Bulk Buys: Fortescue sees robust iron ore demand in a greening world as Champion corners high-grade market

Pic: Diggers and Dealers

- FMG boss Elizabeth Gaines says demand for its Pilbara iron ore will remain strong despite move to curb carbon emissions from steel

- Champion Iron sees opportunity in niche market for low emissions steelmaking and DRI quality iron ore

- Global coal consumption rises to levels not seen in a decade: IEA

Some analysts view China’s carbon emissions roadmap, which would see the world’s largest industrial emitter hit net zero by 2060, as a major headwind for iron ore.

Other issues like China’s Covid Zero policy, falling steel demand and global interest rate rises are clouding the picture at the moment.

Singapore futures were up 0.65% to a relatively healthy US$115.50/t yesterday, and mill margins have also recovered in recent days.

“The recovery in mill margins has spurred hopes that production capacity may resume more quickly than expected. However, this wasn’t the line that the industry was taking last week,” ANZ’s David Plank said.

“China Iron and Steel Association’s executive chair, He Wenbo, told a conference that the steel industry’s production capacity must be adjusted.”

Longer term, the carbon question will be a dominant one when it comes to iron ore demand. Each tonne of steel produced generates twice as much CO2.

The industry, which has seen near consistent growth for 7 years to almost 2Btpa, accounts for 8% of global carbon emissions.

We need steel, but we also need greener ways to produce it.

Fortescue Metals Group (ASX:FMG) for instance, is looking to supply higher grade iron ore suited to lower emissions steel production through its new US$3.6-3.8 billion 22 Mtpa Iron Bridge magnetite mine.

The project is due to deliver 1Mt in its first reporting year in FY23, with first concentrate in March 2023 after years of delays and cost blowouts.

Gaines sees support for iron ore demand ahead

FMG shipped a record 189Mt of hematite last year, most of it well below the 62% reference grade for iron ore fines.

It wants to secure a license from WA’s enviro department to ship up to 210Mt from Port Hedland to supplement growth from Iron Bridge.

But FMG does not think efforts to limit carbon emissions in China will hit demand for its lower grade ore.

Speaking to journalists on the sidelines of the Diggers and Dealers Mining Forum in Kalgoorlie-Boulder yesterday, outgoing FMG CEO Elizabeth Gaines said demand for both low and high grade products will have markets for years to come.

“In the context of demand for iron ore, we’re seeing very strong demand for Fortescue’s ores and one of the benefits of Iron Bridge is we will have a suite of products, everything from a lower grade to mid grade to a higher grade magnetite concentrate,” she said.

“So we think that gives us great flexibility and an ability to deliver to our customers. We’ve seen strong demand, and that’s evidenced by some of the recent data, including in our quarterly with the price realisation increase that we saw from 70 to 78%.

“So that demonstrates the strong demand we’re seeing for our iron ores. Our strategy is to actually have a suite of products that covers both (markets), the low grade, medium grade and high grade ores and we expect to see strong ongoing demand for our products.”

FMG (ASX:FMG) share price today:

Iron Bridge on track

Gaines, who delivered remotely from Perth after her flight was cancelled due to poor weather, said FMG remained on track to deliver Iron Bridge on the schedule last updated in its quarterly.

It comes despite concerns from the analyst community that more delays and cost overruns could be on the cards before it is delivered.

“At the moment unfortunately we’re seeing the impact of some resurgence of COVID across our operations, and Iron Bridge in particular, but absent anything outside our control we’re actually on track, we are on track and the team are very focused on that first production in the March quarter, and also in our guidance for costs,” she said.

“So I’m very confident in the team’s ability to deliver on that guidance.”

Meanwhile, Gaines, who will step aside at the end of this month as Andrew Forrest returns to the helm of the iron ore major as executive chairman, said Fortescue was monitoring the formation of China’s centralised iron ore buyer, China Mineral Resources Group.

“We haven’t had any official feedback on how that might operate,” she said.

Simandou not set up to service green steel market

One company completely focused on the high grade portion of the iron ore market is Champion Iron (ASX:CIA), which is aiming to ramp up its high grade Bloom Lake mine in Canada to 15Mtpa.

Initially that will be at its prevailing 66.2% concentrate grade, a product largely linked to the 65% Platts index.

It is studying an improvement to the production of DRI pellets grading 69%, a product that would currently garner a massive US$67/t over the already premium prices 65% fe index.

Champion Iron Senior Vice-President, Corporate Development and Capital Markets Michael Marcotte said just 5% of the global iron ore market was can supply direct reduced iron plants, a cleaner form of iron ore production currently powered by gas and potentially powered by hydrogen in the future.

Much of that is produced in Russia and Ukraine, where Scope 1 emissions are high and the obvious shadow of war remains.

