limit the spread of COVID-19,” said Dhar.

For standard-grade hard coking coal for spot shipment from ports in Queensland, prices are around $US90 per tonne this week.

Trades for premium quality hard coking coal for January shipment from Queensland were heard in the market at $US102 per tonne.

“Coking coal prices and volumes from Australia are likely to remain under pressure for the remainder of this year,” said Dhar.

Large backlog of coal shipments is waiting to clear Chinese ports

In addition, there is a huge volume of coking coal in ships floating off numerous Chinese ports that is available to buyers.

Customs clearance procedures for imported coal cargoes have slowed at Chinese ports leading to a large backlog.

Another reason for weaker Australian hard coking coal prices is that Chinese buyers have been opting to book higher-priced cargoes from North American coking coal producers.

Cargoes of coking coal for delivery to ports in northeastern China were heard at $US154 per tonne, up $US10 on week.

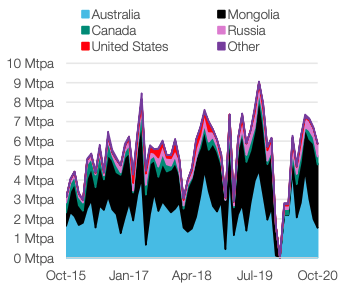

China appears to be diversifying its buying for coking coal, as its steel mills have booked more cargoes from Mongolia, up 14 per cent year on year in October, and Canada, up 136 per cent on year in October.

China is also taking coking coal cargoes from relative newcomer Mozambique in east Africa, a sailing distance farther than Australia.

Time will tell if this is a temporary shift in Chinese buying behaviour, or a change of trend long term.

China resets its import quotas for all types of seaborne-traded coal starting on January 1, 2021.

The types of coking coal arriving in China next year will show which way the market is moving in terms of supply sources.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| LNY | Laneway Res Ltd | 0.008 | 14 | 14 | 14 | $26.4M |

| MCM | Mc Mining Ltd | 0.205 | 8 | 105 | -55 | $31.7M |

| CRN | Coronado Global Res | 1.01 | 7 | 35 | -47 | $1.5B |

| SMR | Stanmore Coal Ltd | 0.72 | 5 | 2 | -24 | $190.6M |

| YAL | Yancoal Aust Ltd | 2.1 | 5 | 7 | -29 | $2.8B |

| JAL | Jameson Resources | 0.125 | 4 | 14 | -32 | $37.9M |

| AHQ | Allegiance Coal Ltd | 0.056 | 4 | -7 | -57 | $46.7M |

| TER | Terracom Ltd | 0.145 | 4 | -6 | -57 | $109.3M |

| BCB | Bowen Coal Limited | 0.05 | 2 | -9 | -15 | $45.4M |

| WHC | Whitehaven Coal | 1.33 | 1 | 25 | -58 | $1.4B |

| AKM | Aspire Mining Ltd | 0.073 | 0 | -3 | -44 | $37.1M |

| NCZ | New Century Resource | 0.225 | -2 | 37 | -21 | $255.8M |

| PDZ | Prairie Mining Ltd | 0.19 | -5 | -7 | -25 | $45.4M |

| CKA | Cokal Ltd | 0.07 | -5 | 19 | 46 | $60.6M |

| BRL | Bathurst Res Ltd. | 0.039 | -7 | 0 | -65 | $66.7M |

| MEY | Marenica Energy Ltd | 0.084 | -8 | -5 | -2 | $17.1M |

| PAK | Pacific American Hld | 0.022 | -8 | -8 | -17 | $6.9M |

| NAE | New Age Exploration | 0.011 | -8 | -15 | 267 | $13.3M |

| LNY | Laneway Res Ltd | 0.008 | 14 | 14 | 14 | $26.4M |

Allegiance Coal (ASX:AHQ) said this week it has entered into a four-year supply deal for high sulphur Alabama hard coking coal.

The US coking coal is required by the company for blending with low sulphur hard coking coal from its New Elk mine.

New Elk mine in Colorado goes into production in Q2 2021, and its product will be coking coal with a sulphur content of 0.5 per cent.

The Allegiance mine has a production target of 1.4 million tonnes of saleable coal per year.

The total volume under the deal is 2.7 million tonnes and is being delivered by Alabama producer Mays Mining.

Allegiance will rail 65,000 tonnes per month of its New Elk hard coking coal to the US port of New Orleans.

The Alabama coking coal will be barged to New Orleans port from Mobile, where it will be blended with its New Elk coking coal.

Blending will ensure that the resulting combined New Elk and Alabama coking coal product has a sulphur content of less than 1 per cent.

One per cent is currently the sulphur threshold for US coking coal traded in the seaborne market.

Allegiance has agreed to pay Mays a fixed price for its Alabama coking coal and a bonus payment on an agreed share of the sales price above $US110 per tonne.

Coking coal futures prices increase for March cargoes

Forward prices for Australian coking coal on the Chicago Mercantile Exchange (CME) have moved into backwardation this week.

A backwardated market is one in which commodity prices are higher for spot delivered cargoes than cargoes for later delivery.

For January 2021 settlement, the futures price is US$121 per tonne, up $US11 on a week ago.

While for February 2021 settlement the price fell back to $US109.50 per tonne from $US125 per tonne a week ago.

This price kink could be reflective of traditionally weak demand during the Lunar New Year holiday in China.

This year’s new year holiday in China occurs in February 2021. Industrial production tends to decline at this holiday time.

March 2021 coking coal futures are trading at $US165.50 per tonne, representing a huge step up in price from January and February.

For the rest of 2021, forward prices for coking coal average around $US146 to $US150 per tonne.

The shape of the futures market’s forward curve could mean there is an expectation in the market that China will pay higher prices for Australian coking coal for March onwards delivery.

The higher futures price could also represent an insurance payment in case shipments from Queensland are affected by cyclones.

Australia’s tropical cyclone season traditionally starts in November and lasts through to April the following year.

The Bureau of Meteorology in its Tropical Cyclone Outlook said it is expecting a higher than average number of cyclones this season.

Cyclones can be devastating to the coal industry in Queensland, as they can result in flooding of rail and mining infrastructure.

Tropical cyclone Debbie in 2017 delayed the export of 15 million to 20 million tonnes of coking coal valued at $3bn.

Another possibility for the higher coking coal futures prices is an expectation that China’s steel production will continue to rise.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.