Marcotte says DRI quality iron ore will see demand growth of 355% in a 1.5C global warming scenario, behind only cobalt, lithium and graphite in demand growth.

“Steel is actually the one common element needed in every one of these (low emissions) technologies,” he said, quoting research from Wood Mackenzie.

“It’s very important… that green steel becomes part of the supply chain.”

While Rio Tinto has marketed its Simandou iron ore development in Guinea, with a hematite grade of 65.5%, as “the Rolls Royce of iron ore”, Marcotte warned it “would not qualify as DRI quality”.

CIA’s premium gives it margins supported by falling costs since the ASX-TSX listed miner took over the Bloom Lake operation, but demonstrates the potential ESG benefits and rarity of high grade iron ore operations.

At more than 69% iron ore and forecast carbon prices, Marcotte says CIA’s Bloom Lake could deliver US$880m in cost savings to 2030.

Champion Iron (ASX:CIA) share price today:

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.046 | 0% | 0% | -18% | -12% | $ 21,437,255.02 |

| ADY | Admiralty Resources. | 0.009 | 13% | -10% | -36% | -50% | $ 11,732,212.38 |

| AKO | Akora Resources | 0.165 | 3% | -20% | -51% | -34% | $ 10,095,511.04 |

| BCK | Brockman Mining Ltd | 0.033 | -8% | -3% | -28% | -8% | $ 306,247,660.32 |

| BHP | BHP Group Limited | 38.58 | 3% | -4% | -4% | -19% | $ 197,936,836,729.00 |

| CIA | Champion Iron Ltd | 4.71 | -6% | -10% | -26% | -38% | $ 2,575,621,767.48 |

| CZR | CZR Resources Ltd | 0.016 | 0% | 0% | 100% | 45% | $ 55,781,172.43 |

| DRE | Dreadnought Resources Ltd | 0.068 | 13% | 42% | 74% | 62% | $ 193,030,481.47 |

| EFE | Eastern Resources | 0.025 | -11% | 19% | -58% | 79% | $ 24,860,915.78 |

| CUF | Cufe Ltd | 0.019 | 0% | -24% | -47% | -78% | $ 18,356,134.94 |

| FEX | Fenix Resources Ltd | 0.285 | 2% | -8% | 19% | -25% | $ 155,670,967.20 |

| FMG | Fortescue Metals Grp | 17.9 | -2% | 5% | -9% | -28% | $ 56,067,951,156.78 |

| FMS | Flinders Mines Ltd | 0.53 | 5% | 23% | 2% | -44% | $ 89,489,745.81 |

| GEN | Genmin | 0.25 | 6% | 39% | 19% | 19% | $ 70,821,962.50 |

| GRR | Grange Resources. | 1.165 | -11% | -6% | 46% | 59% | $ 1,330,939,502.70 |

| GWR | GWR Group Ltd | 0.099 | -1% | -18% | -32% | -73% | $ 30,515,582.23 |

| HAV | Havilah Resources | 0.255 | 6% | 0% | 46% | 24% | $ 83,898,790.65 |

| HAW | Hawthorn Resources | 0.088 | 5% | 6% | -1% | 96% | $ 29,349,373.94 |

| HIO | Hawsons Iron Ltd | 0.3 | -27% | -36% | 43% | 88% | $ 244,547,473.50 |

| IRD | Iron Road Ltd | 0.15 | 3% | 0% | -17% | -35% | $ 111,858,782.56 |

| JNO | Juno | 0.12 | -14% | 0% | 0% | -45% | $ 16,957,250.13 |

| LCY | Legacy Iron Ore | 0.021 | 11% | 17% | 0% | 40% | $ 128,136,523.98 |

| MAG | Magmatic Resrce Ltd | 0.069 | -4% | 28% | -22% | -51% | $ 17,305,102.26 |

| MDX | Mindax Limited | 0.059 | 0% | 0% | 59% | 4% | $ 113,984,913.12 |

| MGT | Magnetite Mines | 0.024 | 4% | 14% | -32% | -42% | $ 94,794,097.65 |

| MGU | Magnum Mining & Exp | 0.039 | 8% | 3% | -51% | -74% | $ 22,385,616.37 |

| MGX | Mount Gibson Iron | 0.51 | 2% | -4% | 23% | -41% | $ 617,389,696.83 |

| MIN | Mineral Resources. | 53.08 | 11% | 15% | -8% | -16% | $ 10,220,075,855.56 |

| MIO | Macarthur Minerals | 0.17 | 0% | -15% | -51% | -73% | $ 29,831,895.28 |

| PFE | Panteraminerals | 0.13 | -7% | 18% | -32% | 0% | $ 6,565,000.00 |

| PLG | Pearlgullironlimited | 0.043 | 0% | 10% | -31% | 0% | $ 2,305,896.94 |

| RHI | Red Hill Iron | 3.3 | 0% | 3% | 18% | 308% | $ 210,632,891.70 |

| RIO | Rio Tinto Limited | 97.3 | 0% | -3% | -11% | -27% | $ 36,720,707,888.88 |

| RLC | Reedy Lagoon Corp. | 0.013 | -28% | -32% | -64% | -19% | $ 7,803,976.77 |

| SHH | Shree Minerals Ltd | 0.009 | 13% | 13% | -18% | -25% | $ 11,146,382.03 |

| SRK | Strike Resources | 0.12 | 9% | 0% | 4% | -57% | $ 33,750,000.00 |

| SRN | Surefire Rescs NL | 0.018 | 0% | -25% | 50% | 13% | $ 26,883,179.11 |

| TI1 | Tombador Iron | 0.023 | 5% | -8% | -50% | -72% | $ 26,935,808.11 |

| TLM | Talisman Mining | 0.16 | 10% | 10% | -3% | -27% | $ 30,038,319.52 |

| VMS | Venture Minerals | 0.027 | -7% | -13% | -34% | -78% | $ 46,968,812.58 |

| EQN | Equinoxresources | 0.145 | 12% | 7% | -31% | 0% | $ 6,075,000.14 |

What about coal?

We’re glad you asked. Prices for thermal coal remain very high, fetching US$405/t Monday.

Yikes.

Coking coal has moderated after a precipitous fall across July, with futures rising slightly to US$203/t Monday on the positive news on steel margins.

That’s less than a third of the record US$670/t met coal producers saw in March.

Is coal going anywhere? Not according to the International Energy Agency.

Despite ambitions globally for a shift to green energy, coal consumption is expected to hit levels not seen in a decade this year with demand to hit an all time high in 2023.

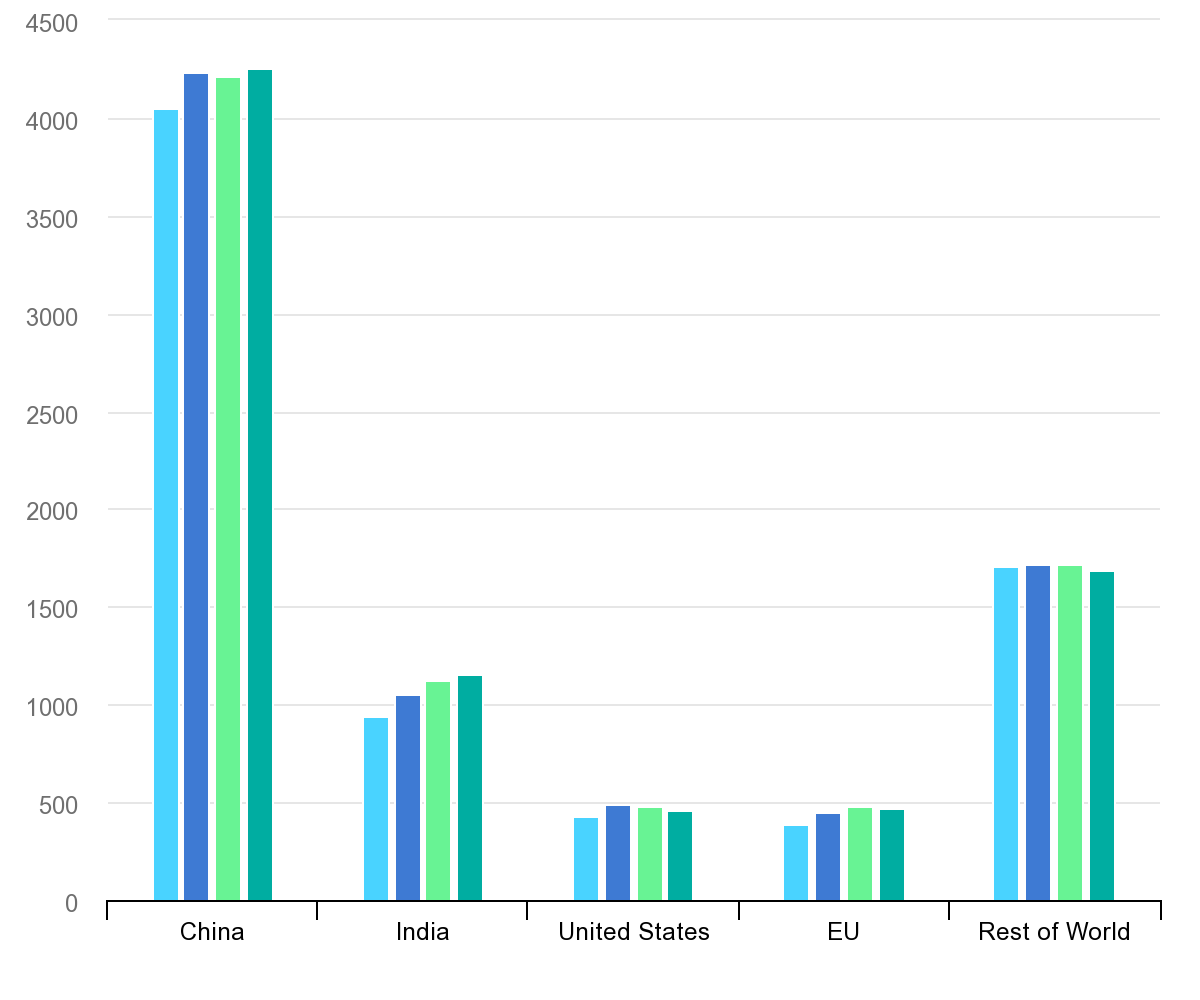

“Based on current economic and market trends, global coal consumption is forecast to rise by 0.7% in 2022 to 8 billion tonnes, assuming the Chinese economy recovers as expected in the second half of the year, the IEA’s July 2022 Coal Market Update says,” the IEA says.

“This global total would match the annual record set in 2013, and coal demand is likely to increase further next year to a new all-time high.”

Thermal coal demand for power generation is expected to lift by 1%.

Coal consumption in the EU is up 7% after a 14% rise last year as economies rebounded from Covid. But it is a 7% lift in the larger Indian market that has really moved the needle.

Chinese coal consumption is the wildcard. It is expected to be in line with last year’s record of 4230Mt, but weak demand from Covid lockdowns and rising hydropower use have hit consumption 3% year on year in the first half.

Coal could drop YoY if China’s economic revival fails to come in the second half.

Meanwhile, a proposed ban on Russian coal is underpinning a rosy outlook for thermal coal prices.

“With other coal producers facing constraints in replacing Russian output, prices on coal futures markets indicate that tight market conditions are expected to continue well into next year and beyond,” the IEA said.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.007 | -13% | 17% | -53% | -42% | $ 10,051,292.37 |

| CKA | Cokal Ltd | 0.19 | 19% | 27% | 23% | 90% | $ 166,663,443.95 |

| NCZ | New Century Resource | 1.855 | 20% | 14% | -11% | -40% | $ 237,093,190.53 |

| BCB | Bowen Coal Limited | 0.275 | -10% | 22% | 41% | 231% | $ 439,775,950.92 |

| LNY | Laneway Res Ltd | 0.0045 | -10% | -10% | -6% | -15% | $ 31,510,082.05 |

| GRX | Greenx Metals Ltd | 0.25 | 2% | 35% | 14% | -8% | $ 63,405,116.00 |

| AKM | Aspire Mining Ltd | 0.088 | -1% | 10% | 9% | 17% | $ 46,194,965.64 |

| AVM | Advance Metals Ltd | 0.01 | -9% | 25% | -44% | -49% | $ 4,778,774.02 |

| AHQ | Allegiance Coal Ltd | 0.12 | 4% | -72% | -76% | -83% | $ 44,829,316.10 |

| YAL | Yancoal Aust Ltd | 4.98 | -11% | -3% | 75% | 135% | $ 6,615,401,579.37 |

| NHC | New Hope Corporation | 4.31 | -1% | 29% | 84% | 116% | $ 3,662,371,160.80 |

| TIG | Tigers Realm Coal | 0.016 | 0% | -11% | -16% | 100% | $ 222,133,940.26 |

| SMR | Stanmore Resources | 1.795 | -7% | -3% | 70% | 165% | $ 1,681,076,866.77 |

| WHC | Whitehaven Coal | 6.34 | 4% | 35% | 131% | 186% | $ 6,062,762,273.68 |

| BRL | Bathurst Res Ltd. | 1.005 | -4% | -2% | 31% | 52% | $ 195,186,975.60 |

| CRN | Coronado Global Res | 1.42 | 2% | -12% | 13% | 55% | $ 2,405,711,102.55 |

| JAL | Jameson Resources | 0.079 | 13% | 13% | 5% | -31% | $ 24,374,231.84 |

| TER | Terracom Ltd | 0.795 | 1% | 35% | 279% | 489% | $ 618,334,990.78 |

| ATU | Atrum Coal Ltd | 0.007 | 0% | 17% | -73% | -86% | $ 4,839,578.35 |

| MCM | Mc Mining Ltd | 0.235 | 81% | 88% | 135% | 96% | $ 43,484,071.40 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.